Value (Dollar Store)

Share & Traffic

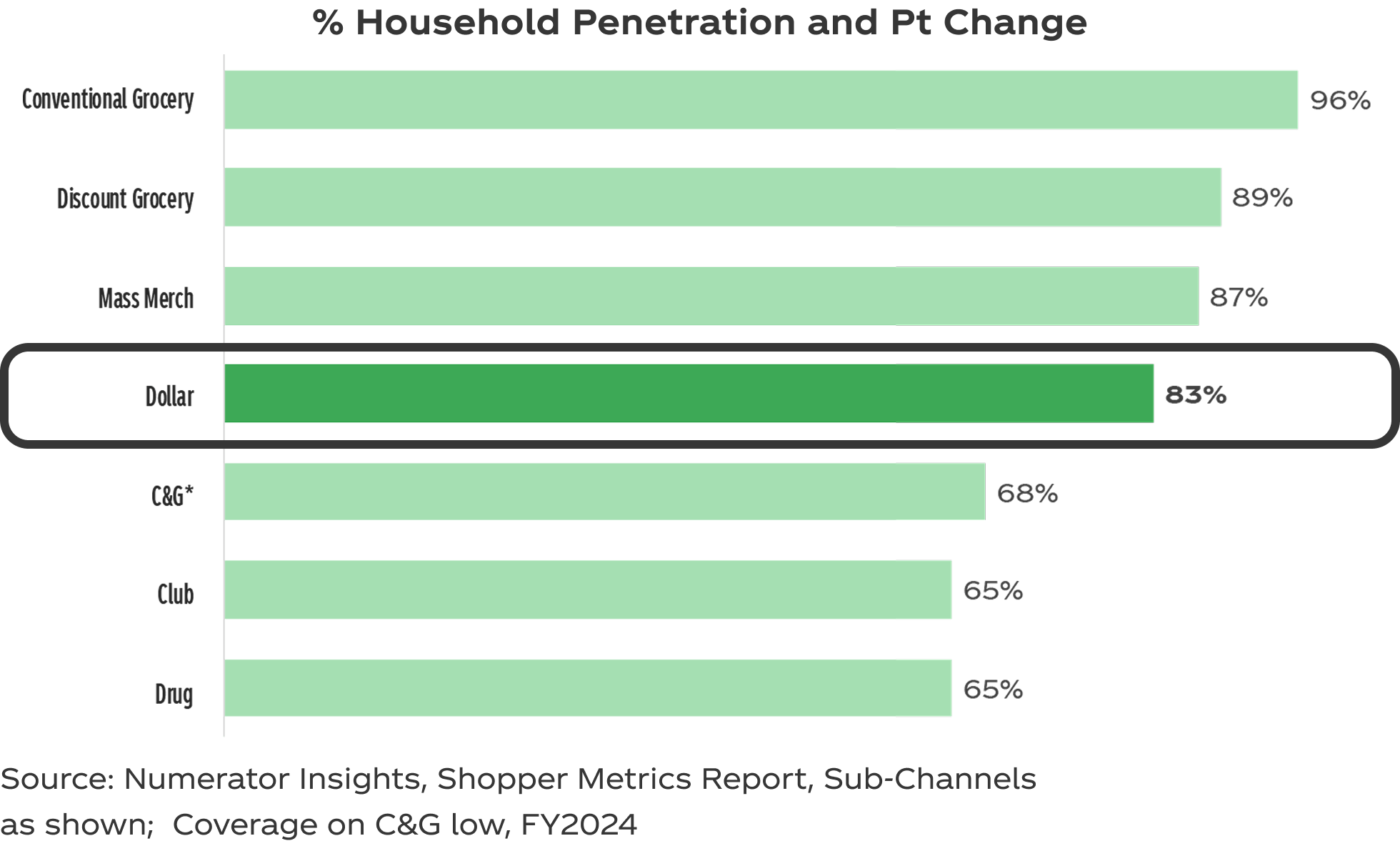

Value channel is highly penetrated with 83% of households 83% of households

