Convenience & Gas

Culture

The Changing Consumer

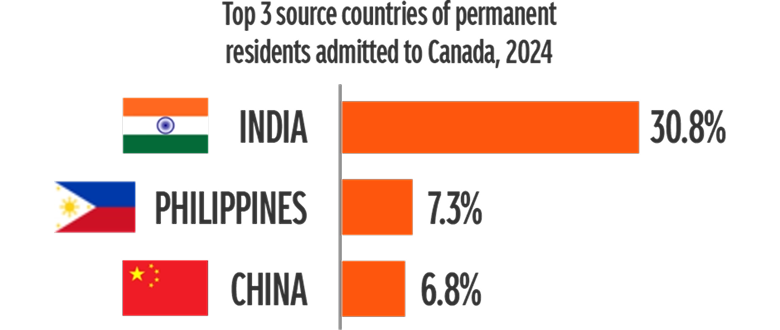

Multiculturalism is a key contributor to population growth

97%

of all population growth is attributed to IMMIGRATION

The dual identity of new immigrants shapes their consumption patters

44% want a product inspired by home country

36% want to see companies support of charities related to culture

Gen Z influence is increasing with Gen X and Millennials

46%

live with their parents

24%

Like to try new things (over indexing vs. total population)

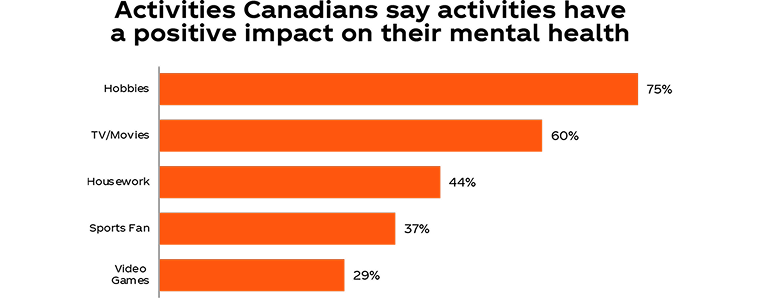

Canadians are tapping into their ‘KID SELVES’ sharing love of hobbies and fandoms

AGE OF VITALITY

Holistic approach to wellness

Consumers are focused on recovery, hydration & nutrition.

57%

Use physical exercise to support mental health

82%

Limit the amount of sugar they eat

37%

Say sports fandom impacts their mental health

Beverage Implications

Cater to the taste of new Canadians and drive relevant assortment like flavors.

Promotional programming that blends new offerings with base offering will speak to multi-gen households.

Promote fitness-focused self-care with low-sugar, hydrating products packed with added benefits. Champion "Zero as the Hero“.

Leverage marketing programs that speak to fandoms.

Technology

Digital In-Person

Self-serve options like online ordering are growing in importance

39%

of Gen Z have CREATED CONTENT while shopping in store

30%

of NARTD sales are expected to be DIGITAL (+9.3 pts vs 2020)

Beverage Implications

Harmonize content on digital platforms to align with key messages and purchase drivers

Leverage marketing programs to create sharable moments in store

Economy

The Value Equation

Value is more than just price. Quality & loyalty programs are important too.

54%

of Canadians report having a BUDGET +9% since 2017

50%

of consumers say LOYALTY PROGRAMS are an IMPORTANT factor in where they shop

Snacking occasions are rising - Canadians look for mood enhancers or meal substitutes.

90% of millennial women and 84% millennial men snack regularly

49%

of Gen Z use SNACKS as a REWARD

Economic pressure driven tariffs are encouraging ‘buy local’

92%

of Canadians believe TARIFFS will have a NEGATIVE EFFECT on their daily life (51% very negative)

Beverage Implications

Execute affordability plans within stores with an eye to cultural & socioeconomic demos and specific products

Use loyalty programs to support young and New Canadians

Prioritize snacking promos and drive purchase frequency

Share the Coke Canada story of impact on local jobs, communities and the economy to amplify the ‘Buy Local’ movement

