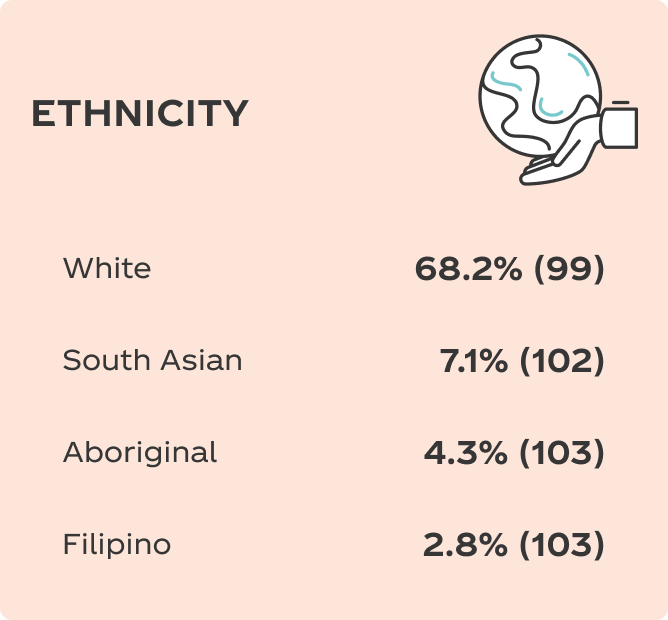

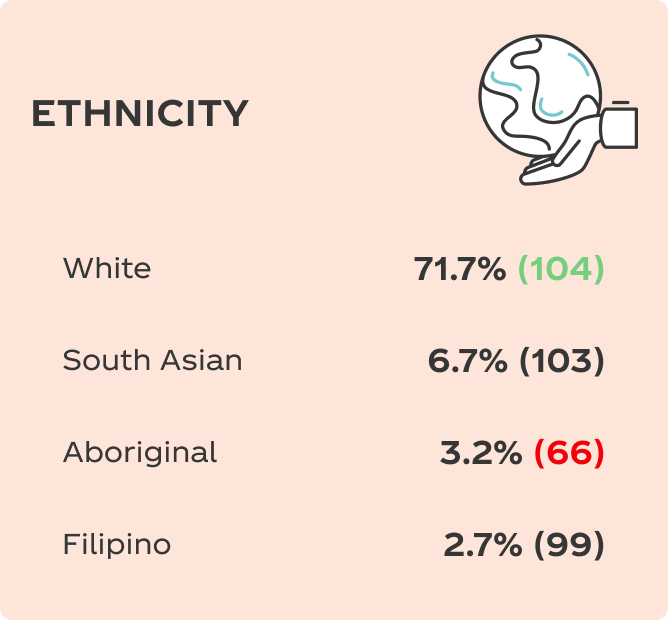

- Focus on assortment that is relevant to the multi-cultural shopper

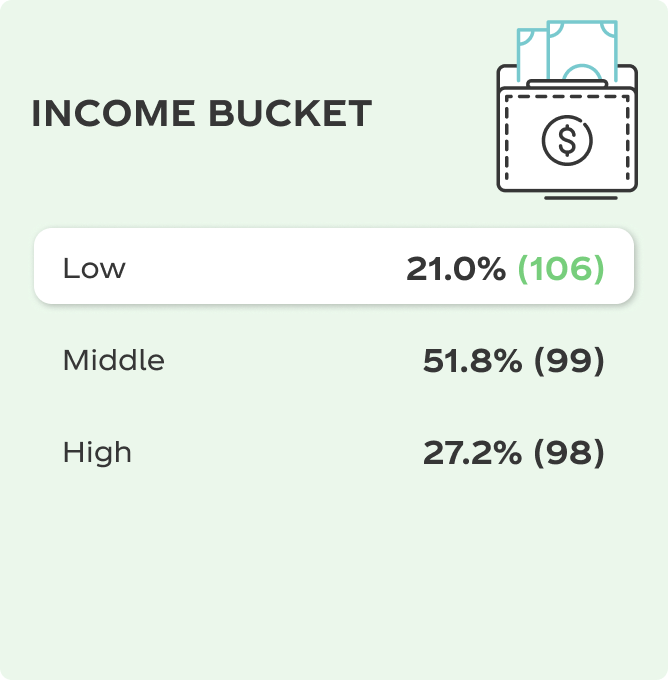

- Focus on deals and affordability packs to connect with a more budget driven shopper

- Promote multipacks which connect with larger HH size shopper

Large Store Discount

Retail Environment

Big‑box grocery & general merchandise stores emphasizing low everyday prices, broad assortments, and promotions to drive high traffic.

Shopper Motivations

Budget‑conscious consumers looking for low prices on a wide range of household needs. They prioritize affordability over premium branding and often do bulk or stock‑up shopping.