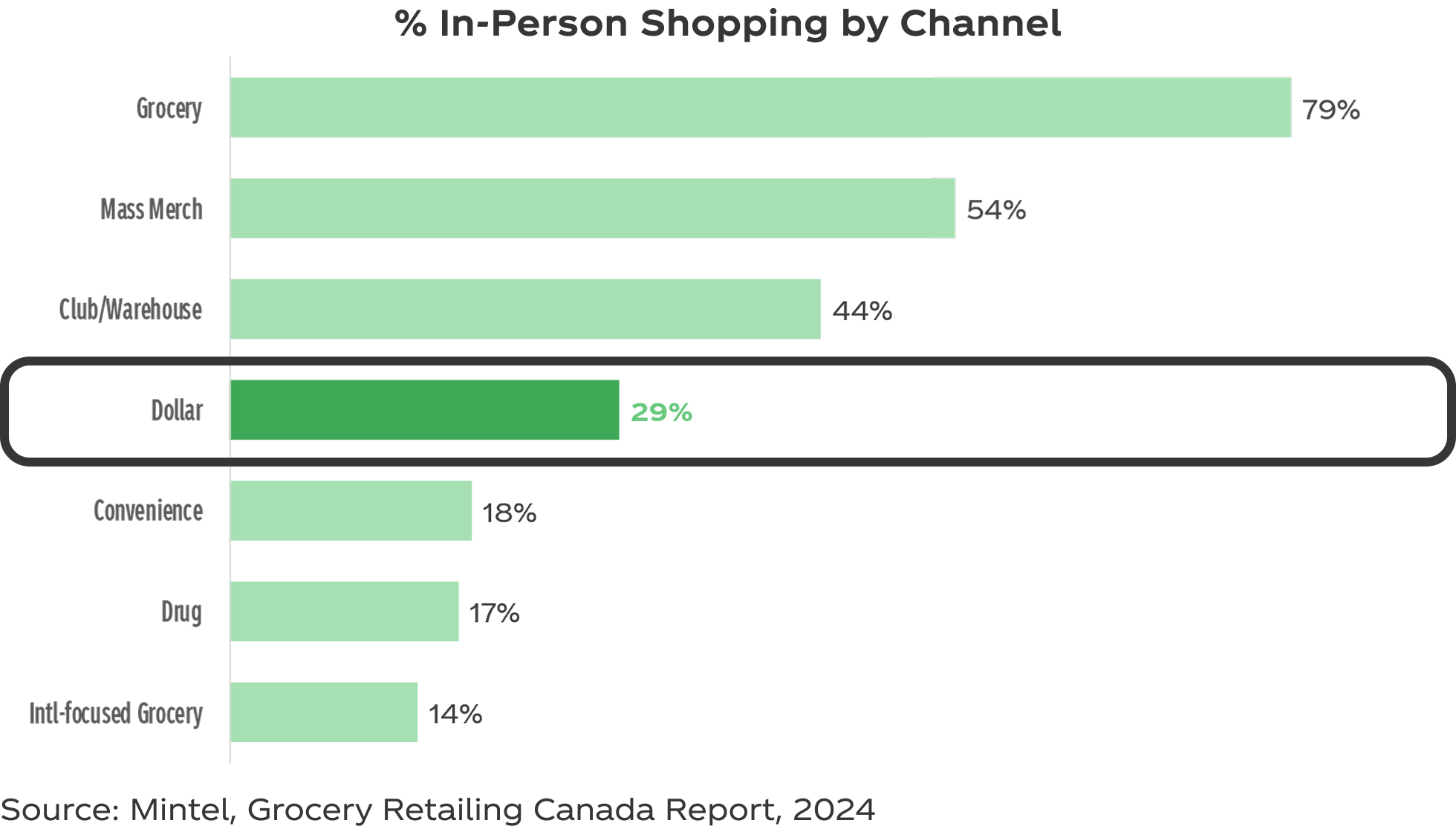

29%

of in-person grocery shopping happens in the Value Channel

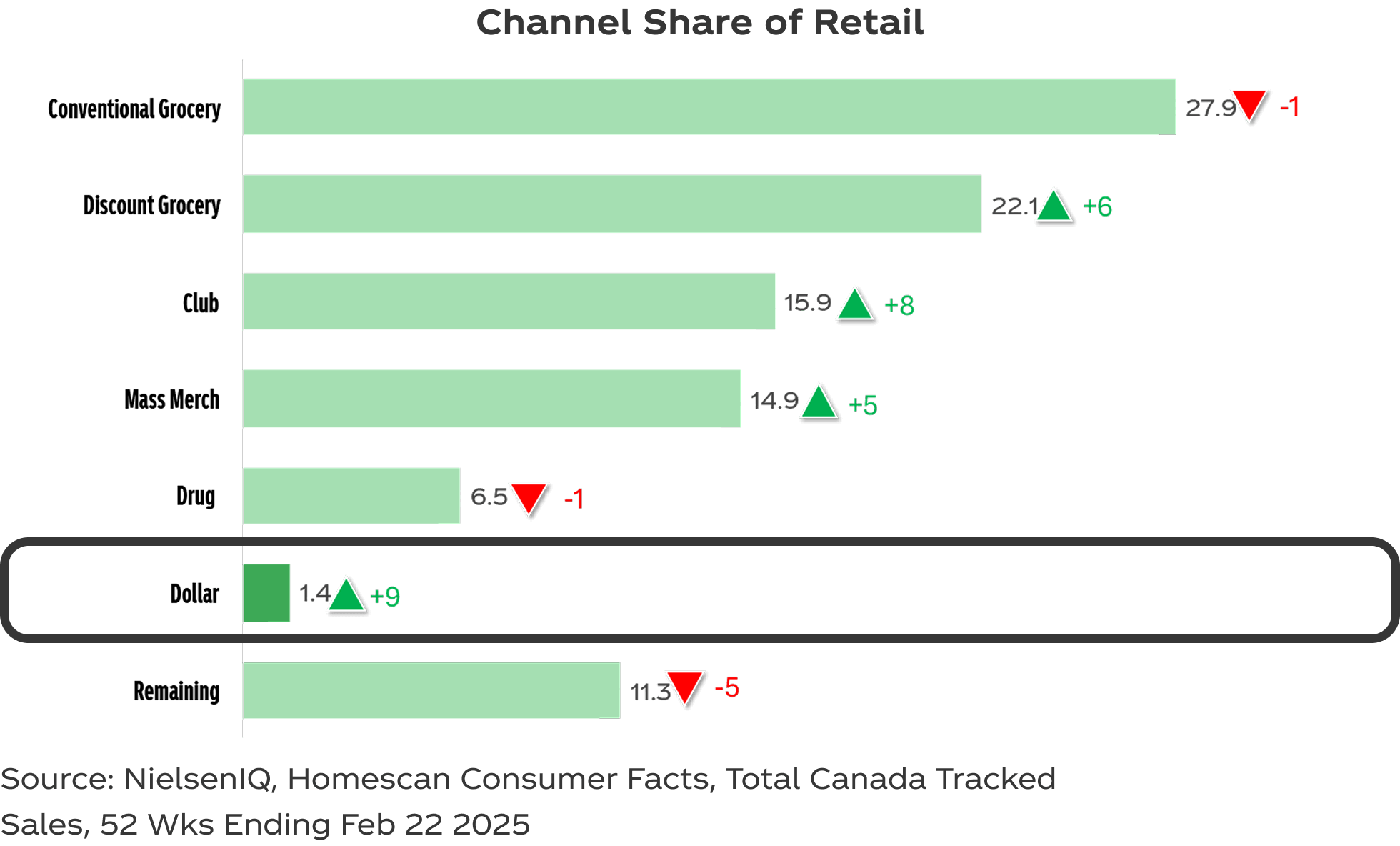

The consumer wallet has changed, with share growth in value-based retailers

Quick Tips

1. Value / Dollar Stores remain an important sub-channel with high HH penetration. Over 8 / 10 Canadians are shopping at Dollar Stores.

