Large Store Conventional

Share & Traffic

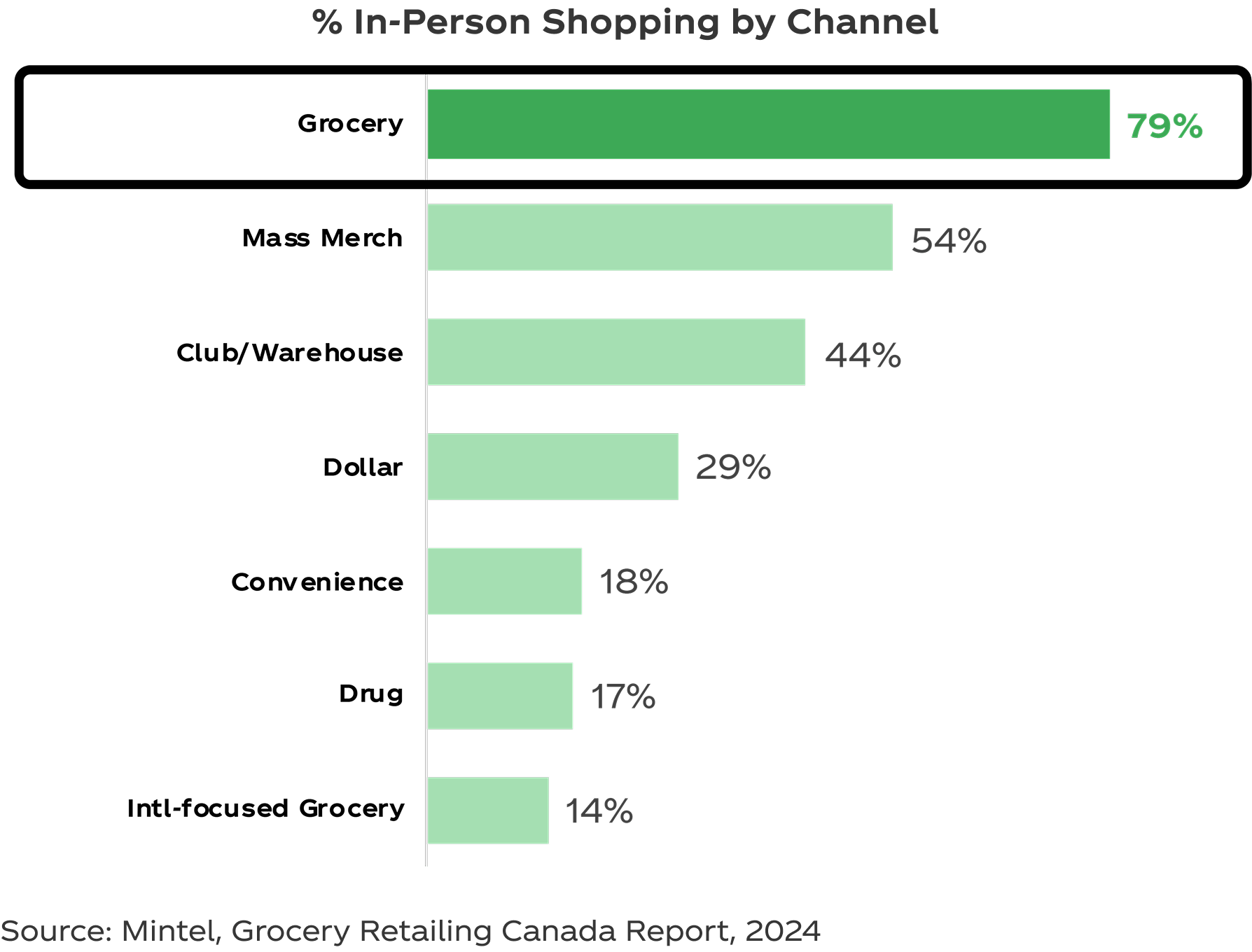

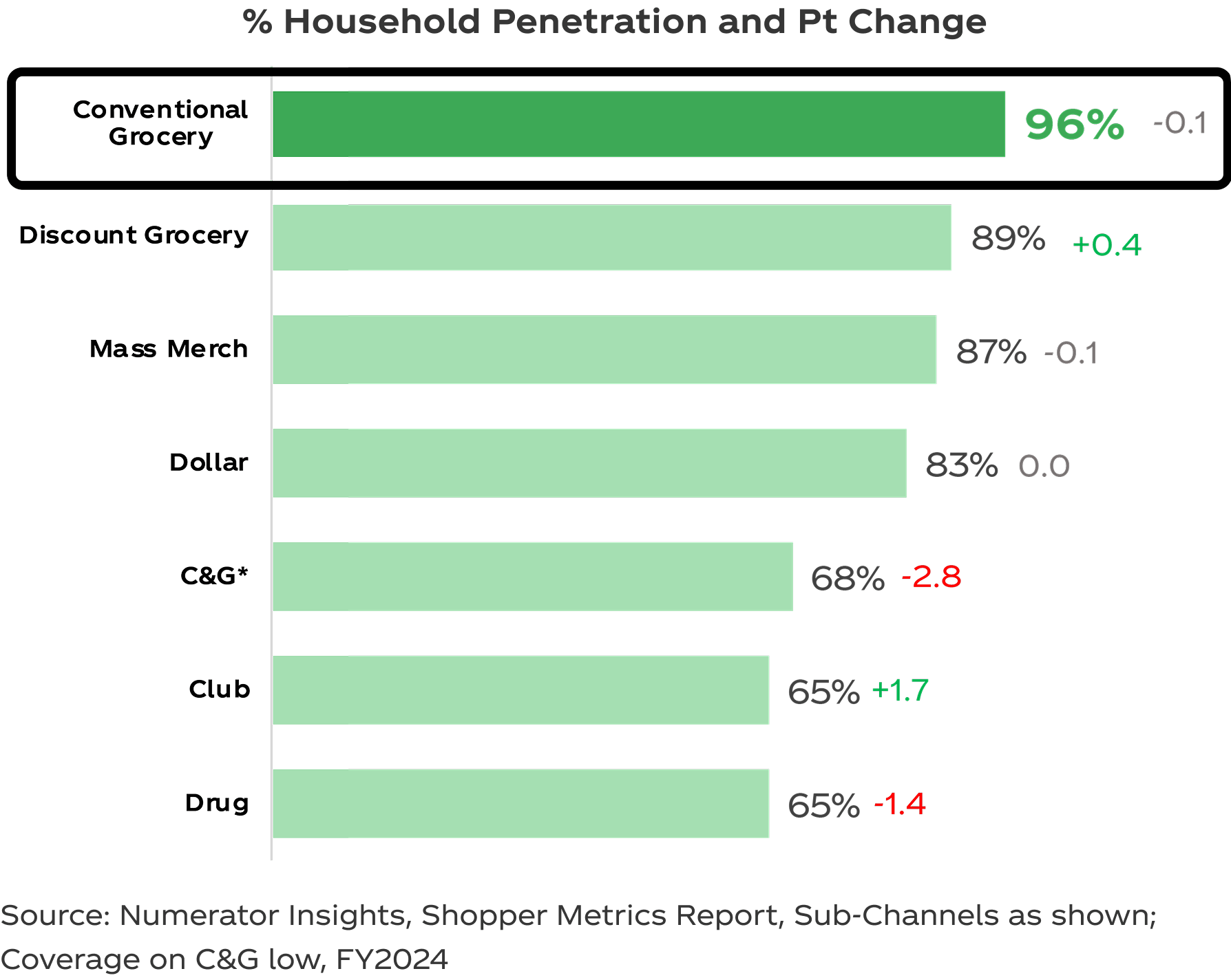

Conventional remains the king of in-person shopping and household penetration

79%

of in-person grocery shopping happens in the Grocery Channel

96%

HH penetration makes Conventional the most penetrated channel

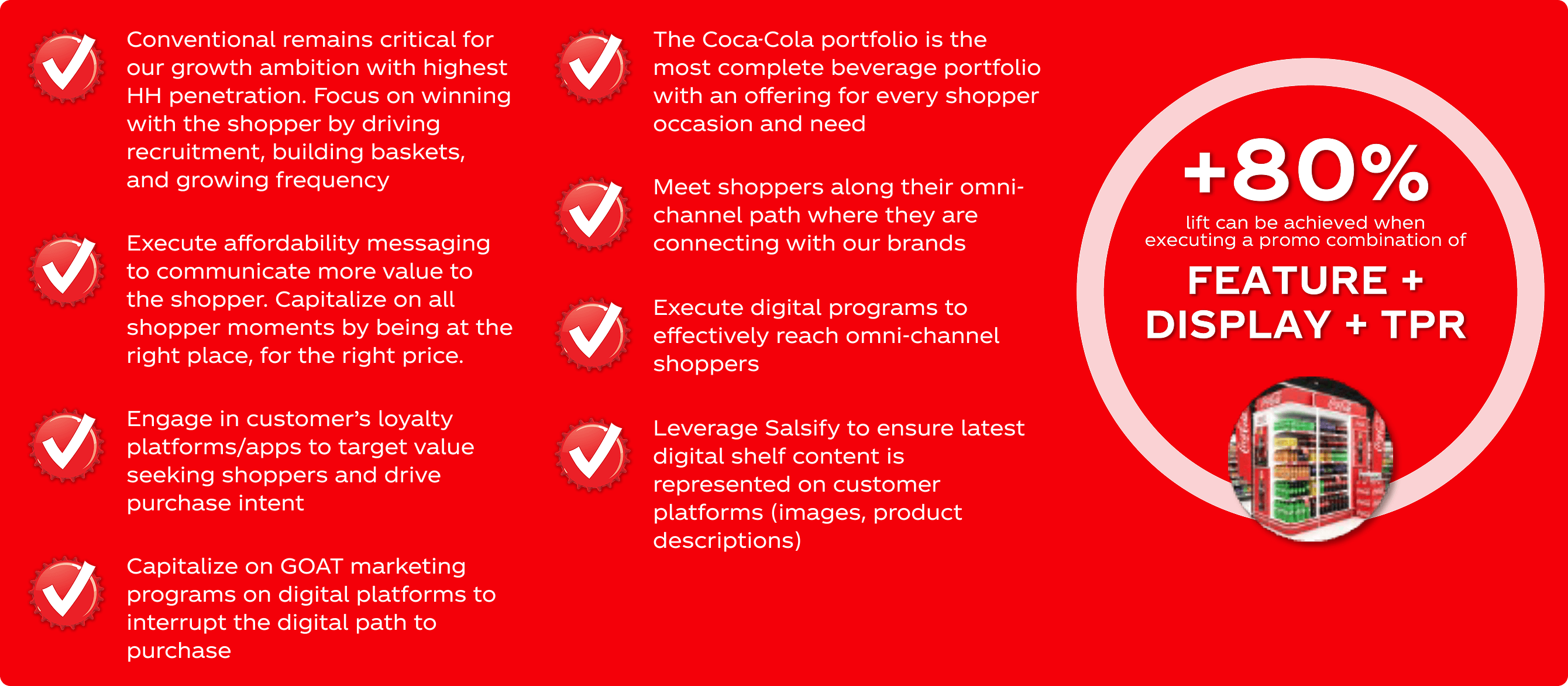

Quick Tips

1. Conventional remains critical for our growth ambition with highest HH penetration (despite shifts to value channels)

2. Focus on winning with the shopper by driving recruitment, building baskets, and growing frequency

KO continues to lead category growth in AMC

Quick Tips

The Coca-Cola portfolio is the most complete beverage portfolio with an offering for every shopper occasion and need