Key Customers

Shopper Profile

DISCOUNT SHOPPER

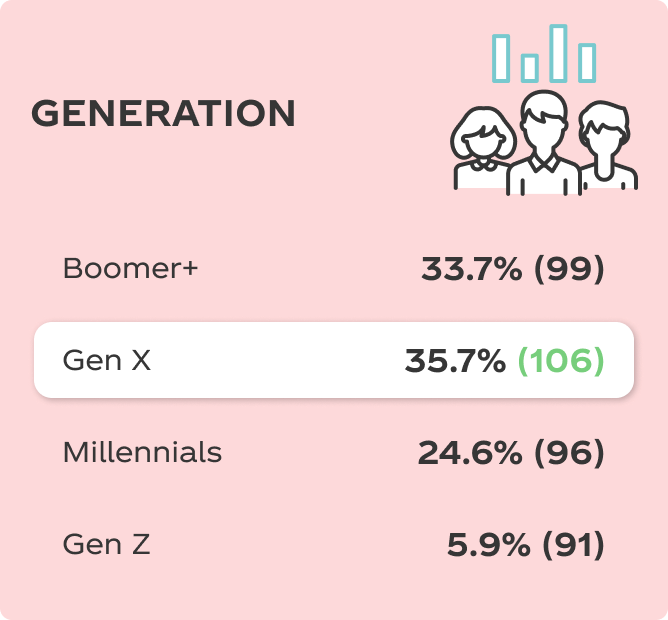

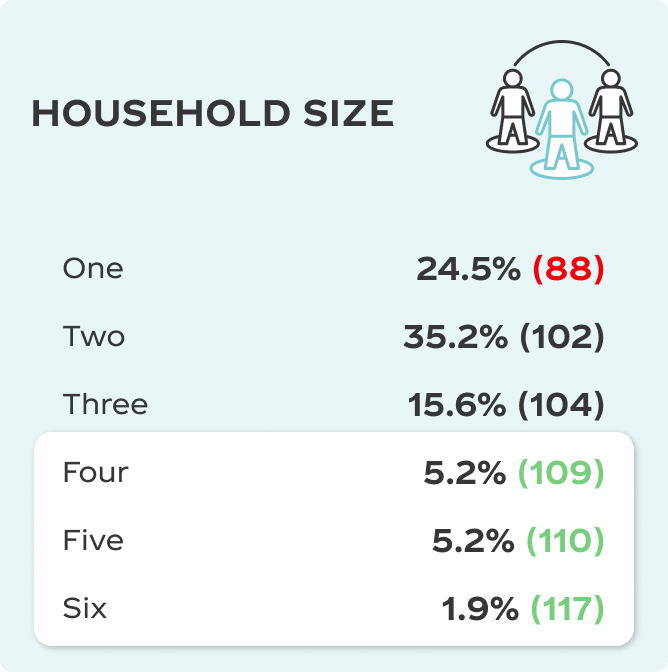

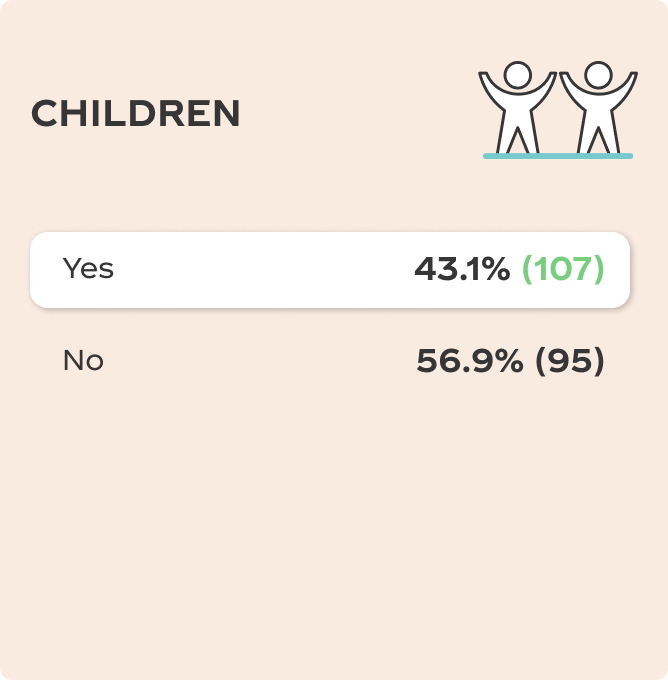

