- Recruit the health-conscious shoppers with the HSTC and Zero portfolio.

- Drive Cold availability across relevant touch points in store to convert impulse shoppers.

Large Store Conventional

Shopper Profile

Retail Environment

Large full‑service grocers offering extensive assortments, strong fresh food departments, and a mix of premium and mainstream brands. More focus on quality, service, and merchandising.

Shopper Motivations

Shoppers seeking quality fresh produce, branded goods, and a pleasant shopping experience. Willing to pay a bit more for service, assortment, and trusted national brands.

Key Customers

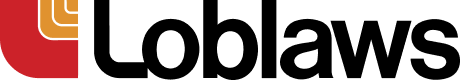

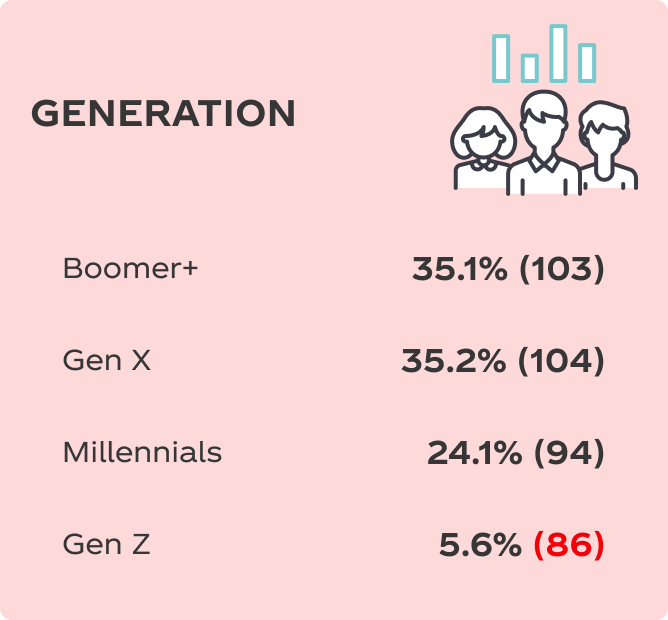

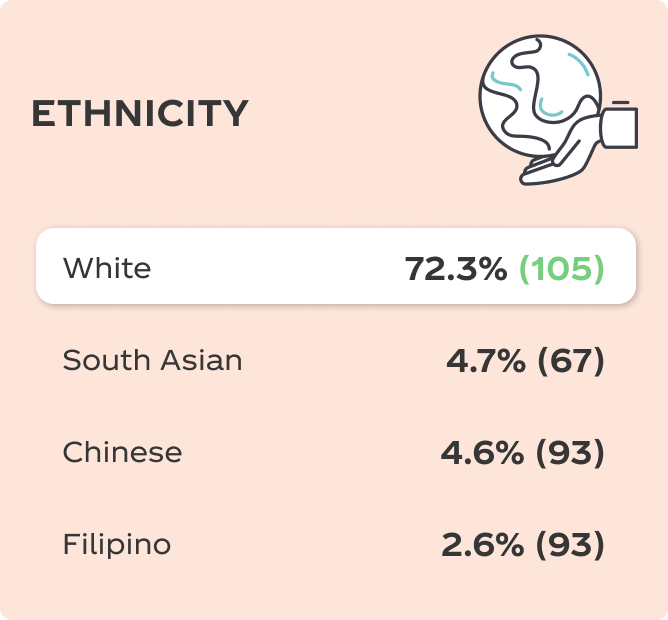

Boomer and Gen X Females

Psychographics & Behaviors

Key Metrics

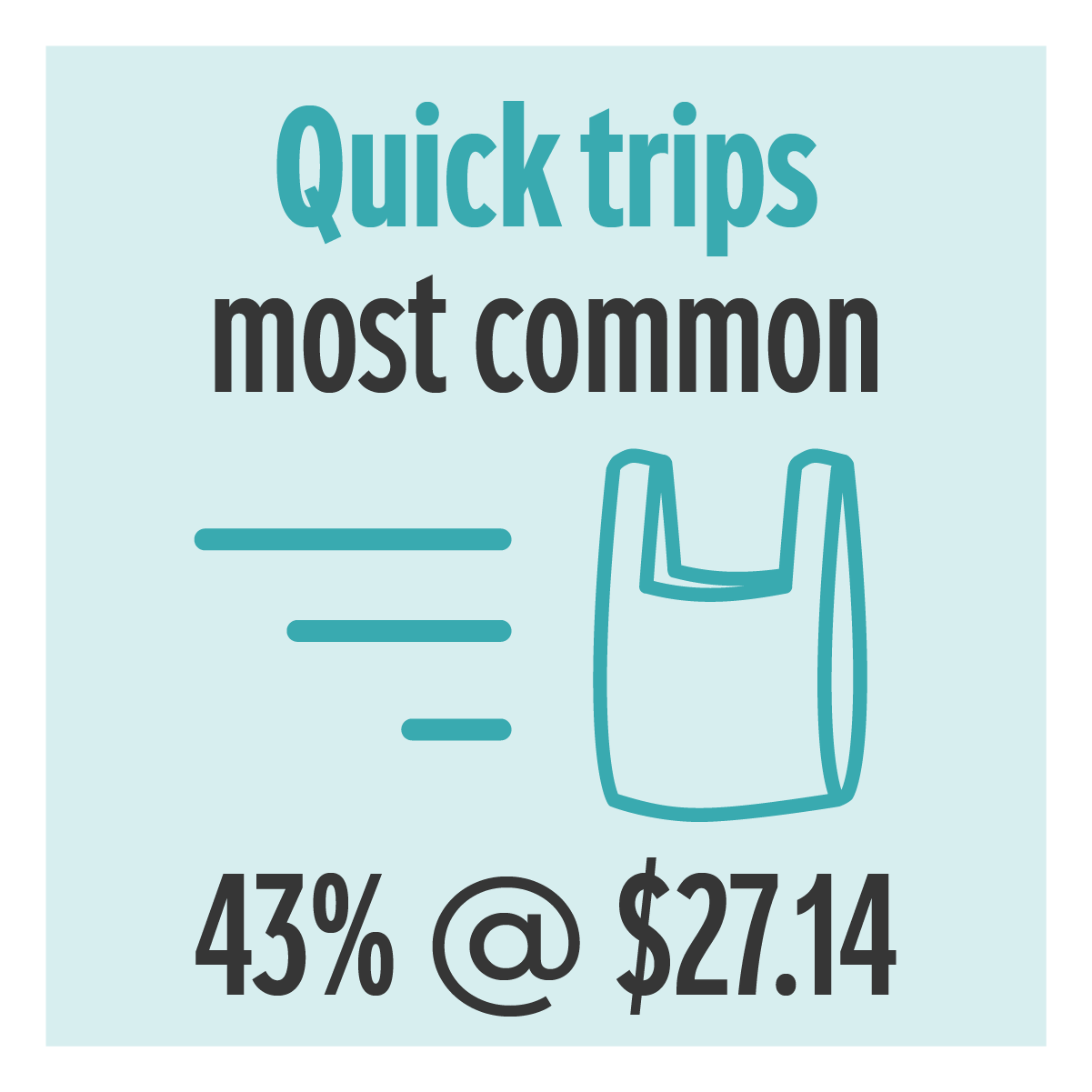

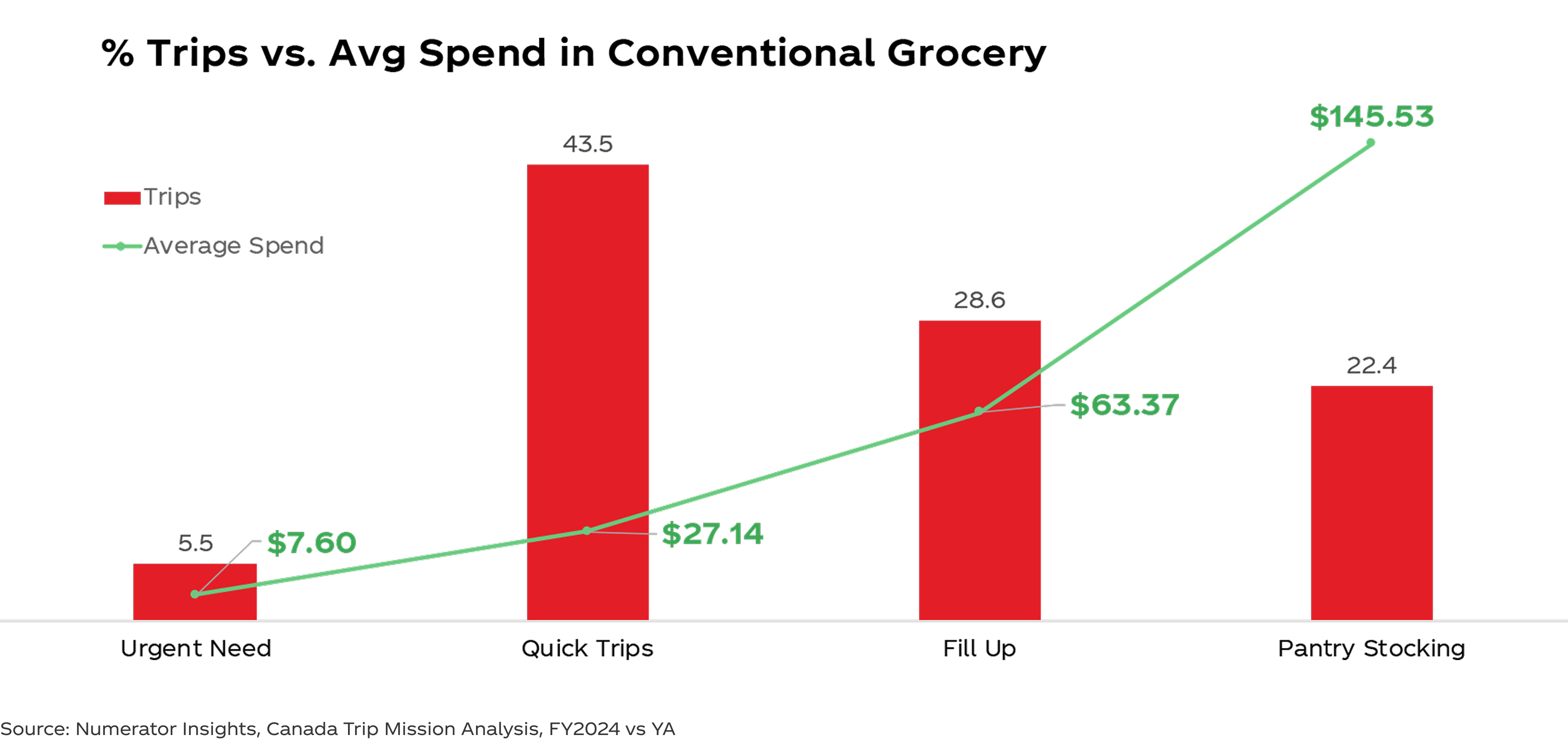

Quick trips represent the greatest percentage of trips,

but stock-up trips are the most valuable

Quick Tips

Convert Quick Trip shoppers with ambient display touchpoints along Lobby, HMR, end-caps, and check-out coolers

Drive basket incidence with pantry stocking & fill up trips through high-impactful lobby displays, in-aisle beverage executions and perimeter pallet executions