Quick Tips

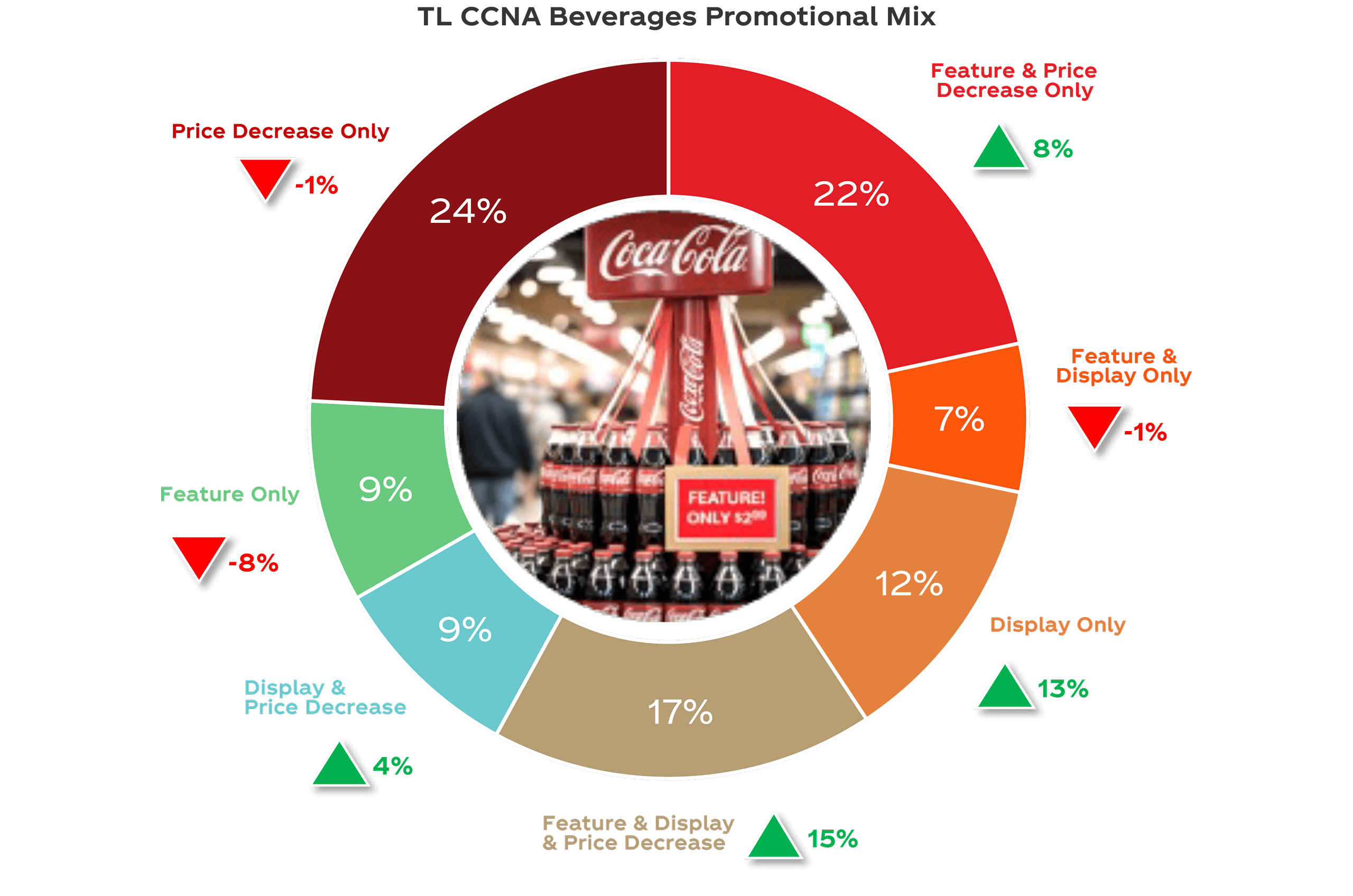

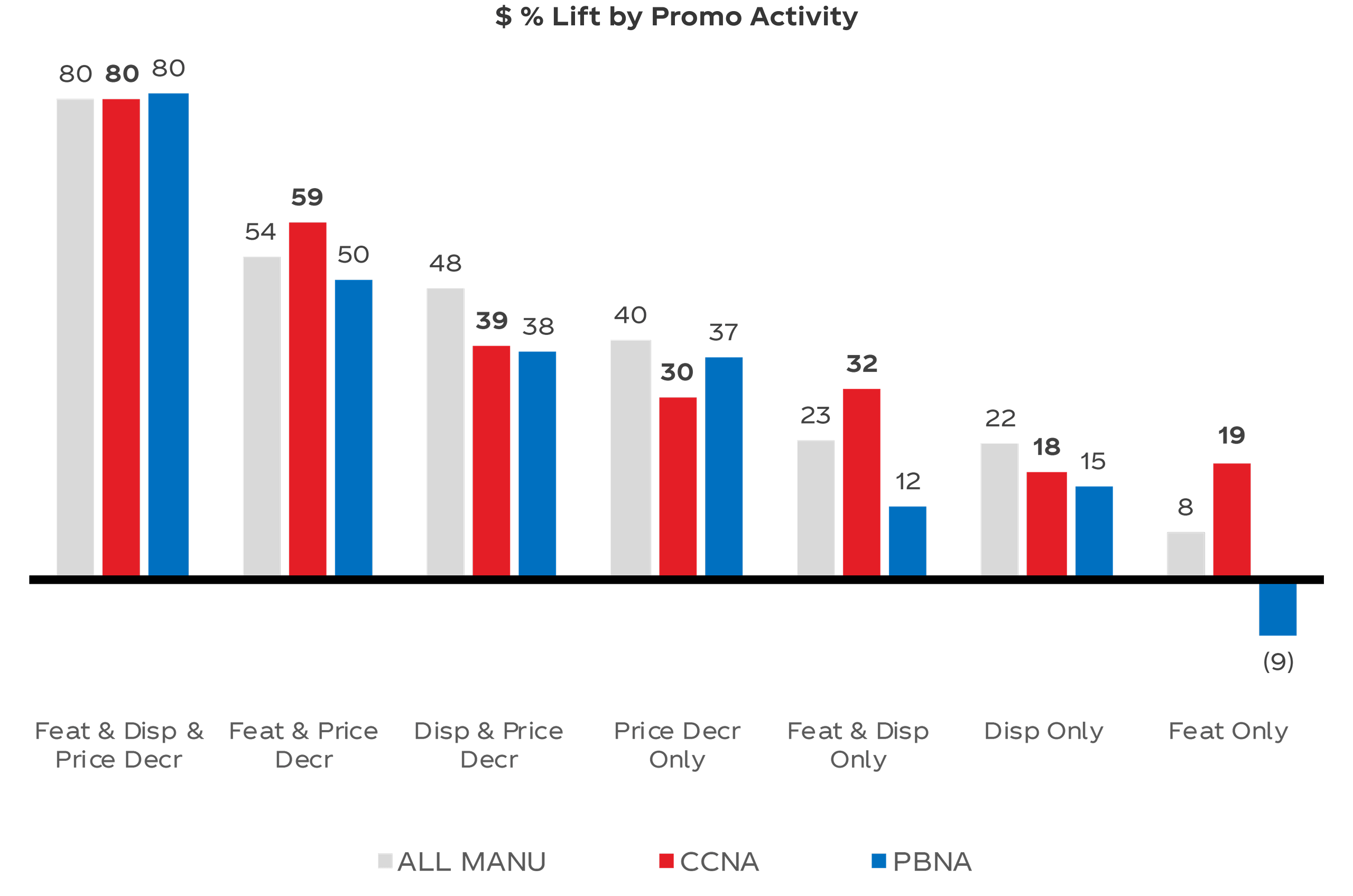

1. Display represents 45% of the TL CCNA Beverage Promotional Mix (in $)

2. Convert shopper from consideration to trial