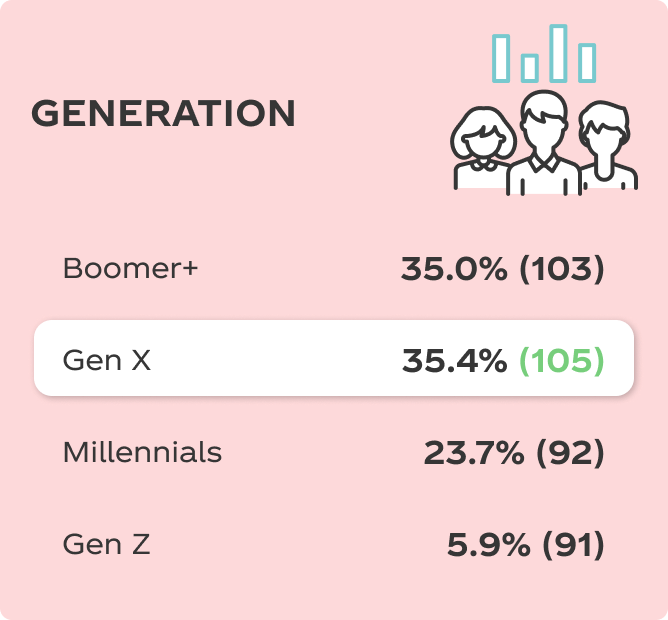

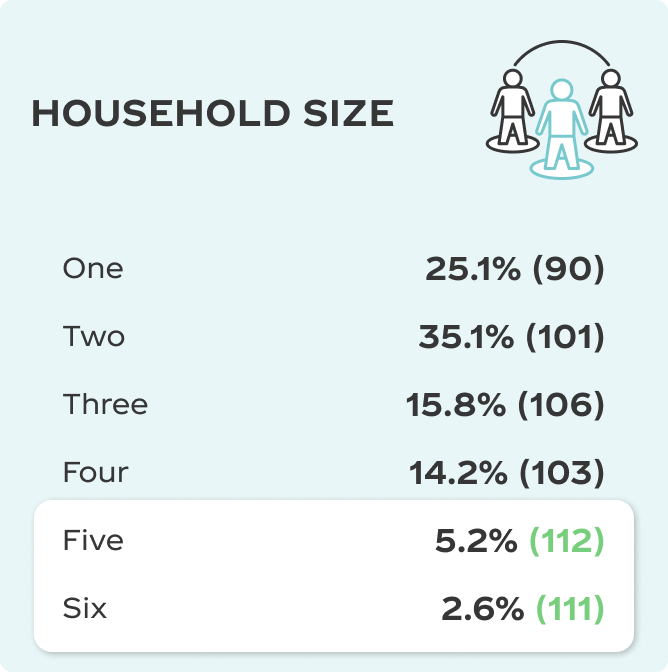

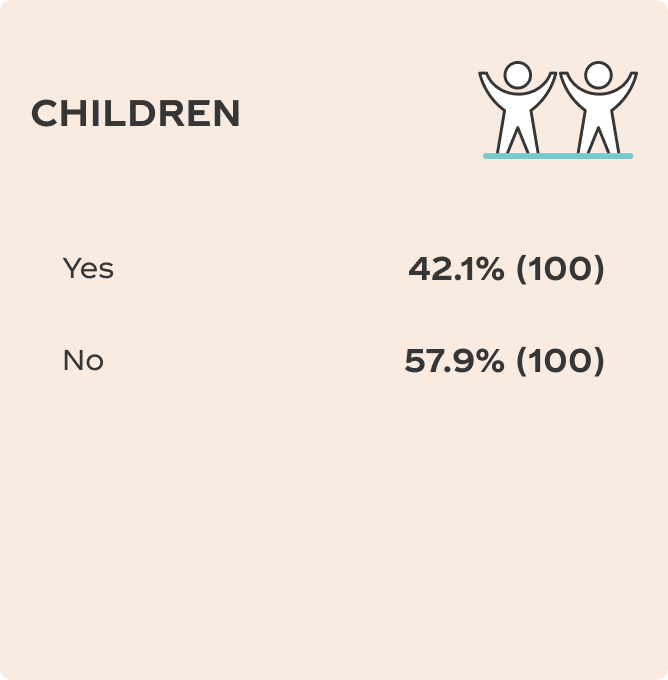

Gen X Skew, Large Households

All ethnicities and incomes with children.

