Club

Share & Traffic

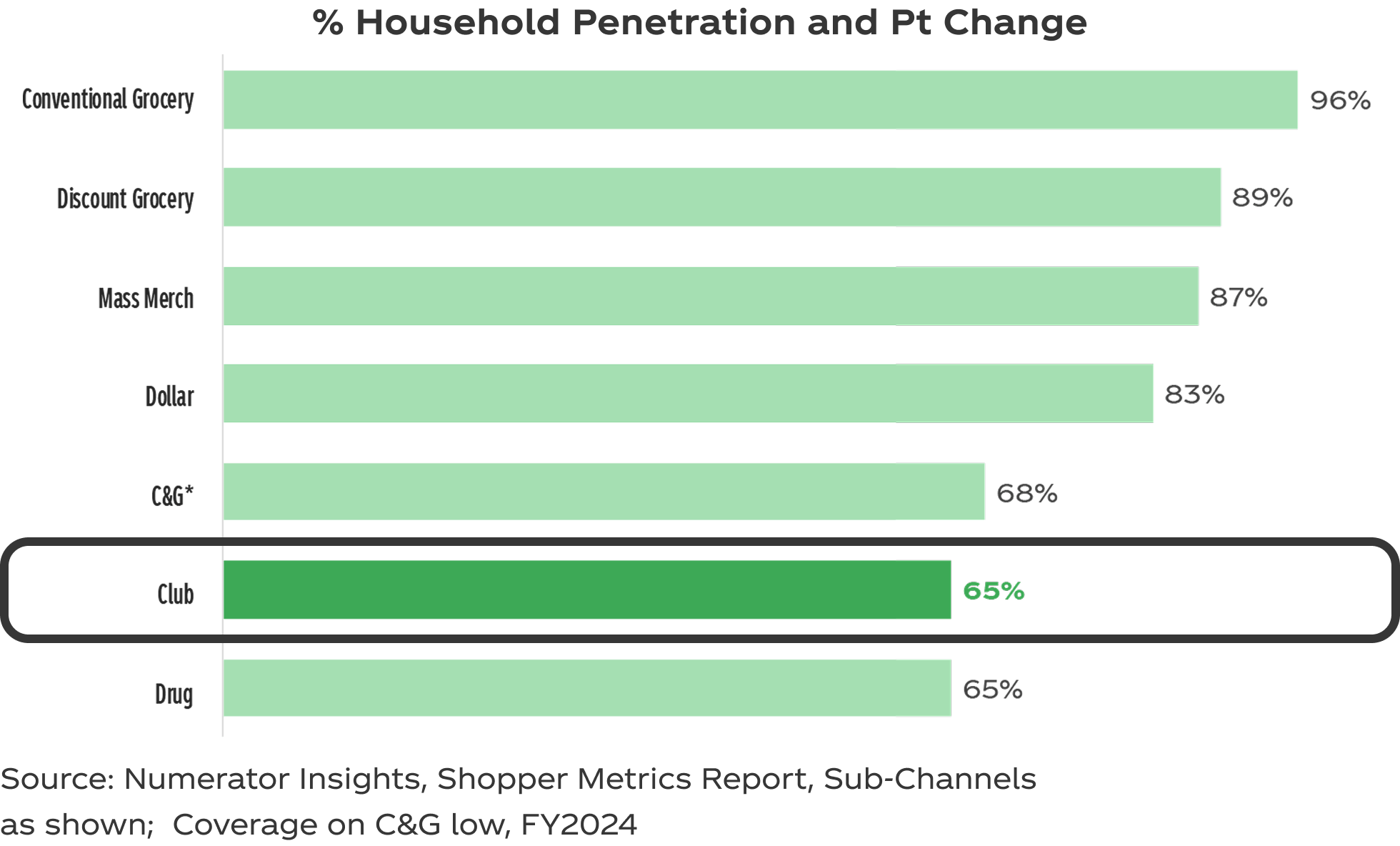

Club experienced the biggest increase in HHP for all channels, +1.7 pts

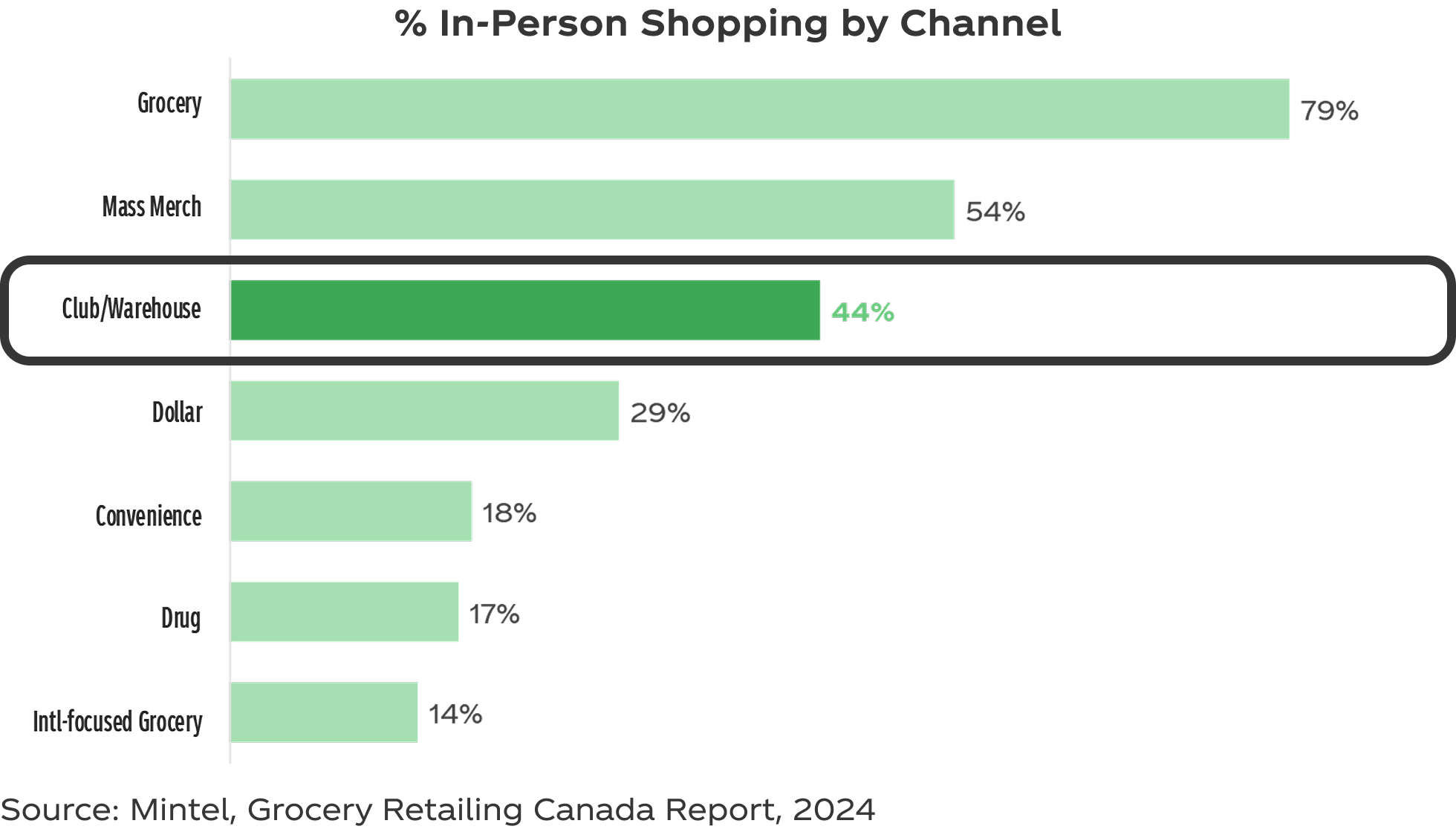

44%

of in-person grocery shopping happens in the Club Channel

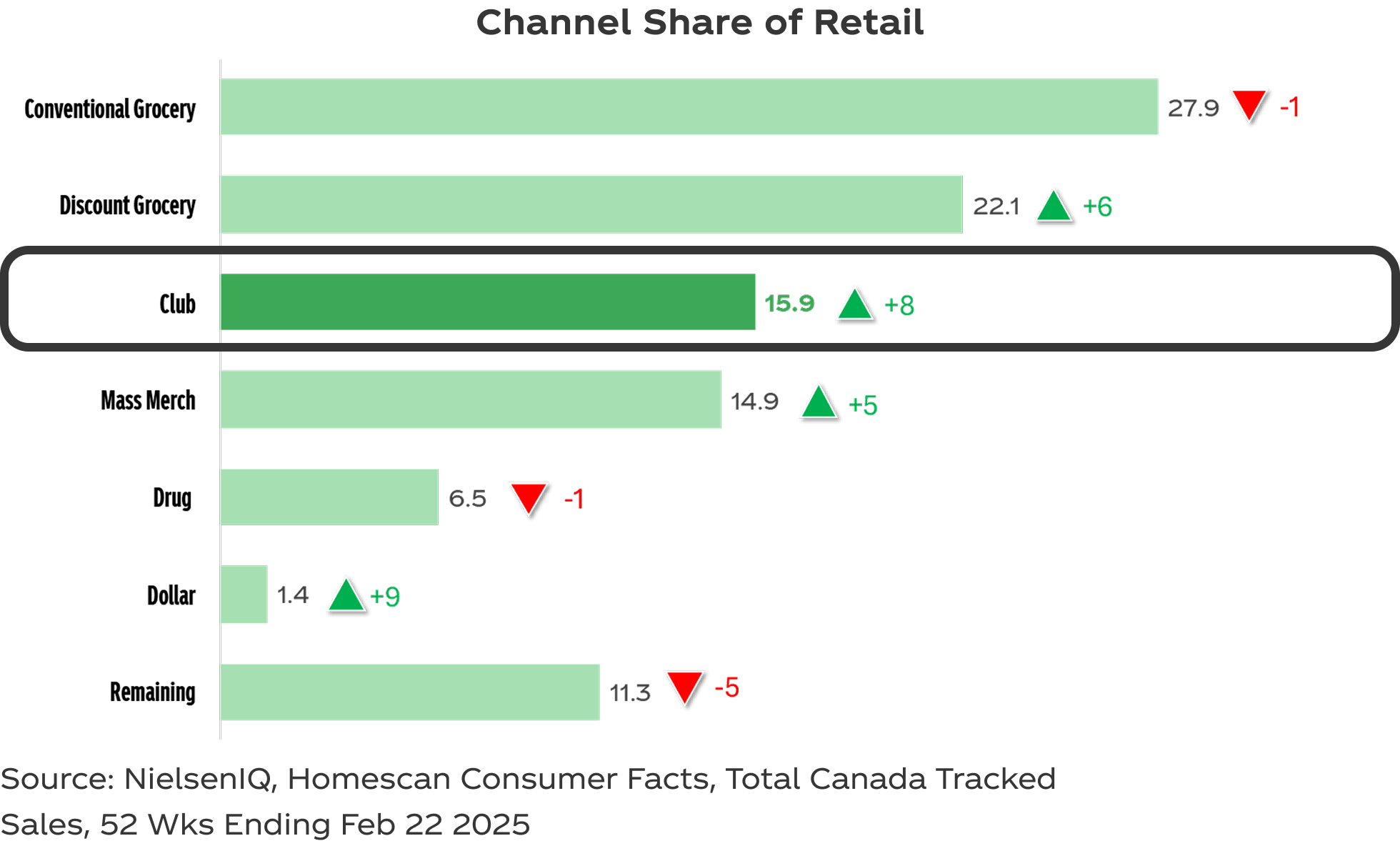