with the most impactful promotional mix through Feature, Display & TPR

Consumer/Shoppers

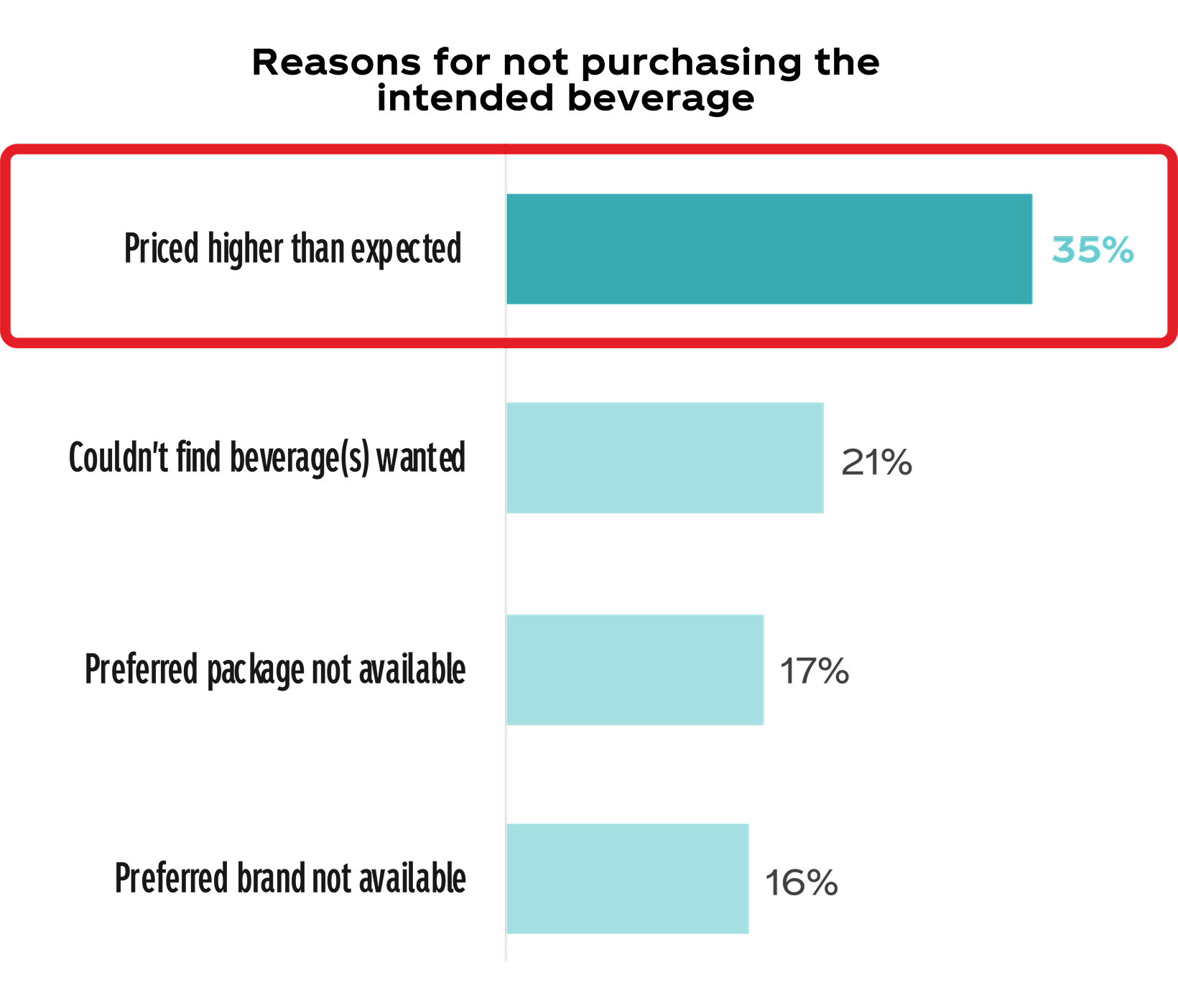

Pricing remains the key reason why shoppers do not pick up a beverage in their basket