Quick Tips

Psychographics & Behaviors

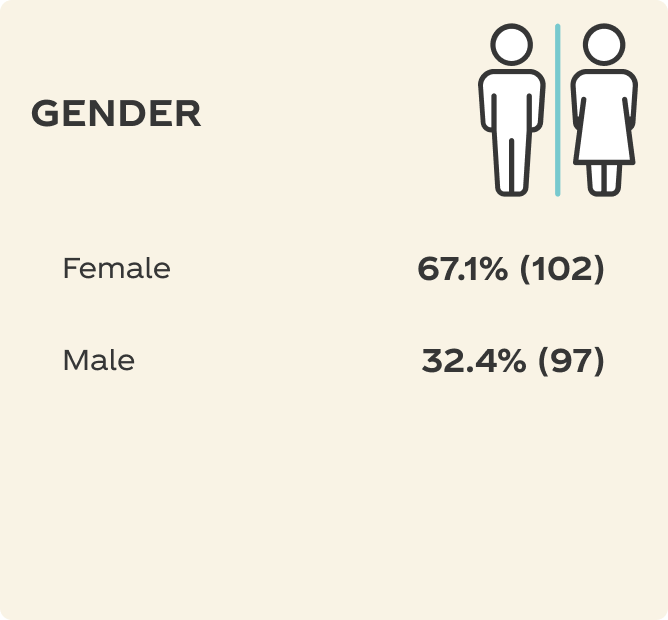

MASS SHOPPER

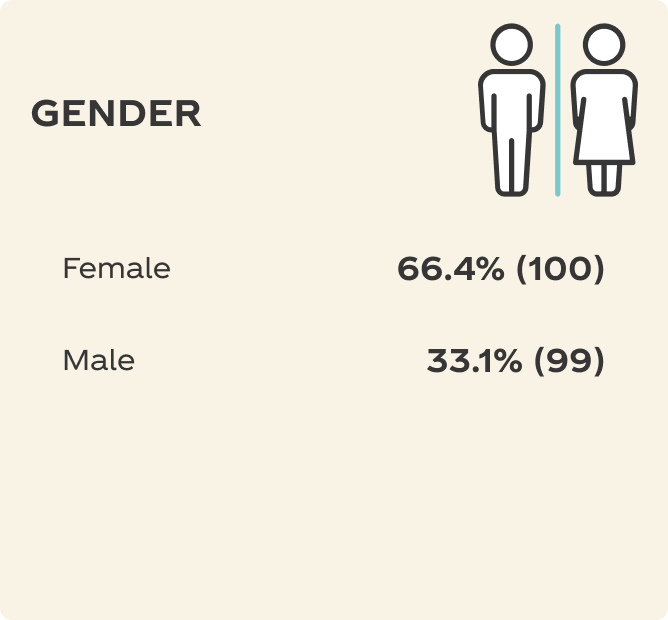

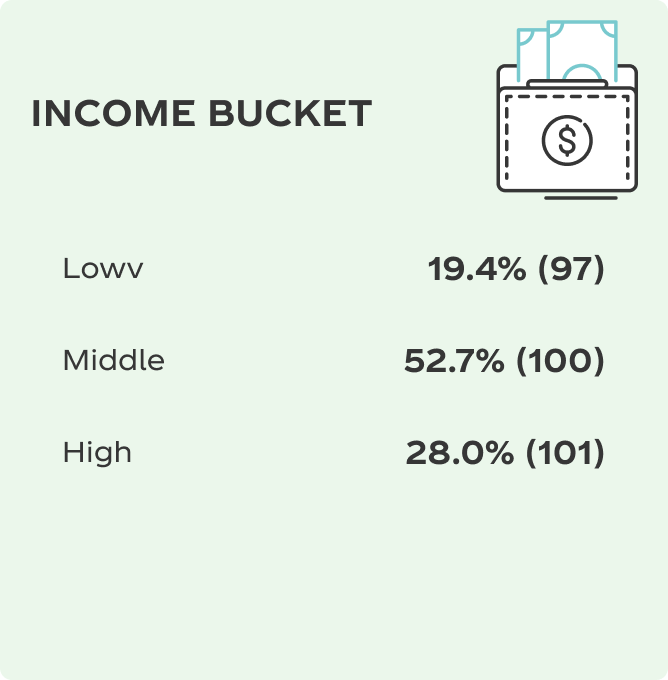

Older Shopper, Larger Households

Skews lower income with families.

Quick Tips

- Focus on affordability packs that is relevant to the low and mid-income level shopper