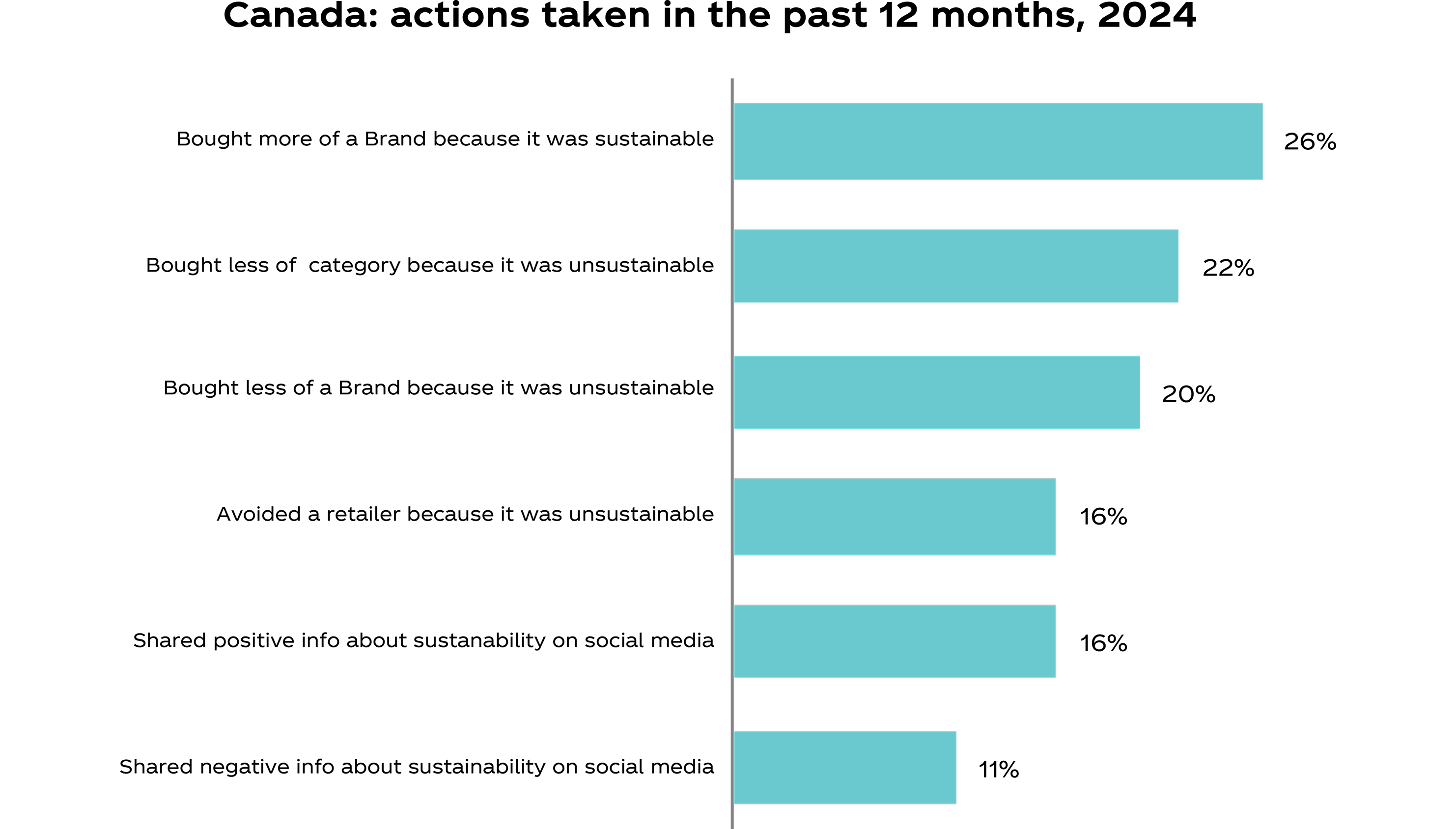

Environment

Prominence of Packaging

Canadians gravitate towards price-equivalent sustainable offerings, and avoid brands and products that don’t meet sustainability expectations

Canadians expect brands to prioritize sustainability... and the onus is on us

90%

of consumers agree COMPANIES should be DOING MORE to IMPROVE SUSTAINABILITY

61%

say they want SUSTAINABLE PACKAGING

TOP 3 CONCERNS

Packaging waste is the primary concern of Canadian consumers.

Packaging waste

Waste after finished using

Resources/emissions in production

Beverage Implications

Speak to innovative packaging design geared towards reducing waste

Highlight carbon reduction initiatives that can support customer sustainability objectives

Spotlight impactful packaging with clear calls to action that resonate with consumers