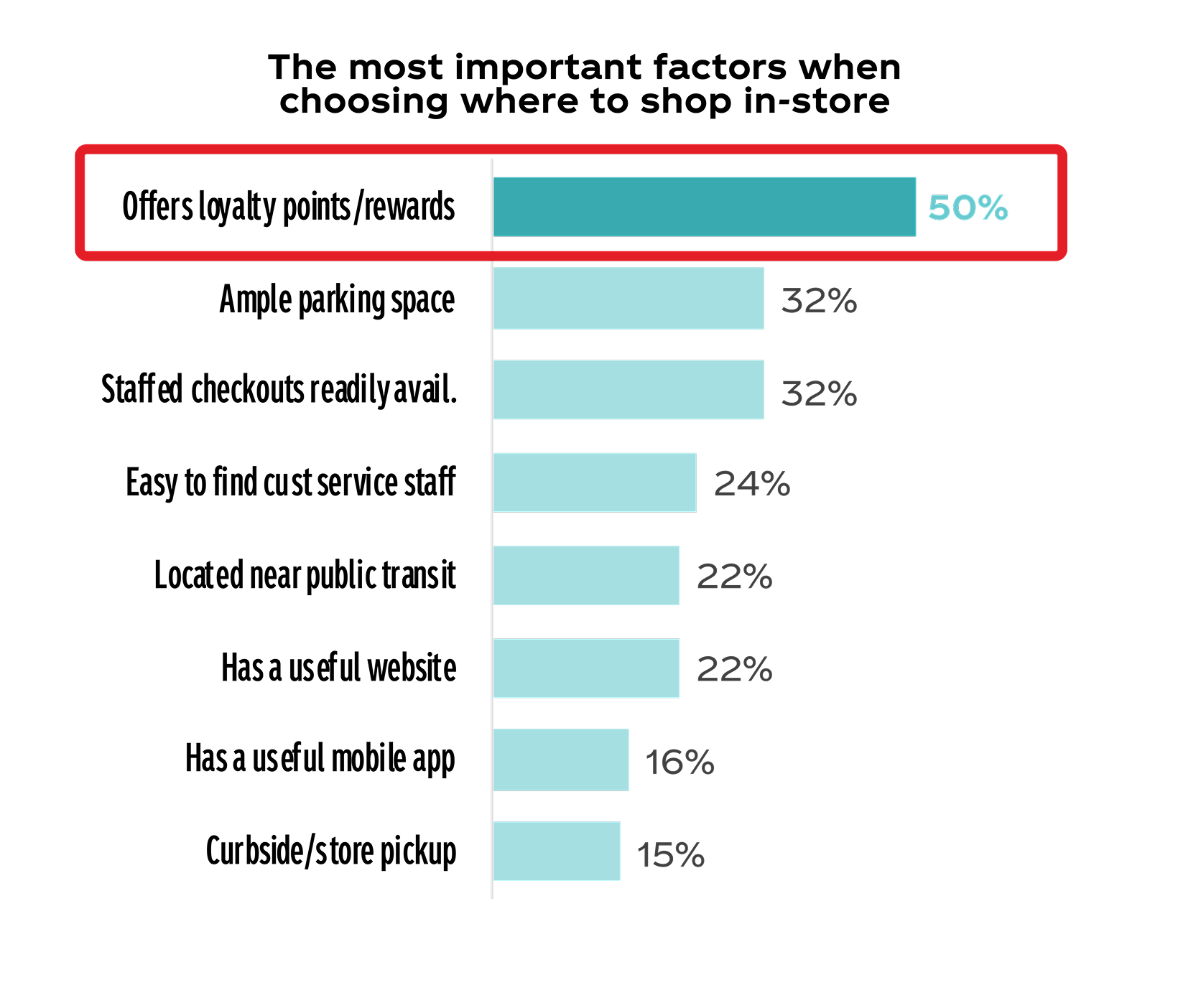

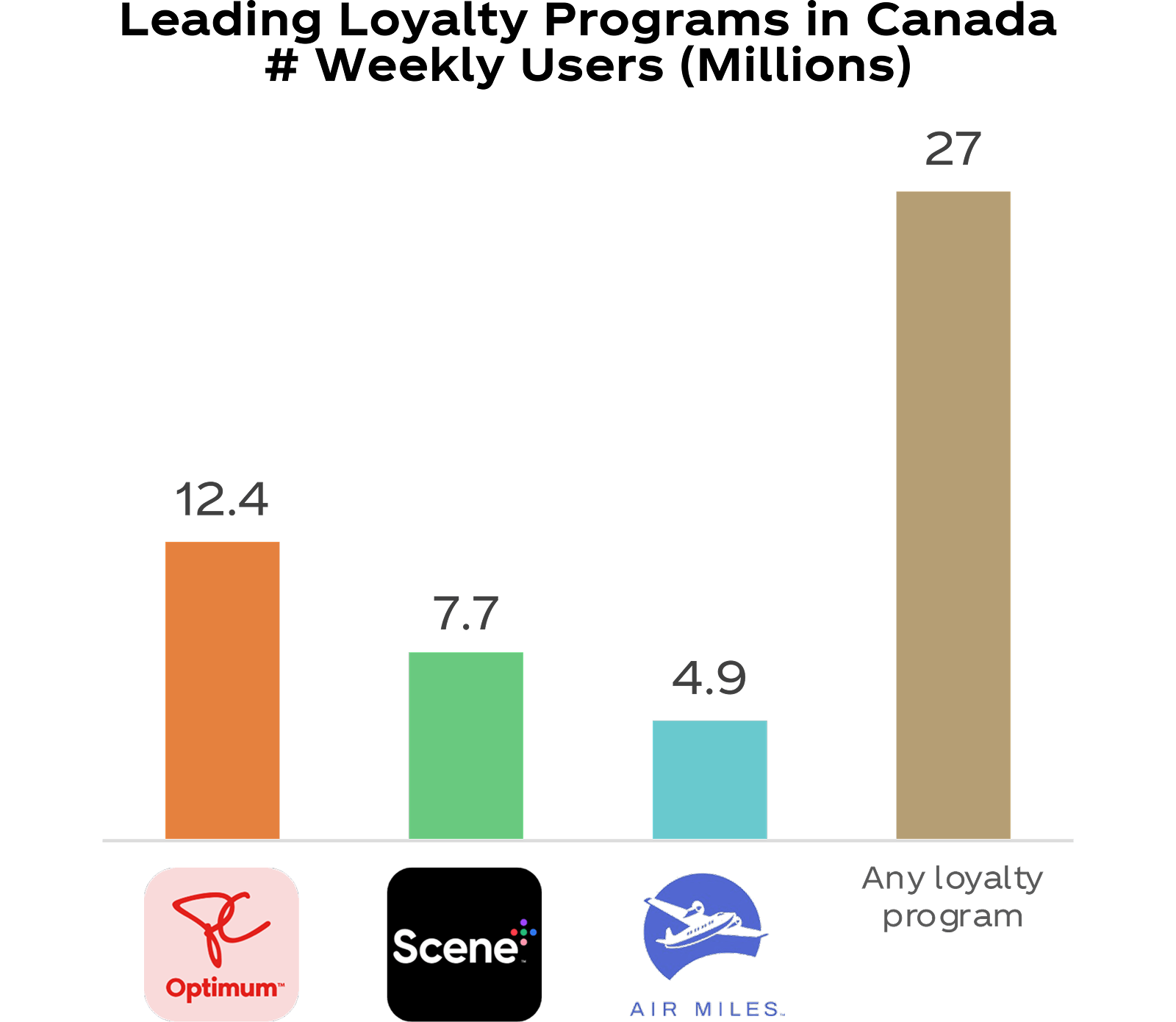

Quick Tips

Implement affordability zone and engage in customer’s loyalty platforms/apps to target value seeking shoppers and drive purchase intent