- Promote multipacks which connect with larger HH size shopper

Psychographics & Behaviors

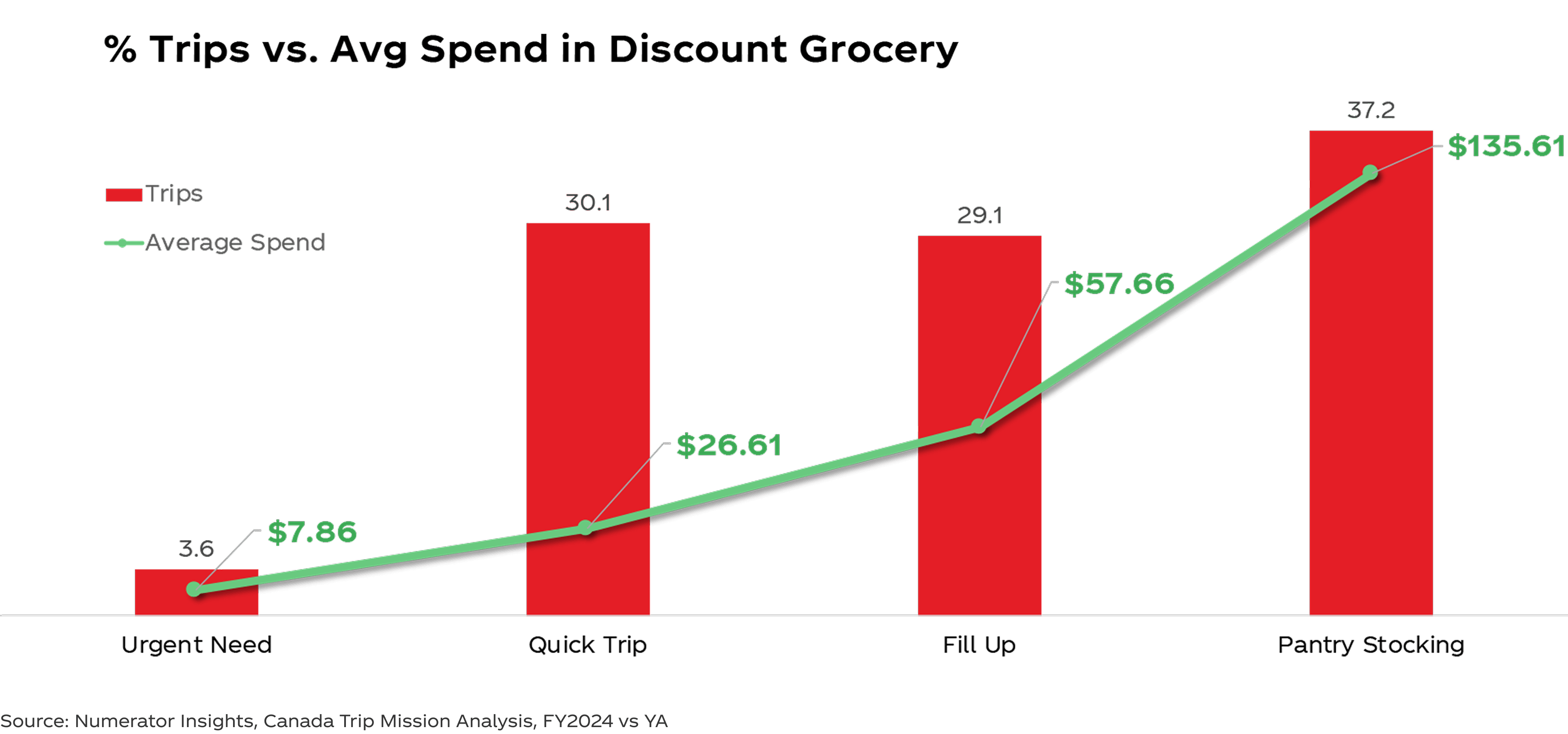

How Shoppers Shop

Stock up trips represent the largest opportunity in Discount Grocery

Quick Tips

Drive Pantry Stocking trips through high-impactful lobby displays and in-aisle beverage executions