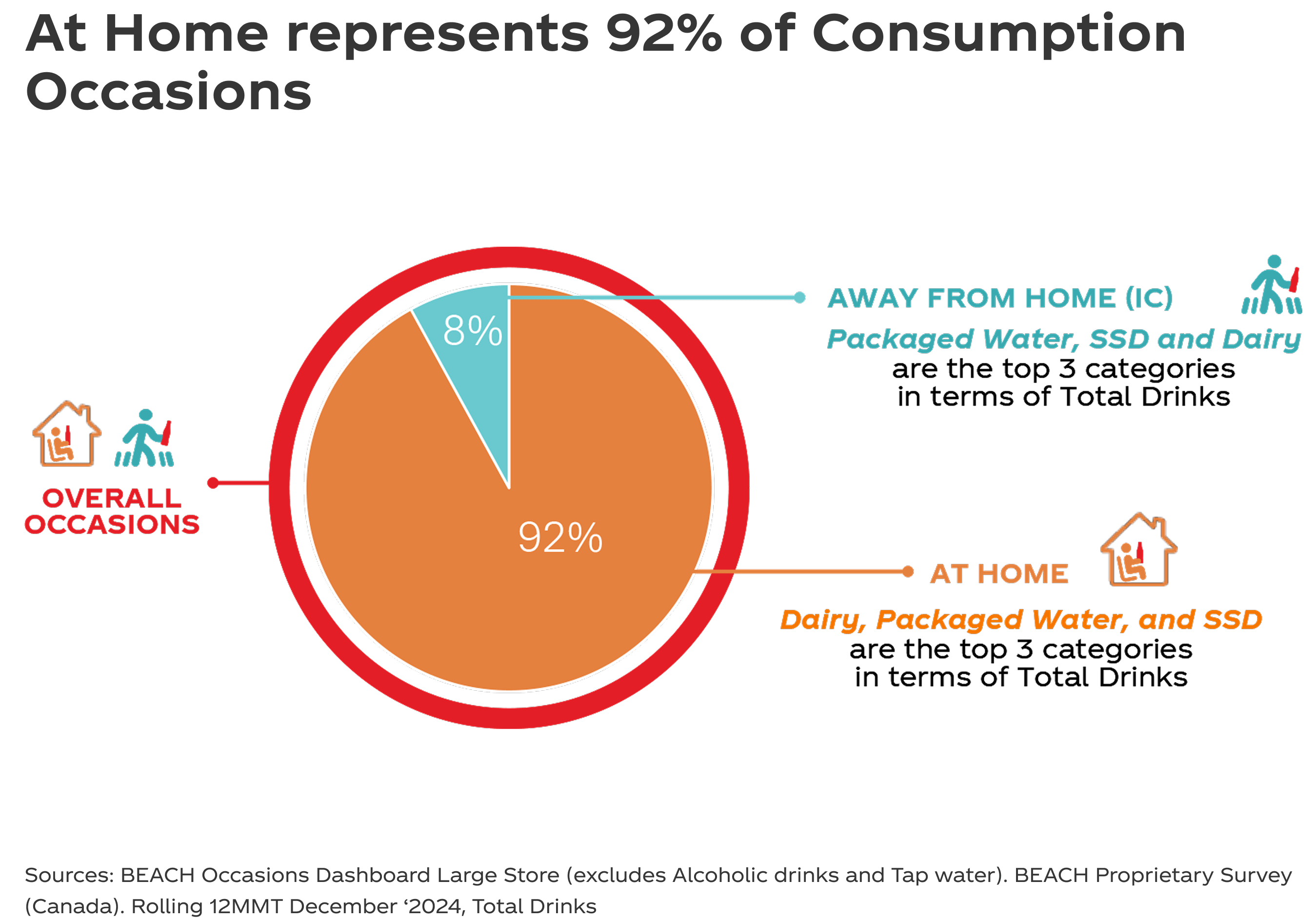

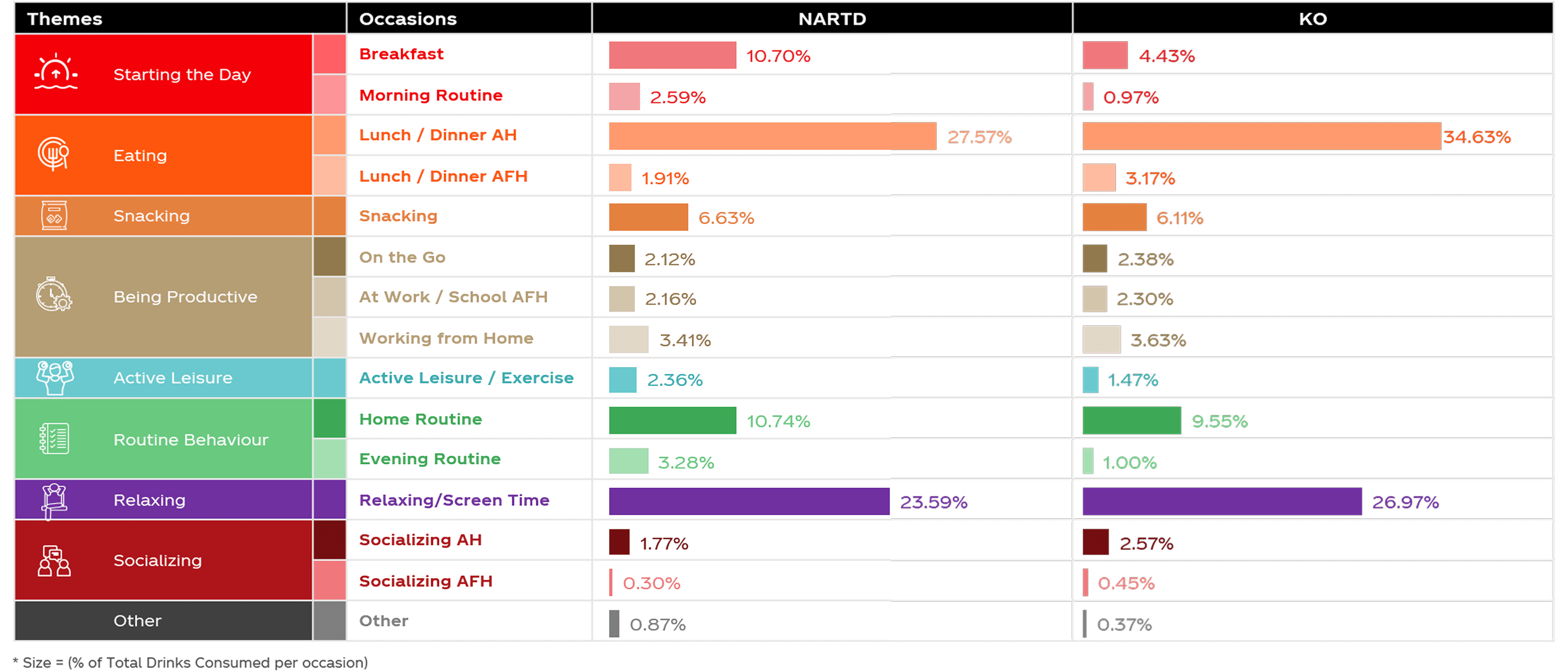

Large Store: Beverage Occasions in NARTD and KO

Quick Tips

Capitalize on the largest occasions through targeted messaging on Relaxation and Meals with best in class ambient displays