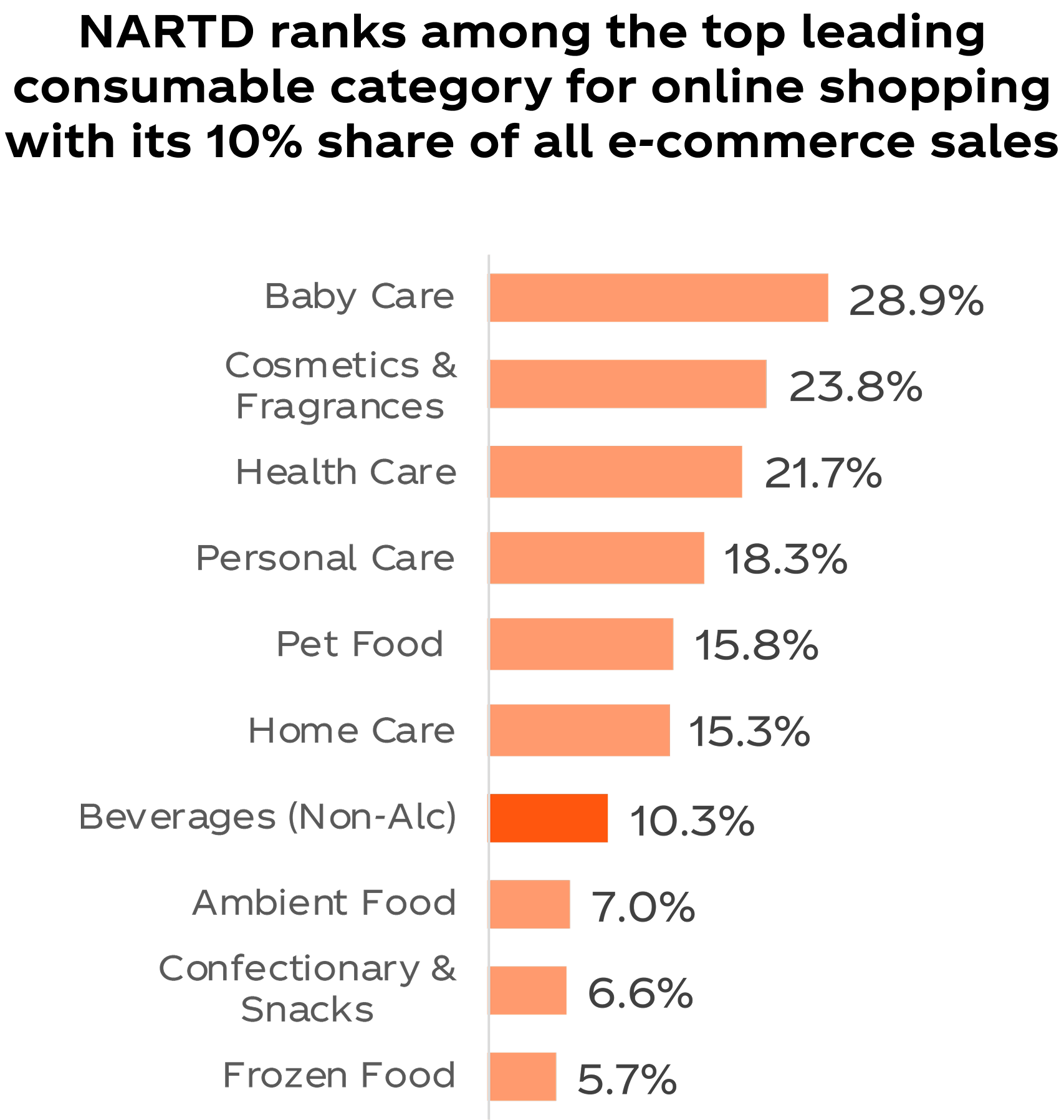

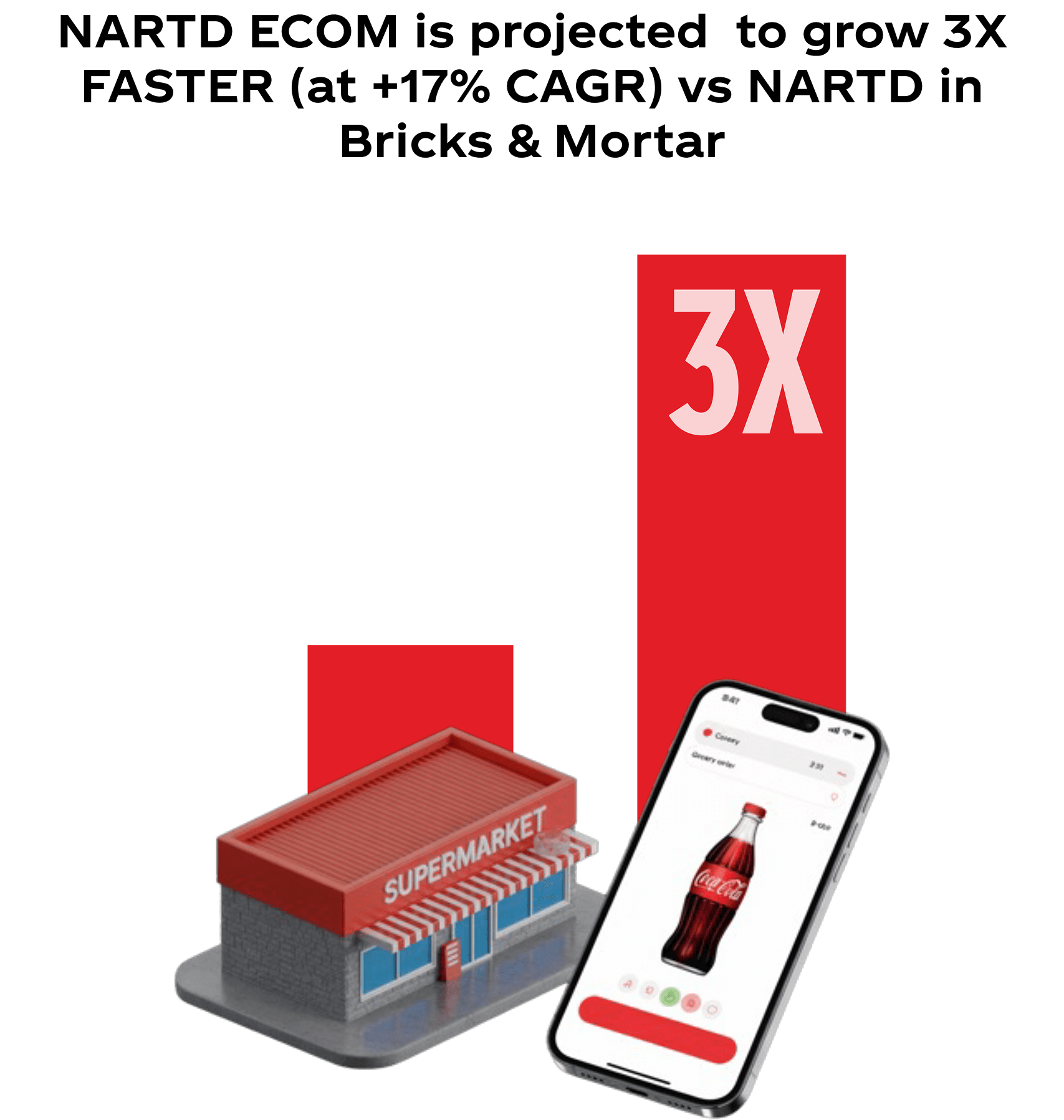

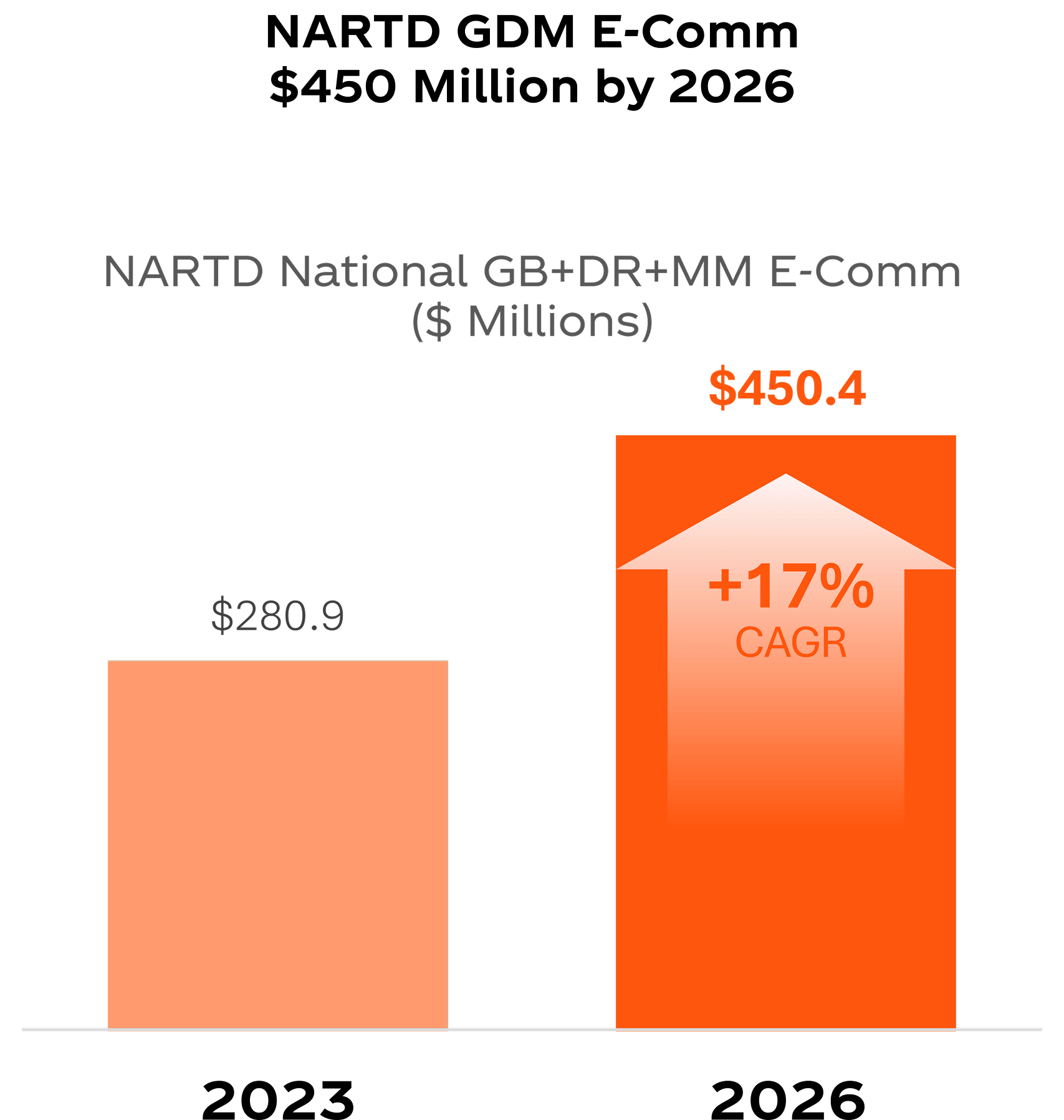

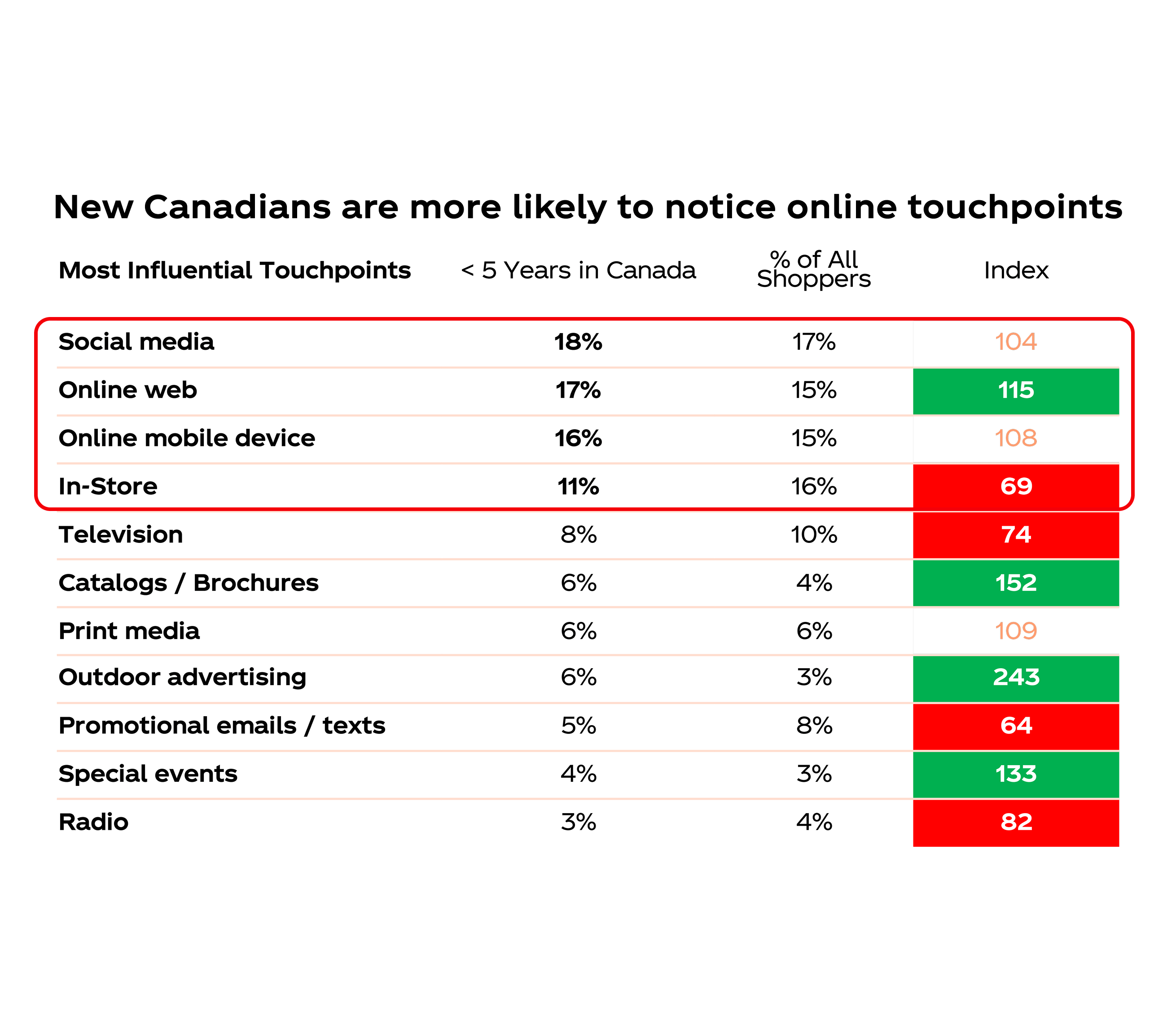

Omni Channel

Quick Tips

1. Leverage Salsify to ensure latest digital