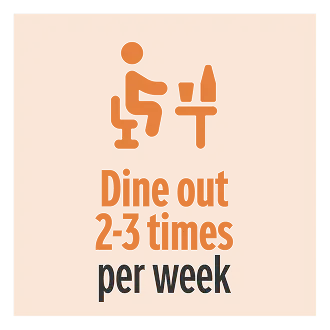

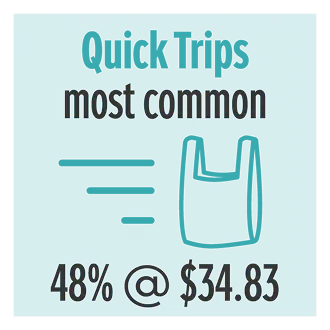

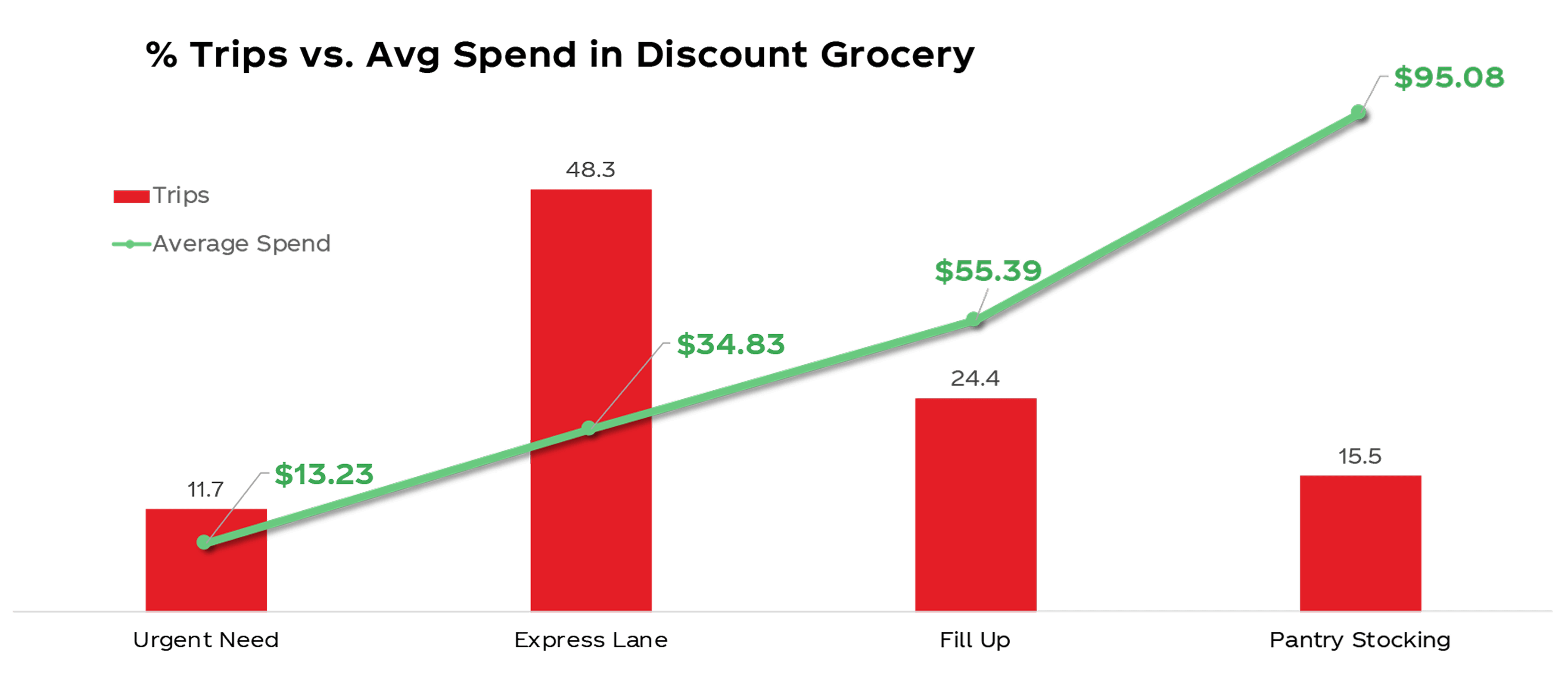

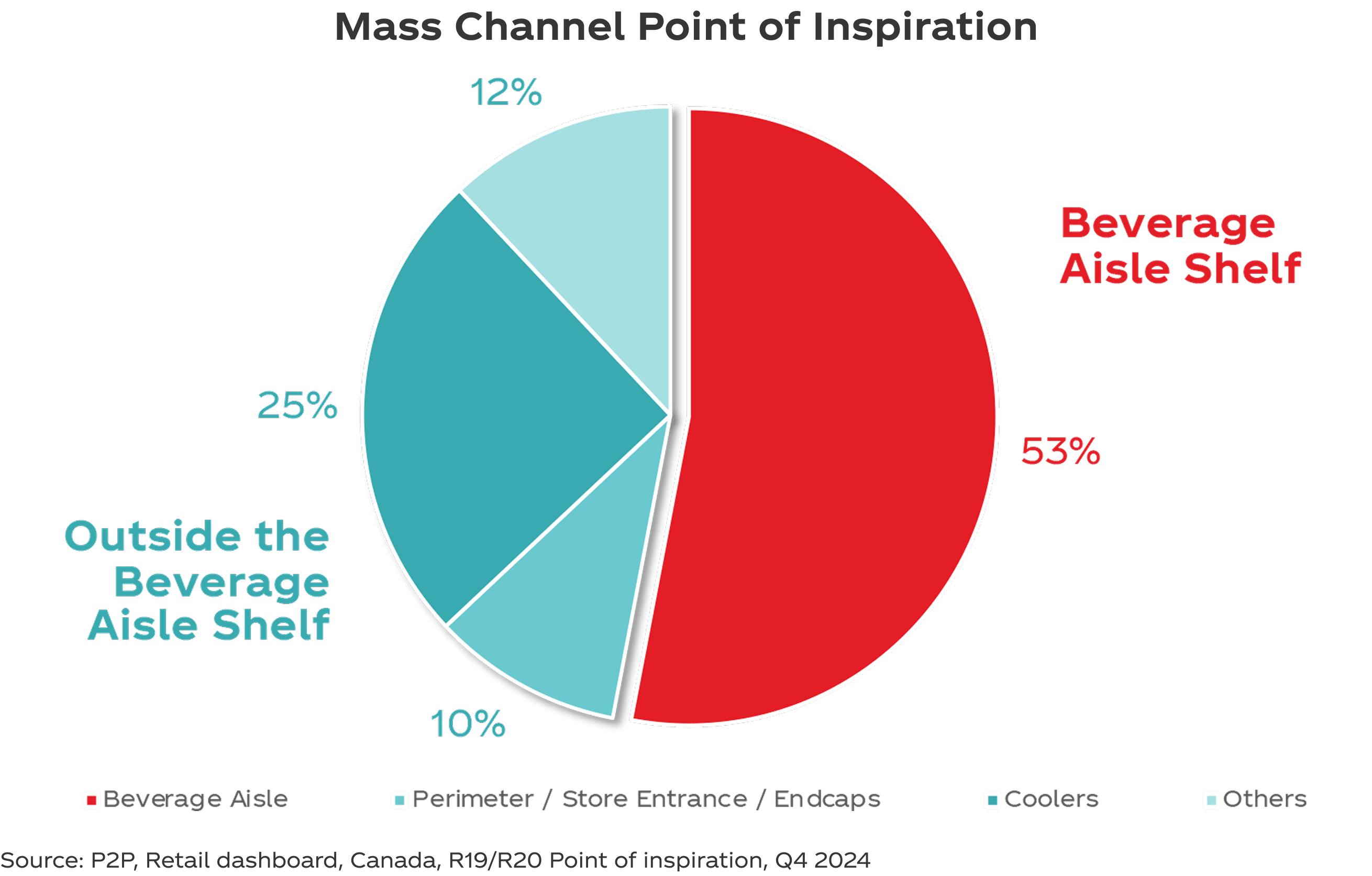

Interrupting the express trip in Mass is Key

Quick Tips

- Convert Express Lane Trip shoppers with ambient display touchpoints along Lobby, end-caps, and check-out coolers

- Driving Fill Up and Pantry Stocking trips through high-impactful lobby displays and in-aisle beverage executions

Source: Numerator Insights, TL NARTD or TL Coca-Cola Manufacturer, TL Discount Grocery or TL Food Online, FY 2024