Connecting with the Shopper

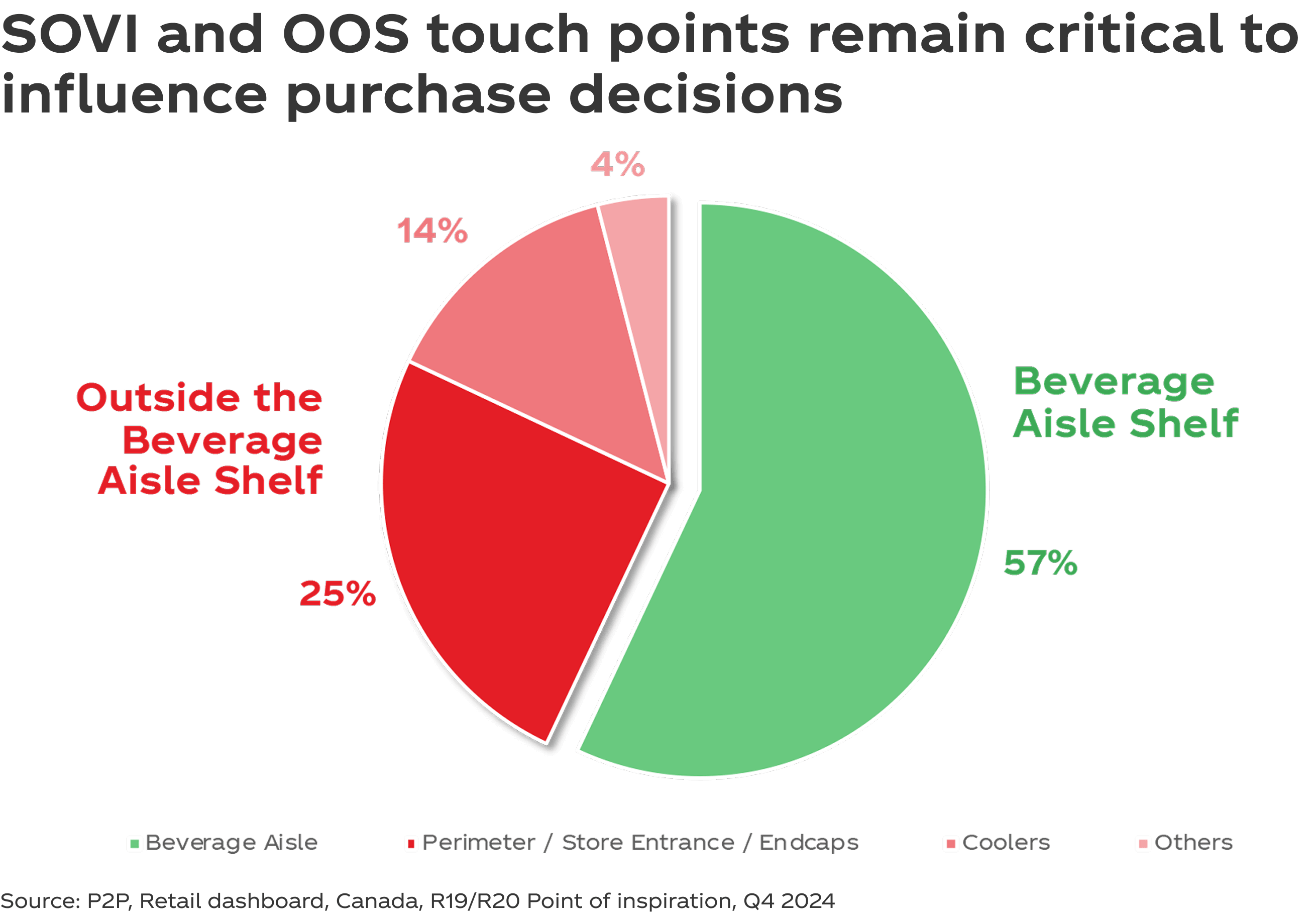

1. AVAILABILITY

2. ACTIVATION & POI

- Create multiple high impact touch points in-store to build baskets and drive frequency

- Scale up execution of Zeros, Premium Hydration and Sports portfolio to attract health-conscious shopper

- Maximize outcomes with the G.O.A.T calendar to drive engagement in store with consumers passion points

3. HRM

- Amplify HMR execution to drive purchases and increased baskets with the convenience seeker (Cold & ambient displays, food combo activation)

4. DIGITAL

- Convert digital shopper by integrating G.O.A.T marketing initiatives into retailers' programs and websites

- Integrate ad activity and marketing activations in digital flyers

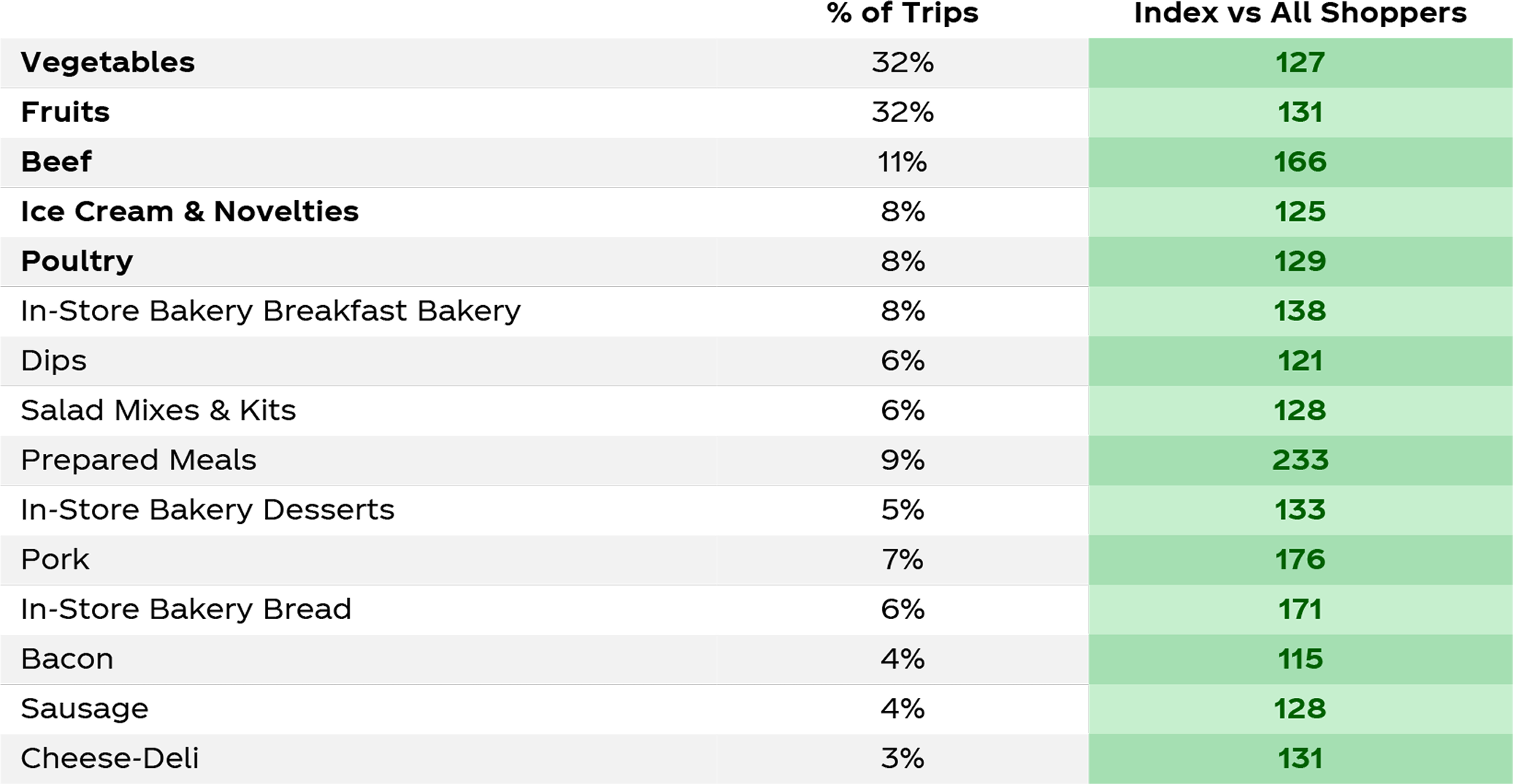

Convert the Non-KO shopper with cross-category touchpoints in key high traffic areas