The consumer wallet has changed, with share growth in value-based retailers

Quick Tips

1. With growing HH penetration, Club remains a critical channel for our system growth ambition

2. Continue to drive traffic and build basket by offering member value to shoppers

Quick Tips

The Coca-Cola portfolio is the most complete beverage portfolio with an offering for every shopper occasion and need

Consumer/Shoppers

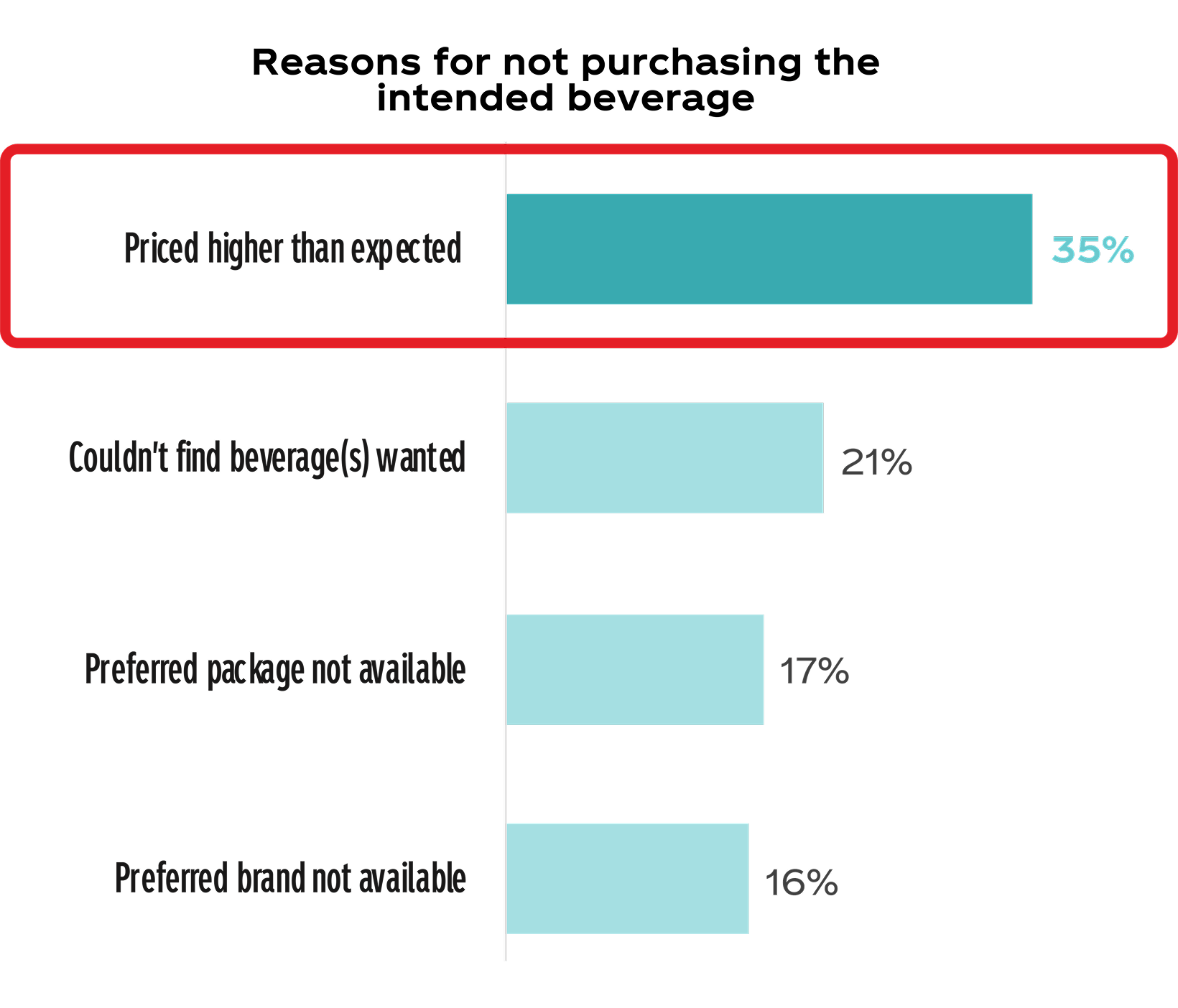

Pricing remains the key reason why shoppers do not pick up a beverage in their basket