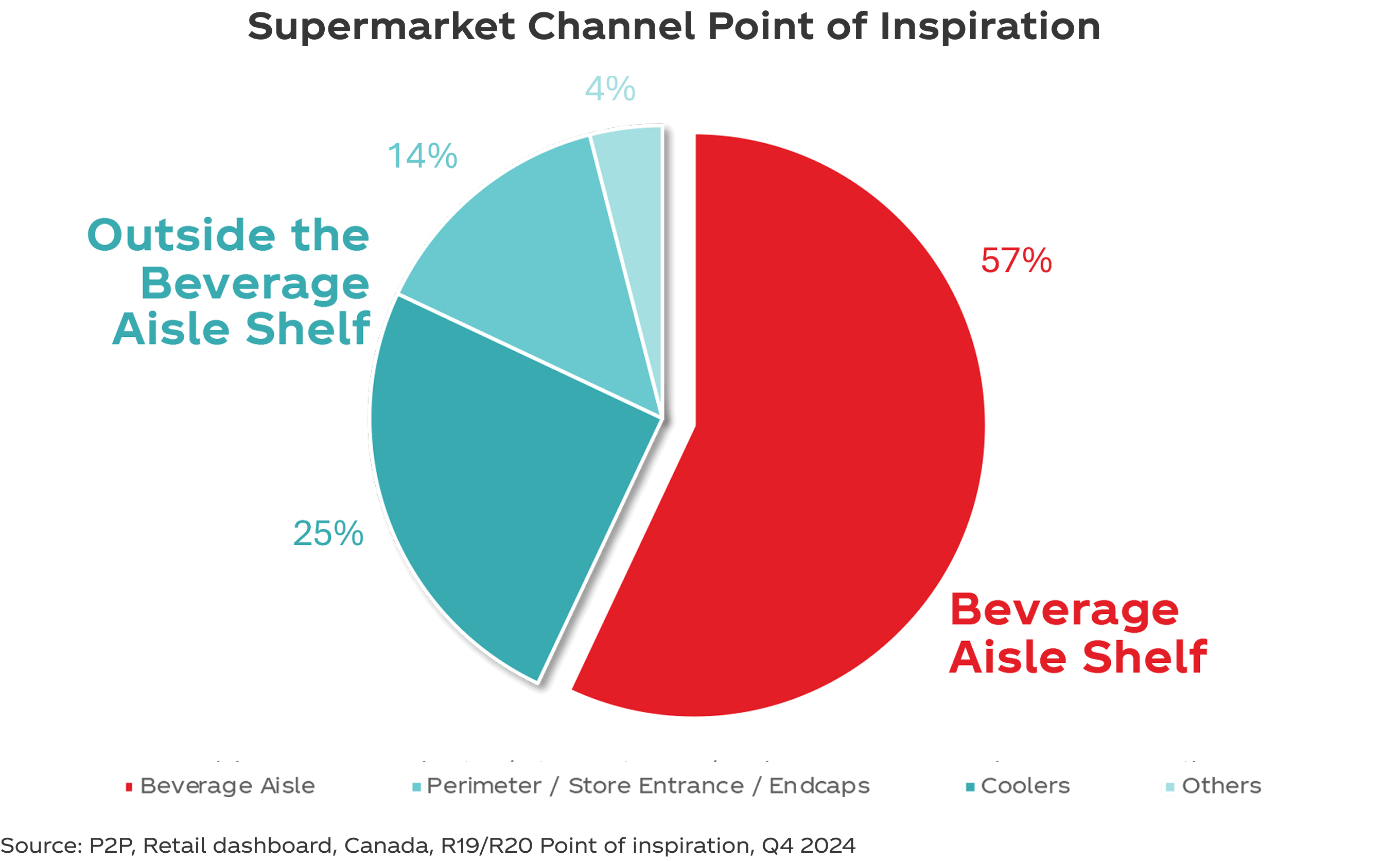

SOVI and OOS touch points remain critical to influence purchase decisions

Quick Tips

- Creating multiple touchpoints within the shopper path to purchase is critical to win baskets

- In beverage aisle, win the Fair share+1 battle through executing on aligned planograms