Source: Numerator Insights, Basket Composition, Trip excluding Manufacturer = Coca-Cola, Conventional Grocery, L52 Weeks P/E May 2025

Quick Tips

1. Intercept the Non-KO shopper in areas we know they are more likely to visit, like Produce, Bakery, HMR (Prepared Foods) and Meats

2. Execute ambient display in high traffic sections

Target convenience seeking HMR shoppers to build basket incidence with food

Shoppers are turning to the HMR for ‘at home’ meal solutions

Both meal components and ready-to-eat solutions

Dinner is the most relevant occasion for HMR

Sobey’s, Loblaw’s, Metro & Walmart represent approximately 70% of HMR Share of Wallet

Beverage Incidence with Food is High!

94% of diners get a beverage while dining in!

91% of diners get a beverage with take out

65% get a beverage with food delivery!

Combo meals are on the rise

Demand for greater value and complete meal

Drive incidence via Combo purchase promotions for Dine-In and Take Home

Consumers prefer Coca-Cola with their meals

#1 brand consumers say ‘Complements My Food”

3x the rate of the closest competitor (Meals Occasion)

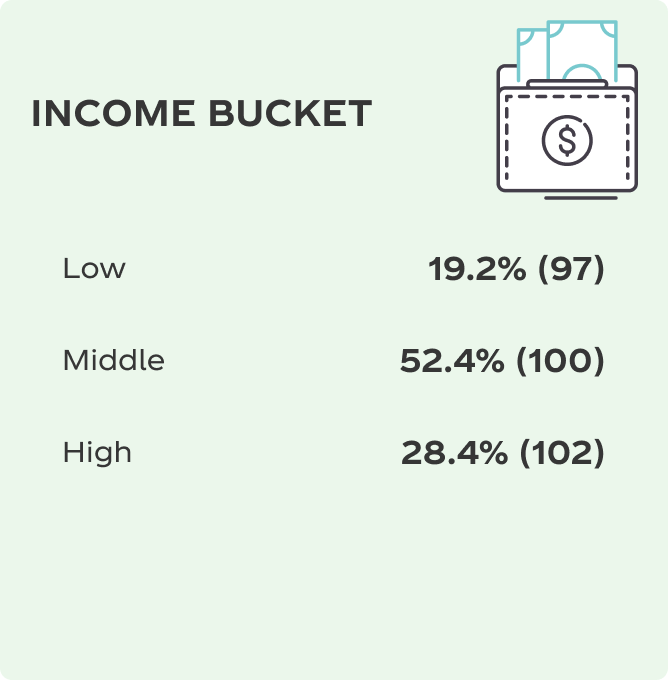

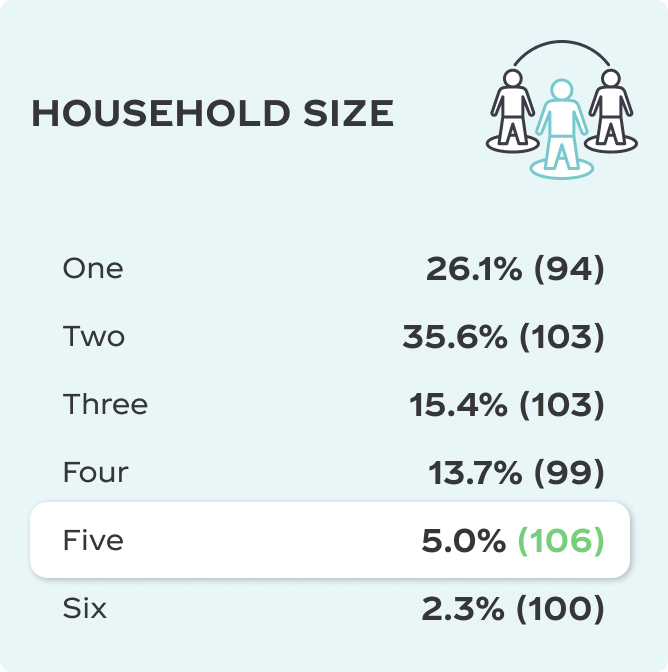

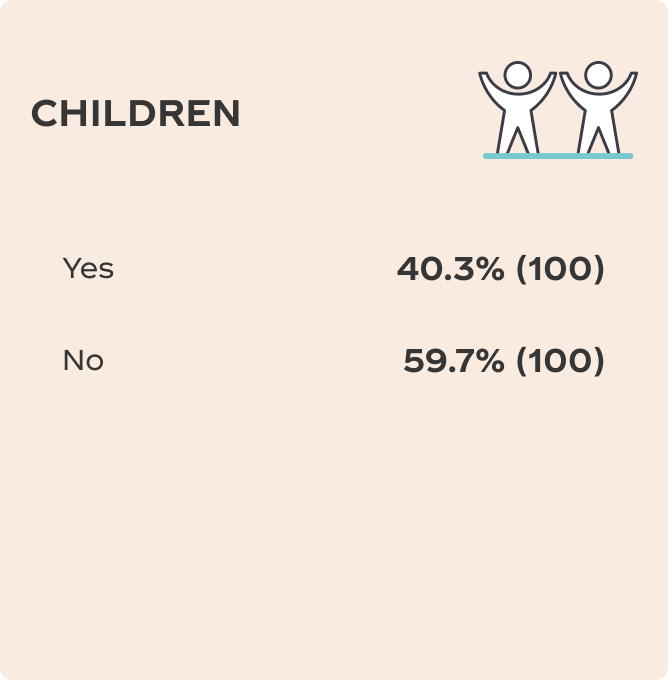

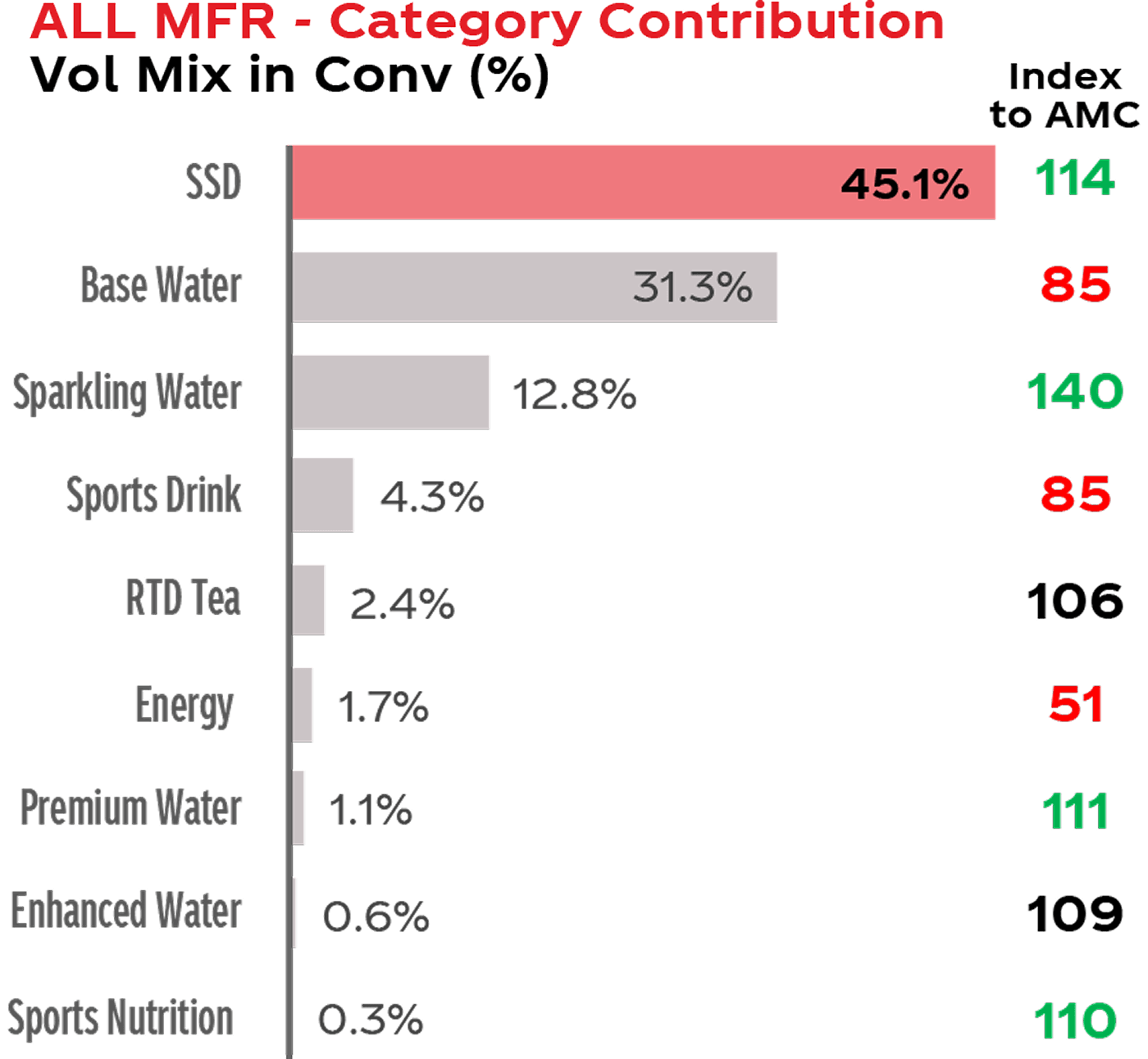

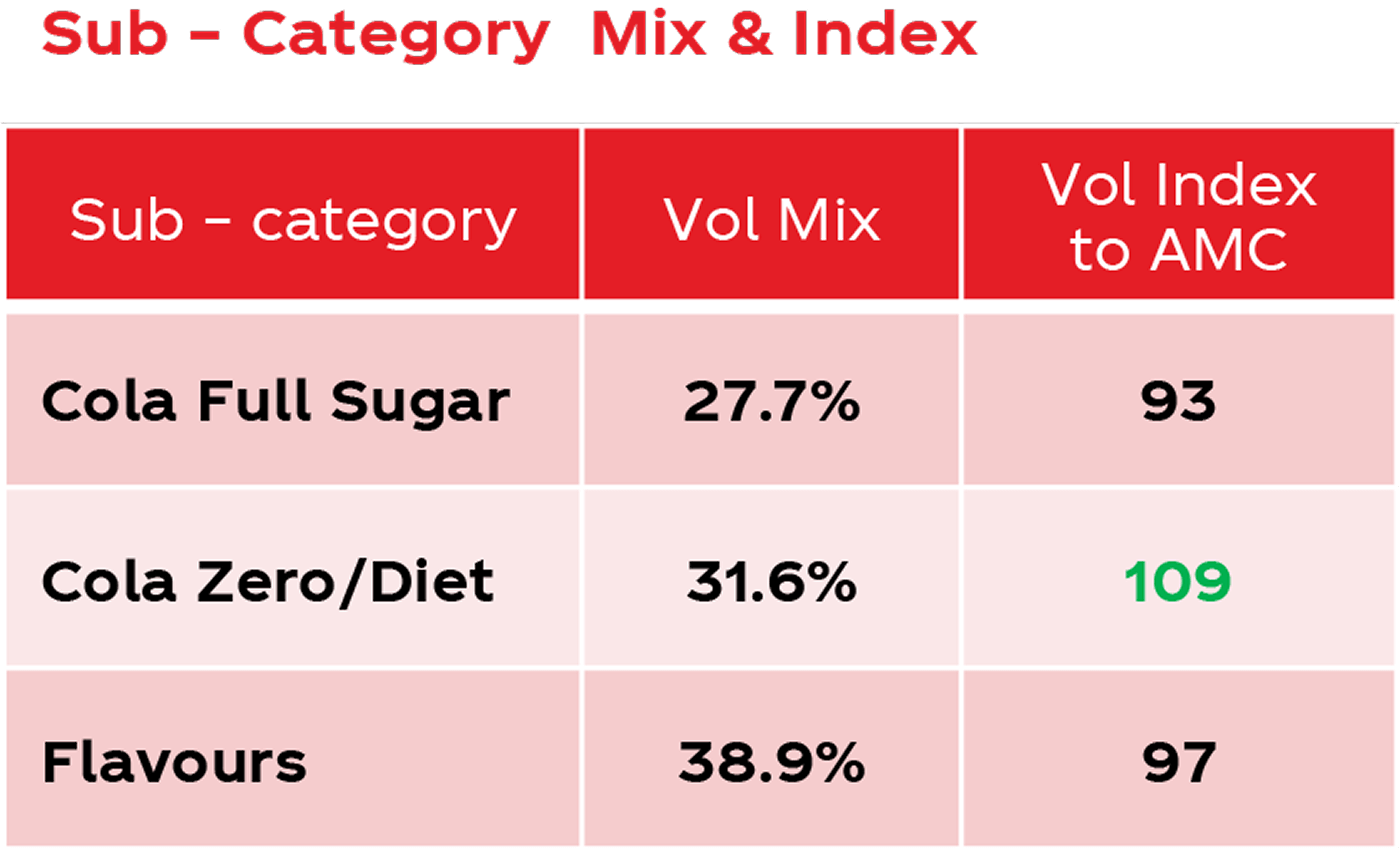

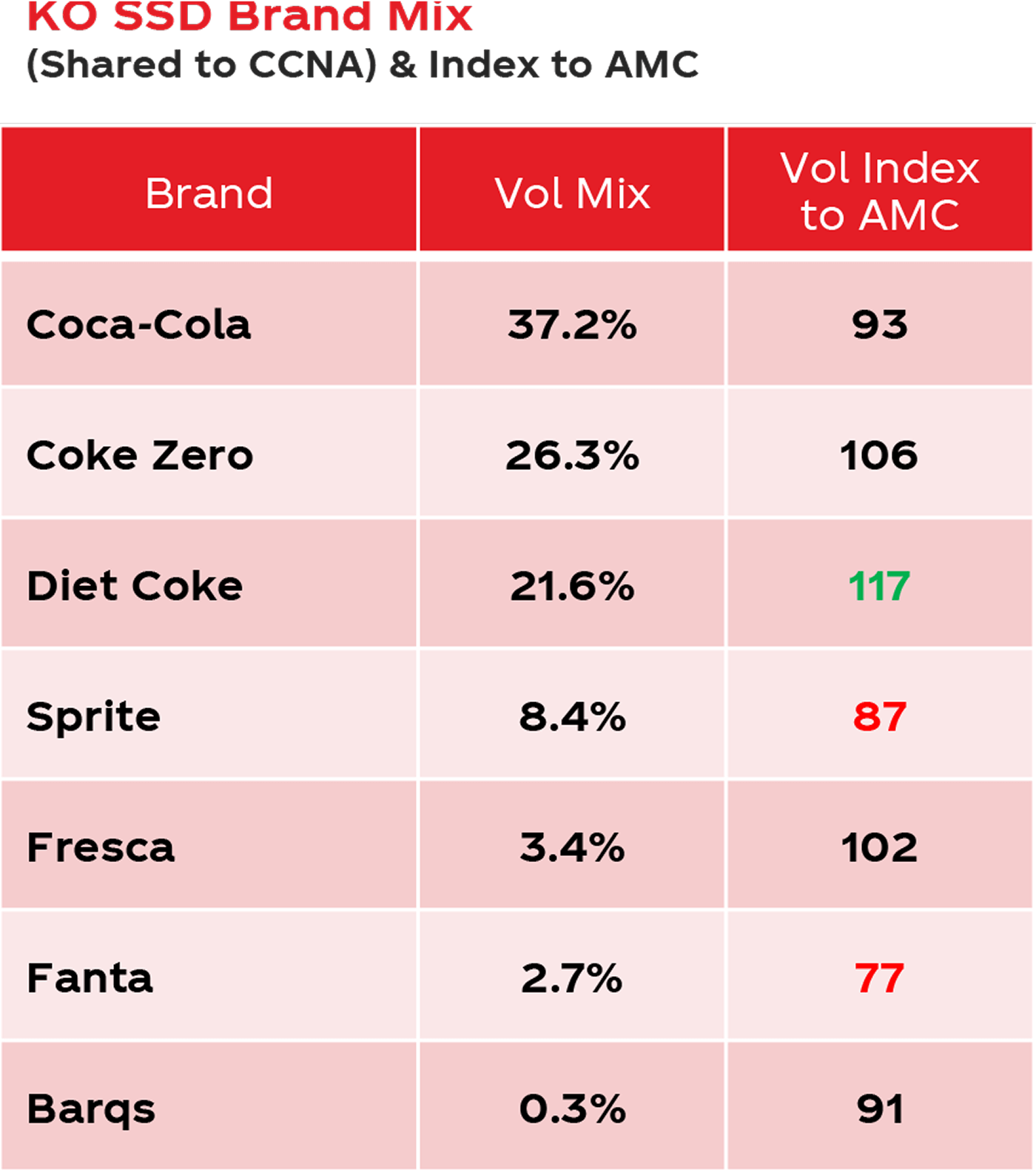

Conventional shoppers over index in Zeroes with KOZ and DKO leading the charge

Index: Category in Sub Channel vs. Category in AMC

Quick Tips

1. SSD is the largest NARTD category - critical to activate with multiple POIs, ambient and Cold, to win with the shopper