Quick Tips

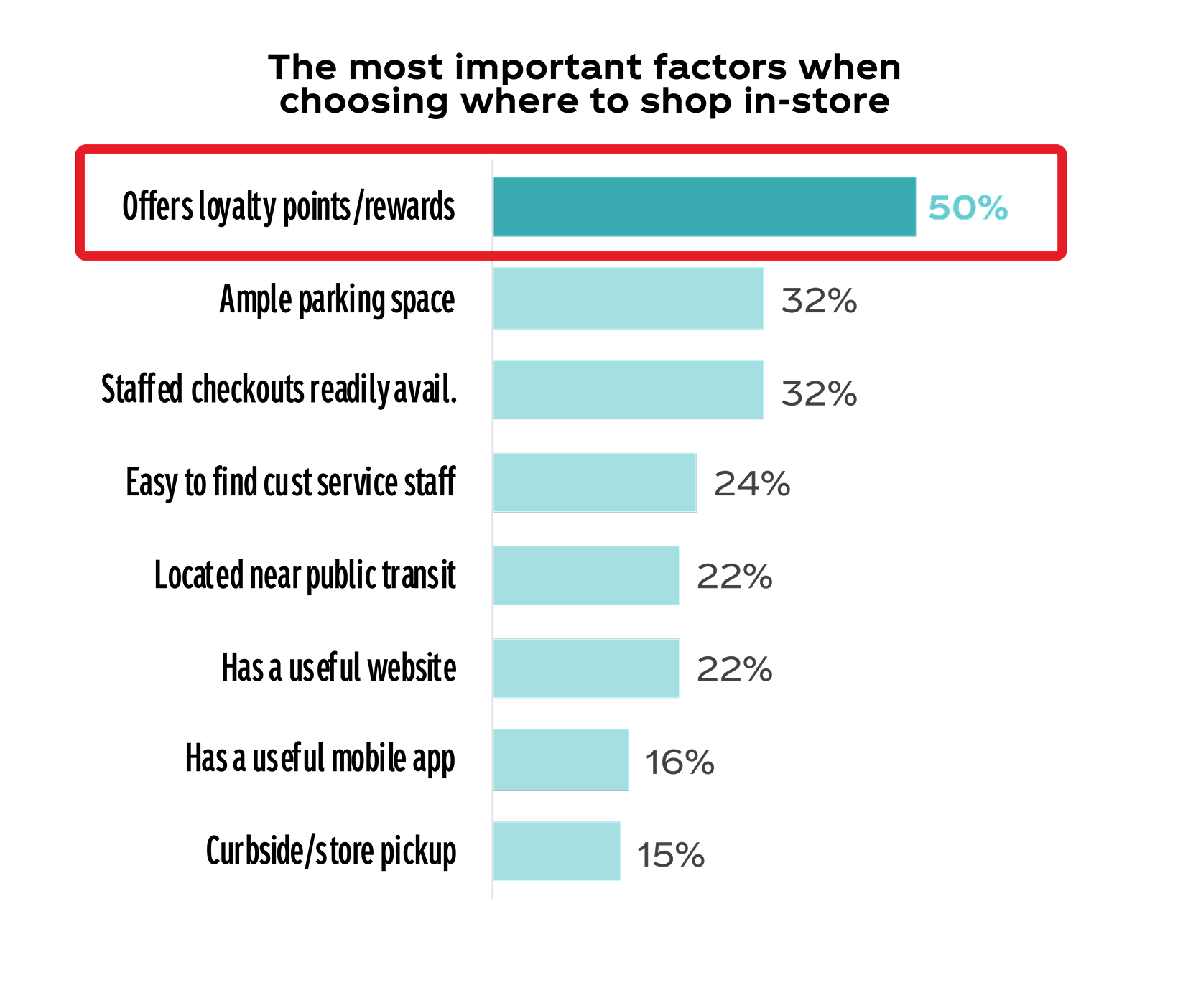

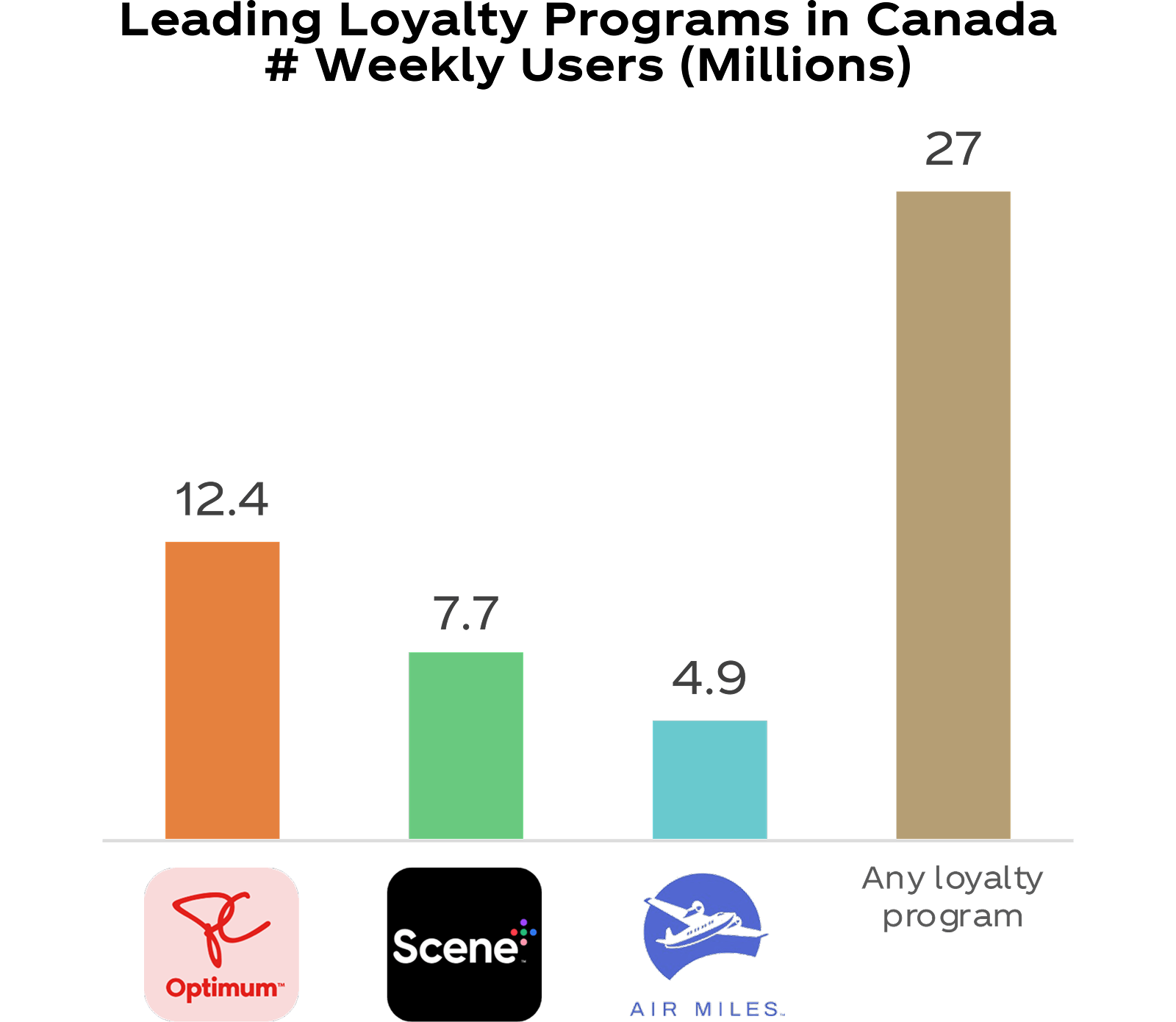

Implement affordability zone and engage in customer’s loyalty platforms/apps to target value seeking shoppers and drive purchase intent