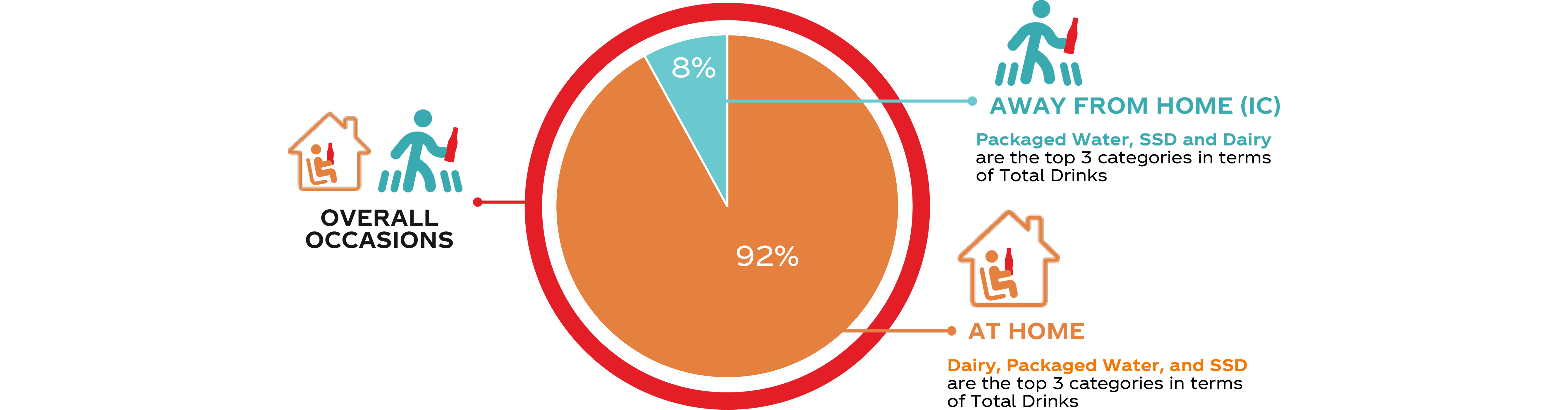

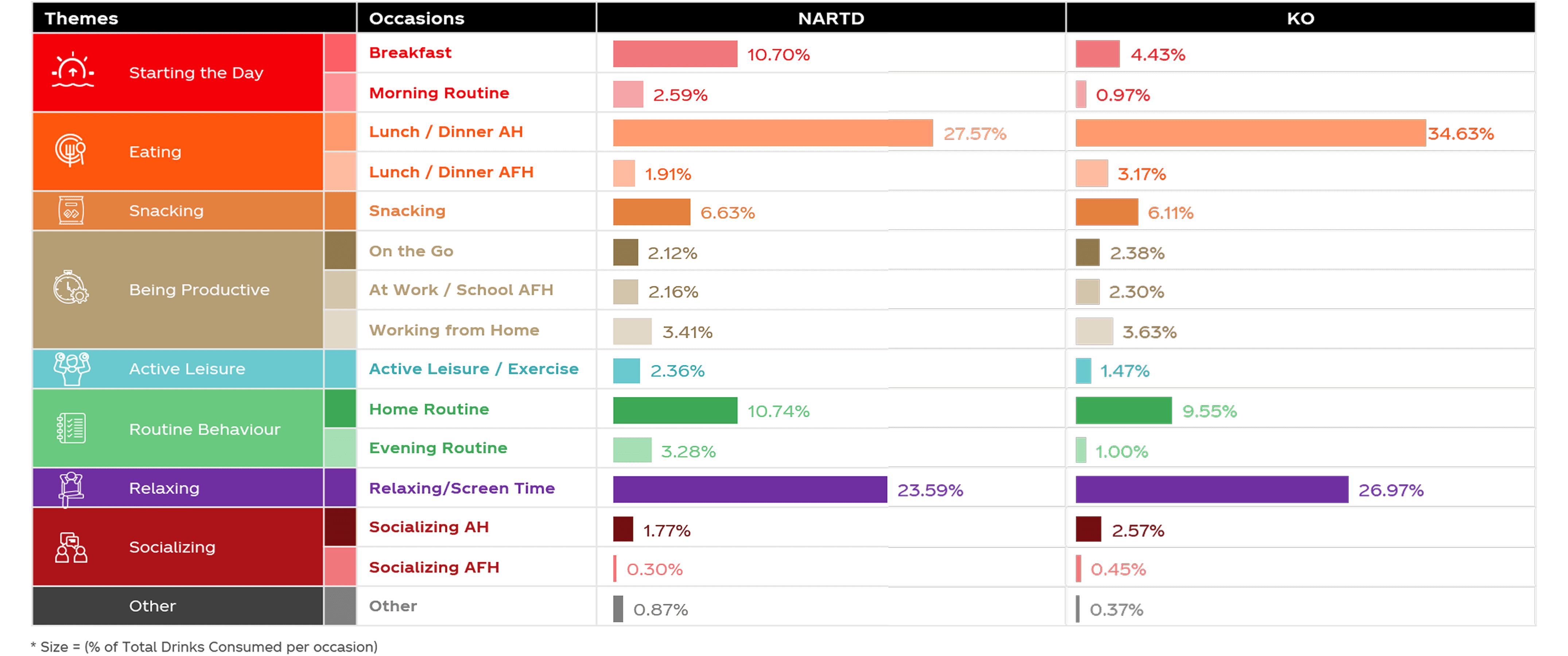

At Home represents 92% of Consumption Occasions

Beverage Occasions in Large Store – NARTD and KO

Quick Tips

Capitalize on the largest occasions through targeted messaging on Relaxation and Meals with best in class ambient displays

Winning with the Discount & Mass Shopper

1. AVAILABILITY

- Connect with the multi-cultural shopper with relevant assortment such as SSD Flavors and RTD Tea

- Keep the shelf stocked with affordability packs like the 6x710ml to engage with the budget driven shopper

- Drive Cold availability across all relevant touchpoints in store to convert the impulse shopper

2. ACTIVATION & POI

- Amplify ad activity and promotional communication which resonates with the budget driven shopper

- Create multiple interruption points in-store to capture quick trips

- Use passion points within Mar-Comm to connect with the shopper – such as BBQs/Grill Season and Entertaining

- Activate transaction packs to match relevant trip missions

3. HMR

- Amplified HMR execution to engage with convenience seeker (Cold & ambient displays, food combo activation)

4. DIGITAL

- Convert digital shopper by integrating into retailers' programs and websites

- Integrate ad activity and marketing activations in digital flyers