2. Zero sugar an opportunity in line with health-conscious shopper

3. Flavours remains a big opportunity at a strategic level – pulse in key activation windows

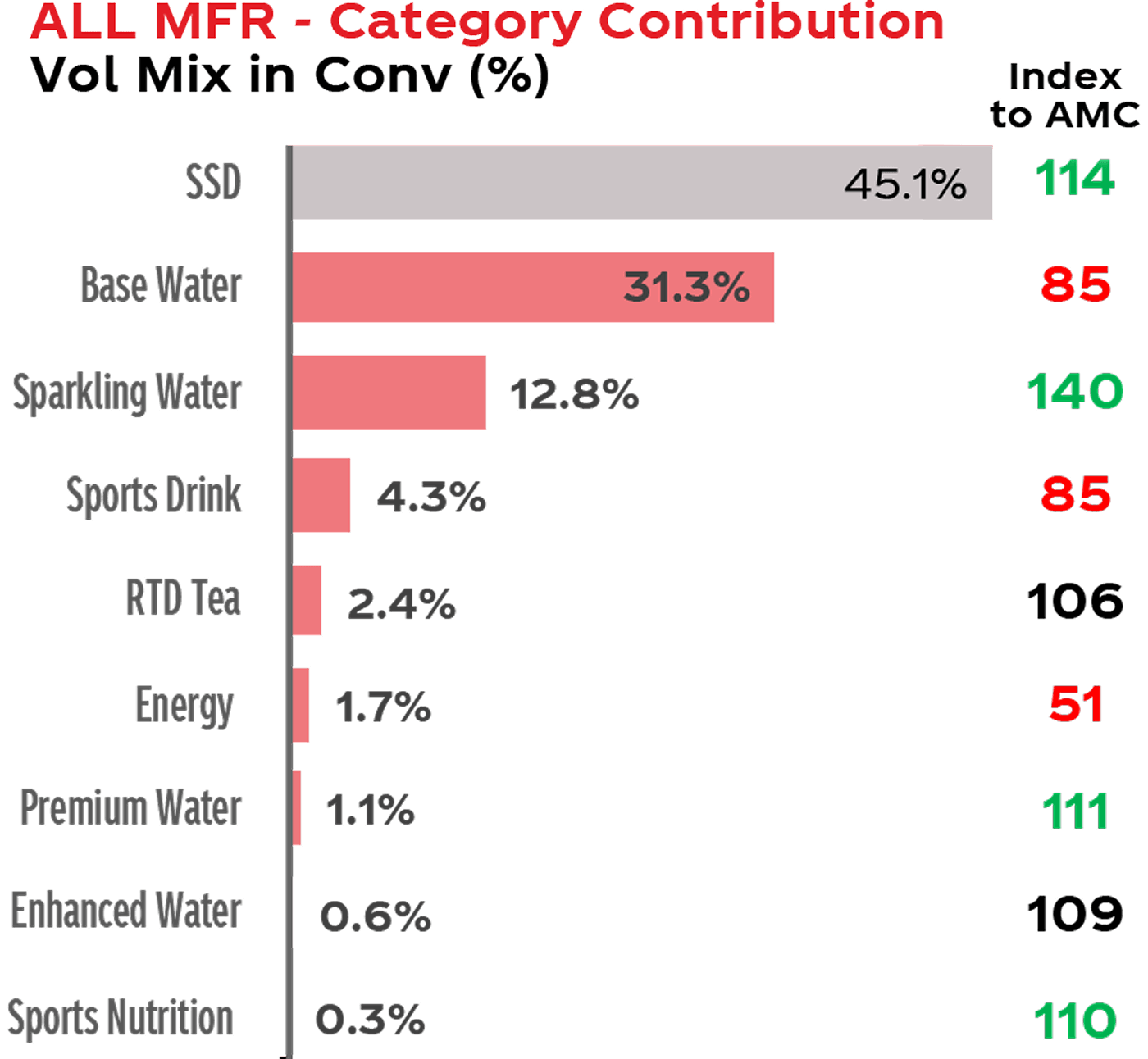

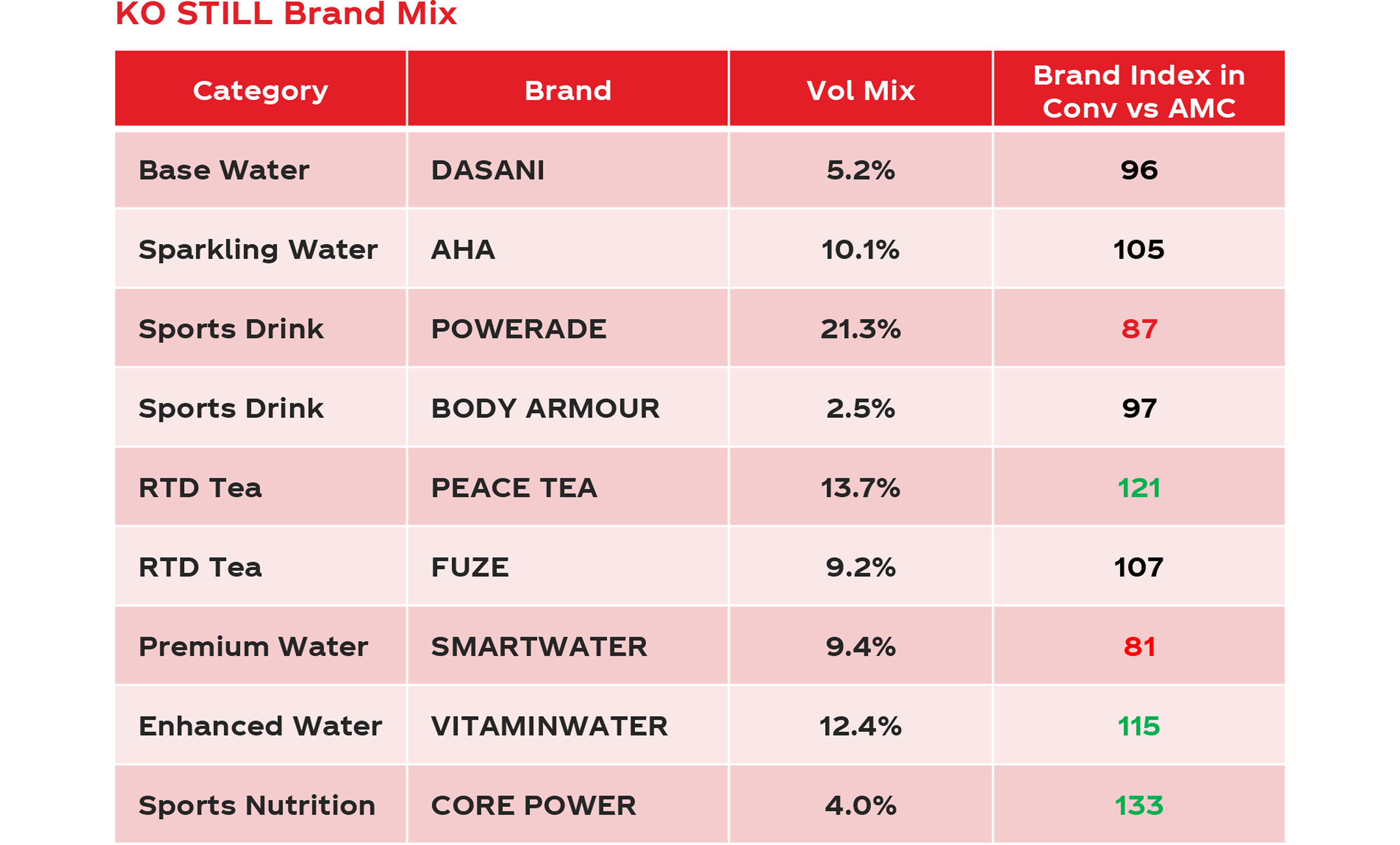

Leverage Still portfolio to convert and build basket with the health conscious Shopper

Index: Category in Sub Channel vs. Category in AMC

Vol Mix: Brand share of CCNA Stills in Conventional GB+DR+MM, L52 wks P/E June 07 2025

Quick Tips

1. Increase listings and drive availability of Fuze Tea, Peace Tea, Core Power, VitaminWater to drive sales with Conventional shopper

2. Activate multiple touch points with Stills portfolio such as end caps, ambient display, and check outs

3. Waters across Sparkling and Still continues to be an opportunity with high category contribution but low KO index