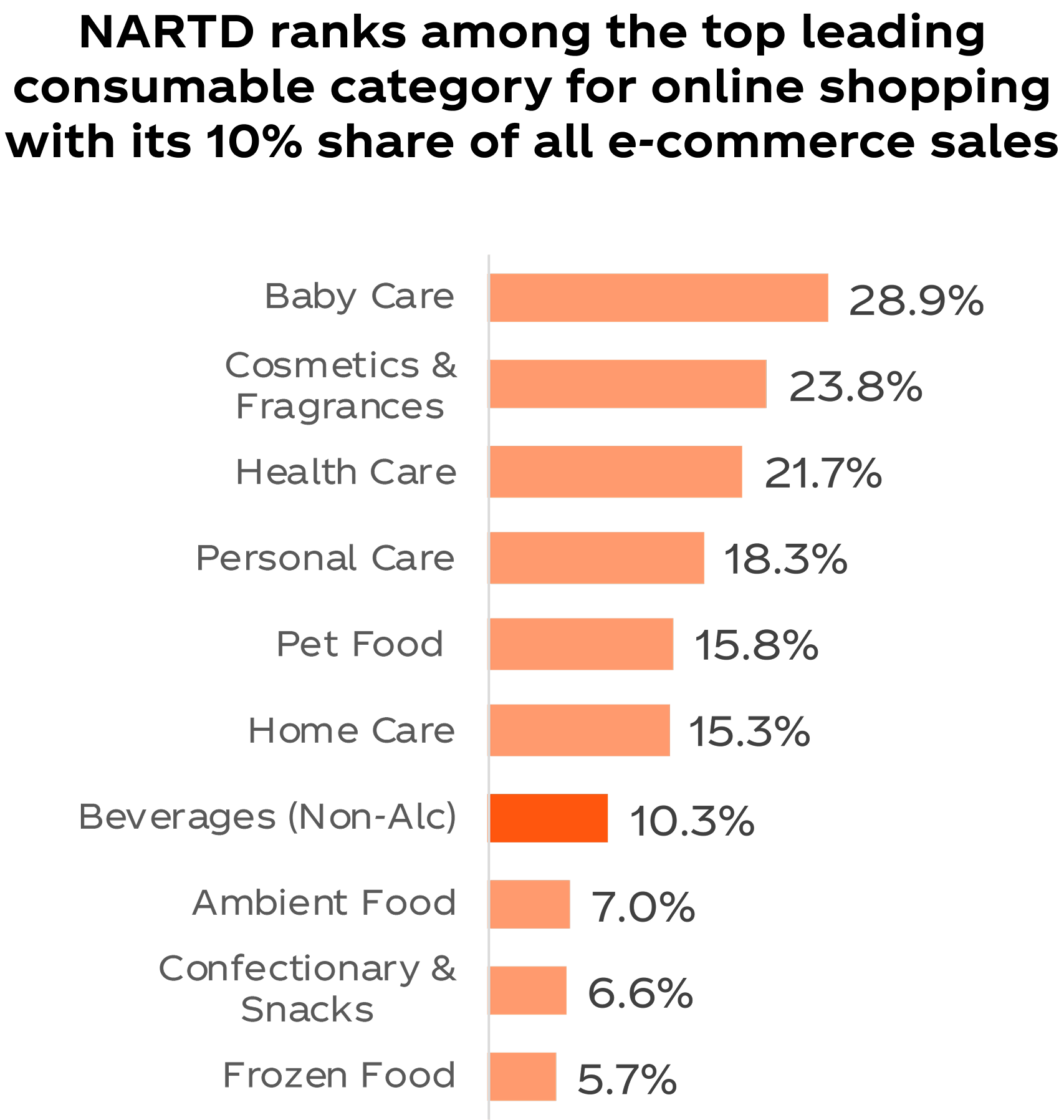

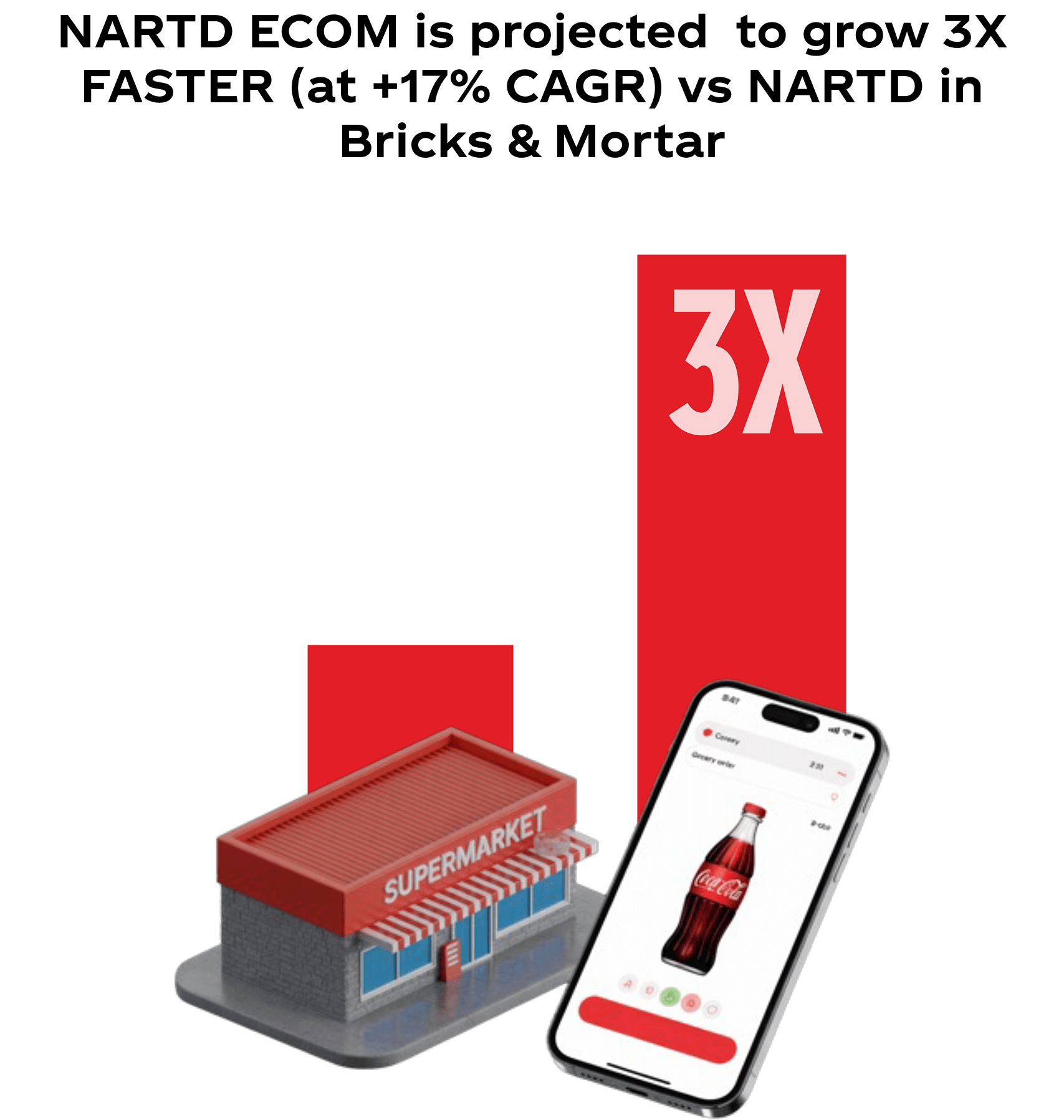

Omni Channel

Quick Tips

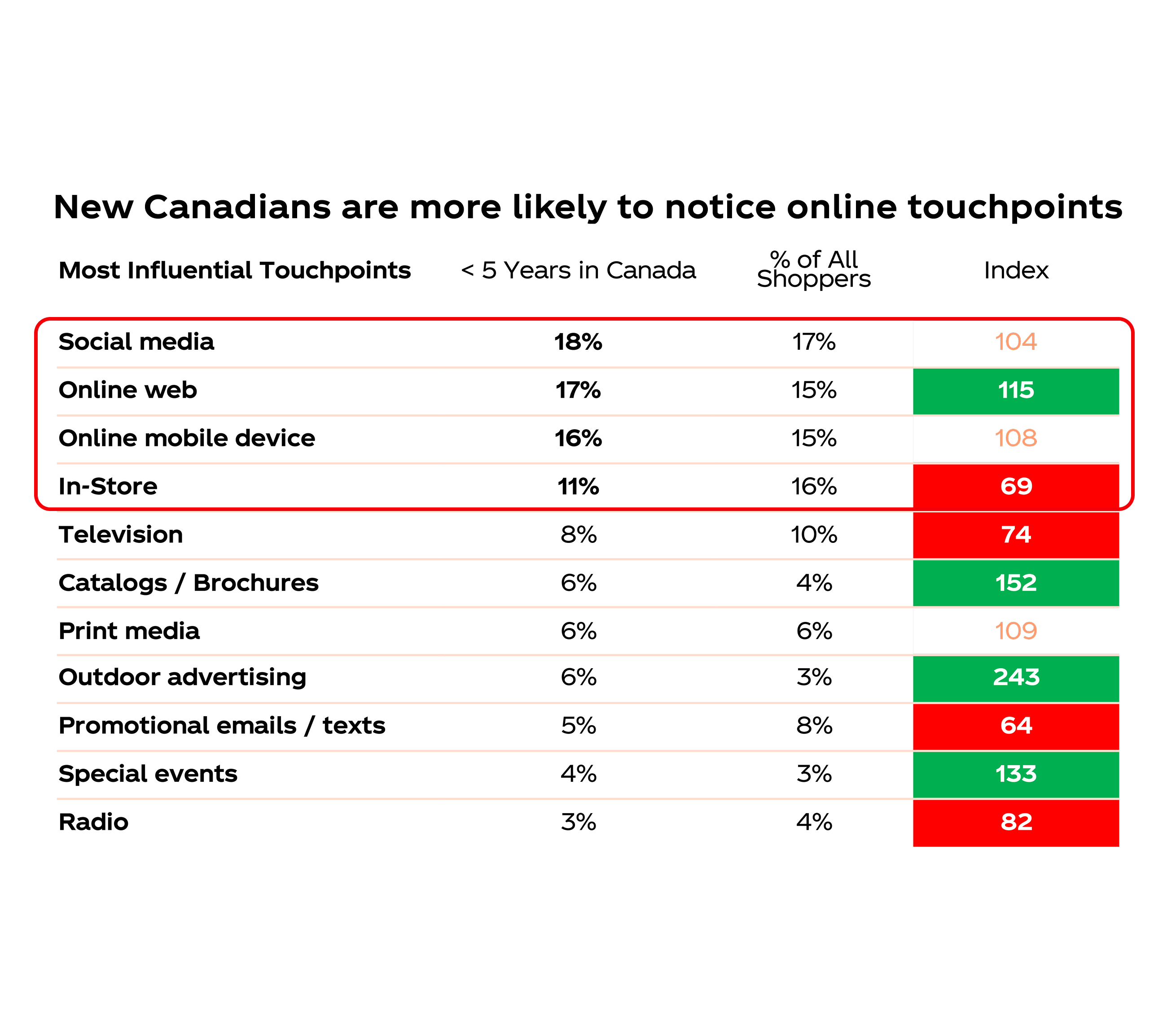

1. Leverage Salsify to ensure latest digital shelf content is represented on customer platforms (images, product descriptions)