shelf content is represented on customer platforms (images, product descriptions)

2. Capitalize on GOAT marketing programs on digital platforms to interrupt the digital path to purchase

Quick Tips

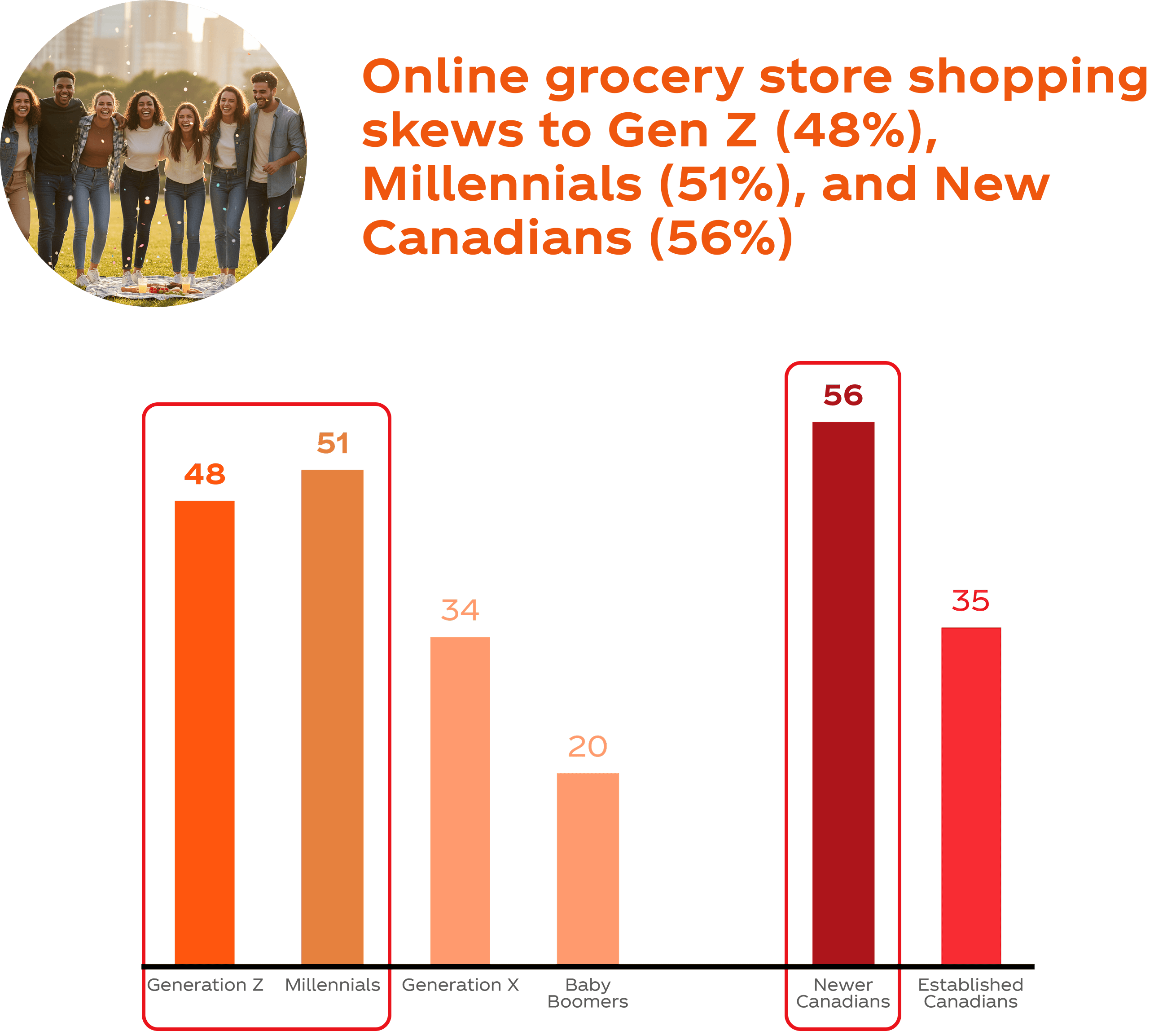

1. Meet shoppers along their omni-channel path where they are connecting with our brands

2. Execute digital programs to effectively reach omni-channel shoppers especially New Canadians, Gen Z and Millennials

Summary Checklist