2. Capitalize on GOAT marketing programs on digital platforms to interrupt the digital path to purchase

Quick Tips

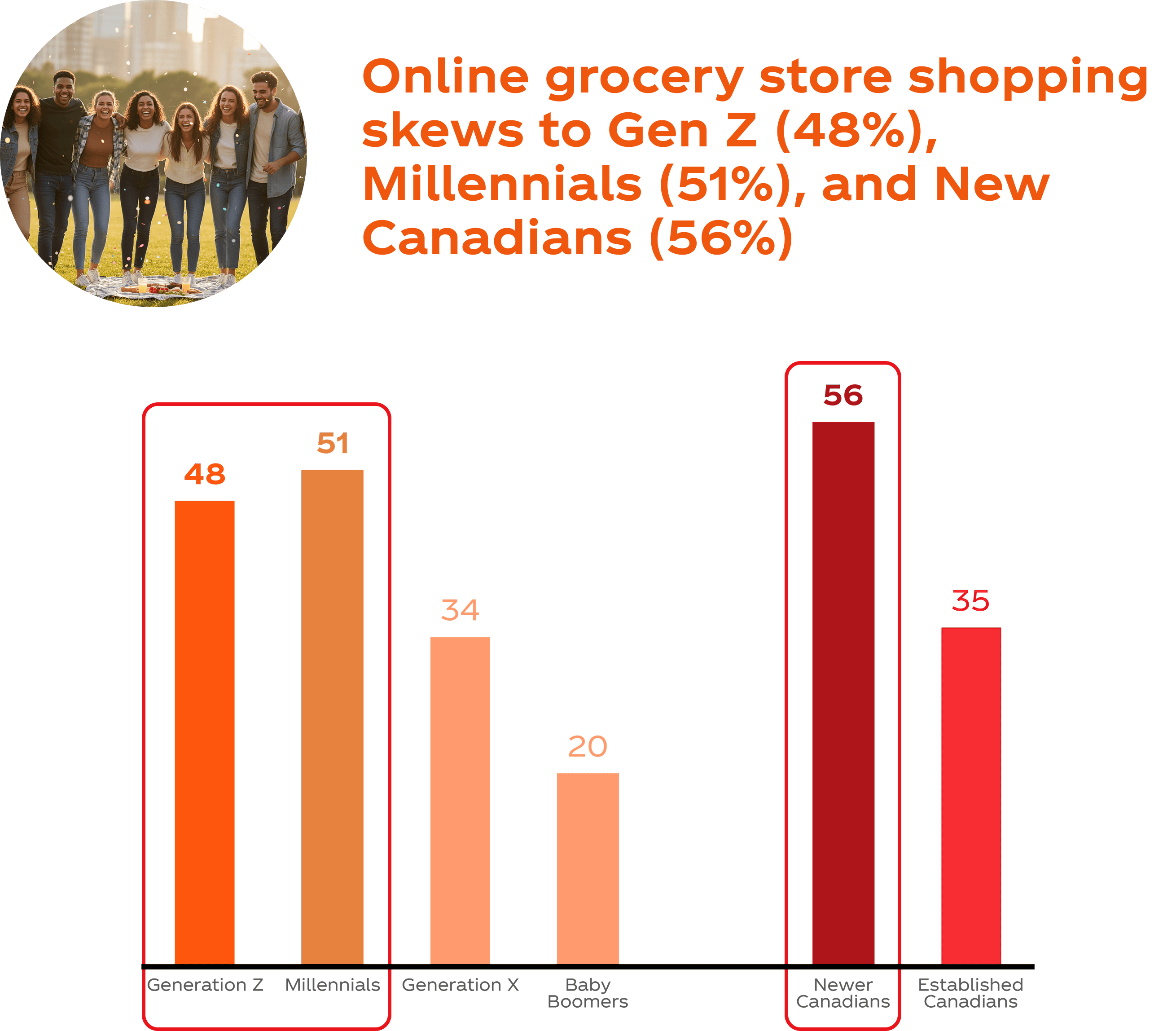

1. Meet shoppers along their omni-channel path where they are connecting with our brands

2. Execute digital programs to effectively reach omni-channel shoppers especially New Canadians, Gen Z and Millennials

Summary Checklist

Traffic shifting favours the Club channel with more Canadians going to Club seeking value

Basket size and trip frequency is growing

Reason for Club as Store Choice:

- Best Overall Value (144)

- Save Money (136)

Reason for Trip to Club:

- Stock Up (133)

- Browse for Interesting Items (140)

- Special Occasions (141)

Higher basket spend in Club makes larger trips lucrative

Shoppers go to Club for larger trips

- Basket Size with a beverage included +2.3%

- Trip Frequency for a beverage +2.2%

Larger & higher income households over-index at Club. Wealthy immigrants make multicultural considerations key.

Shoppers go to Club for larger trips

- 38% of trips for fill-i

- 28% for stock up.

Target Zeros at Club as this option is driving SSD growth

Coke Zero at Costco

•16% buy rate

•+6% purchase frequency

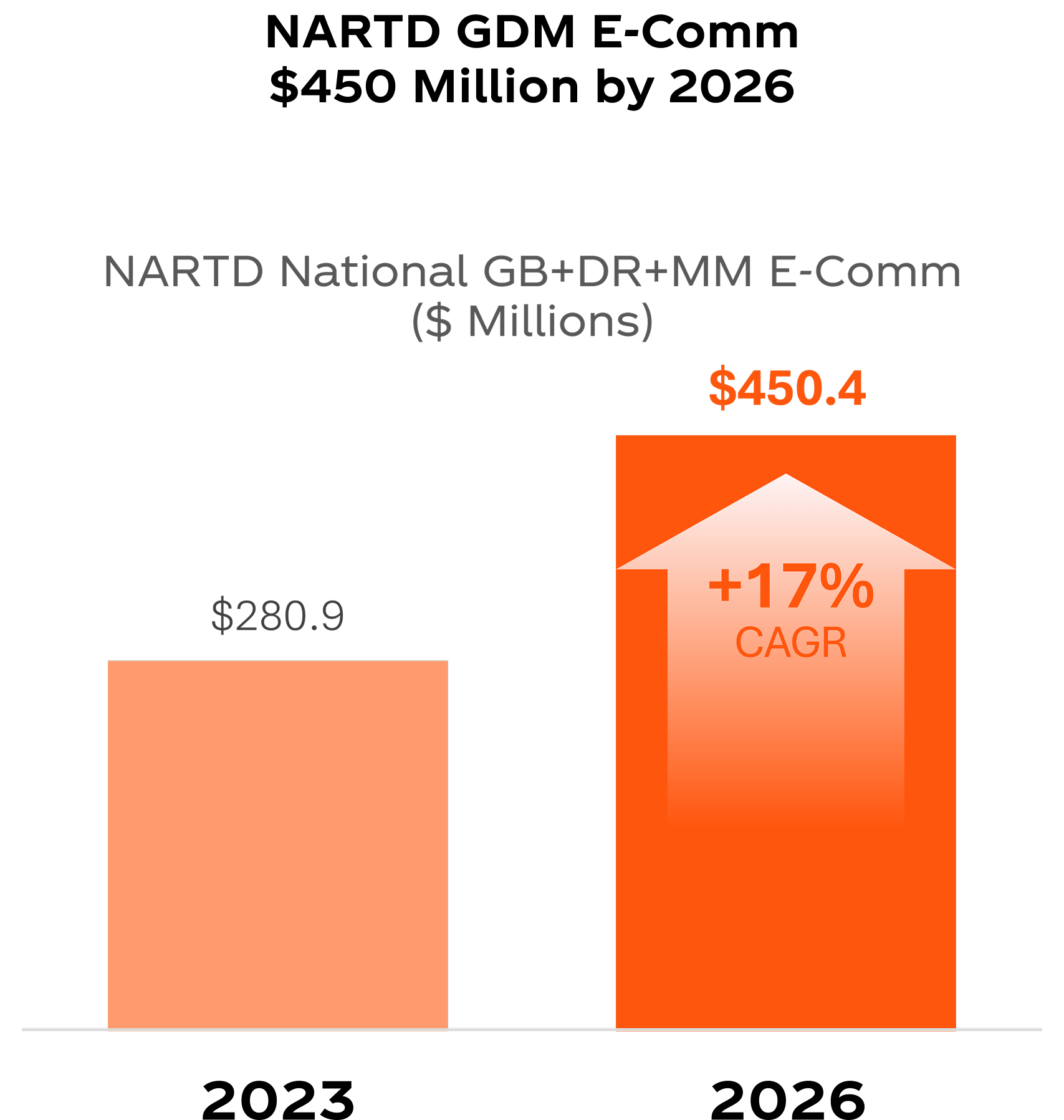

Omni-Channel approach needed to meet digital shopper needs

Customers’ focus on technology drives online sales with larger baskets and greater convenience for all digital and in-store shoppers.

- Online Club trips are +9% since YA

The role of the Club channel continues to be to provide value Replenishment, interesting items and special occasions are also key motivators