2. Focus on winning the shopper by driving recruitment, building baskets, and growing frequency.

Consumer/Shoppers

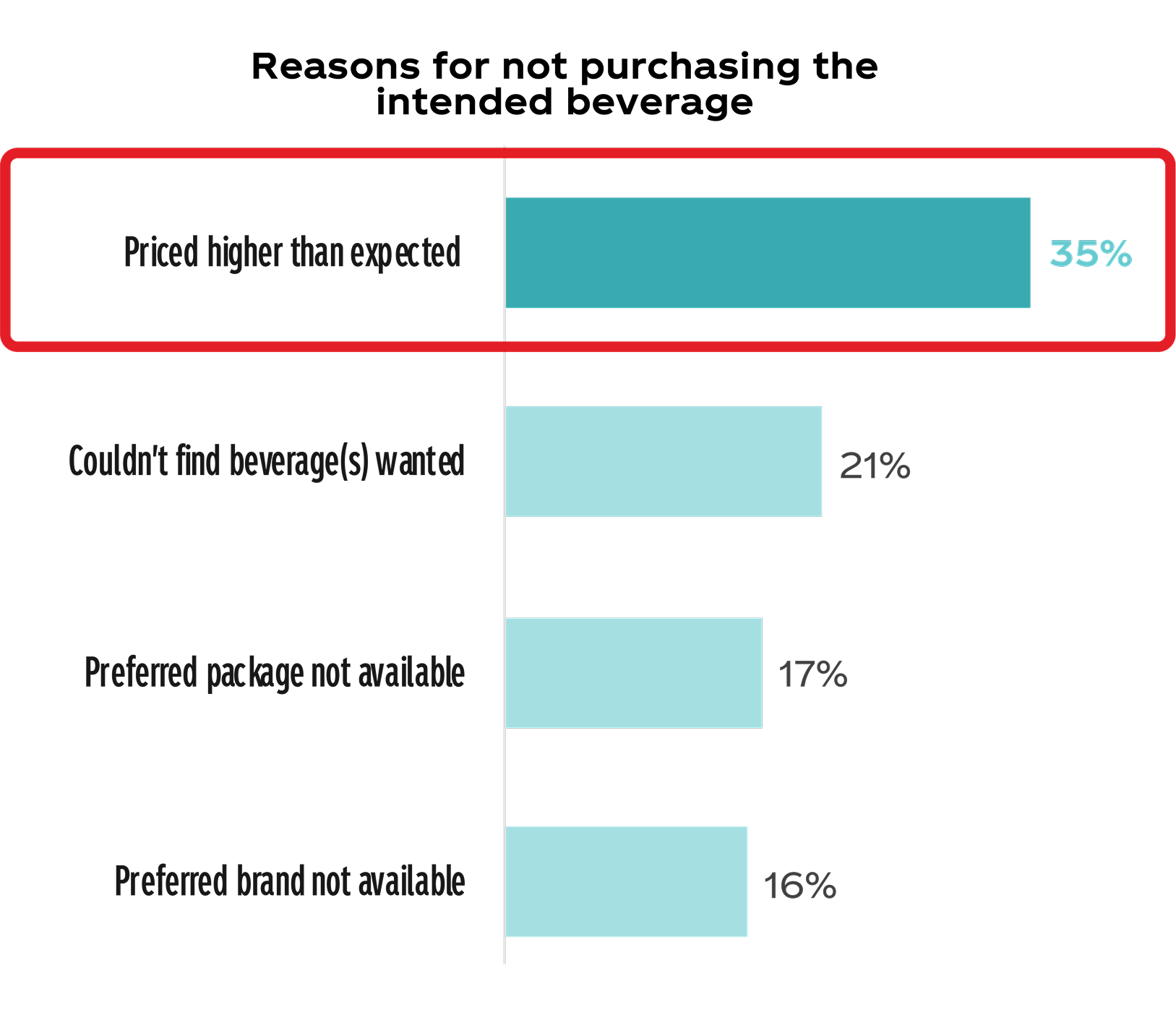

Pricing remains the key reason why shoppers do not pick up a beverage in their basket

Quick Tips

Implement affordability zone and engage in customer’s loyalty platforms/apps to target value seeking shoppers and drive purchase intent

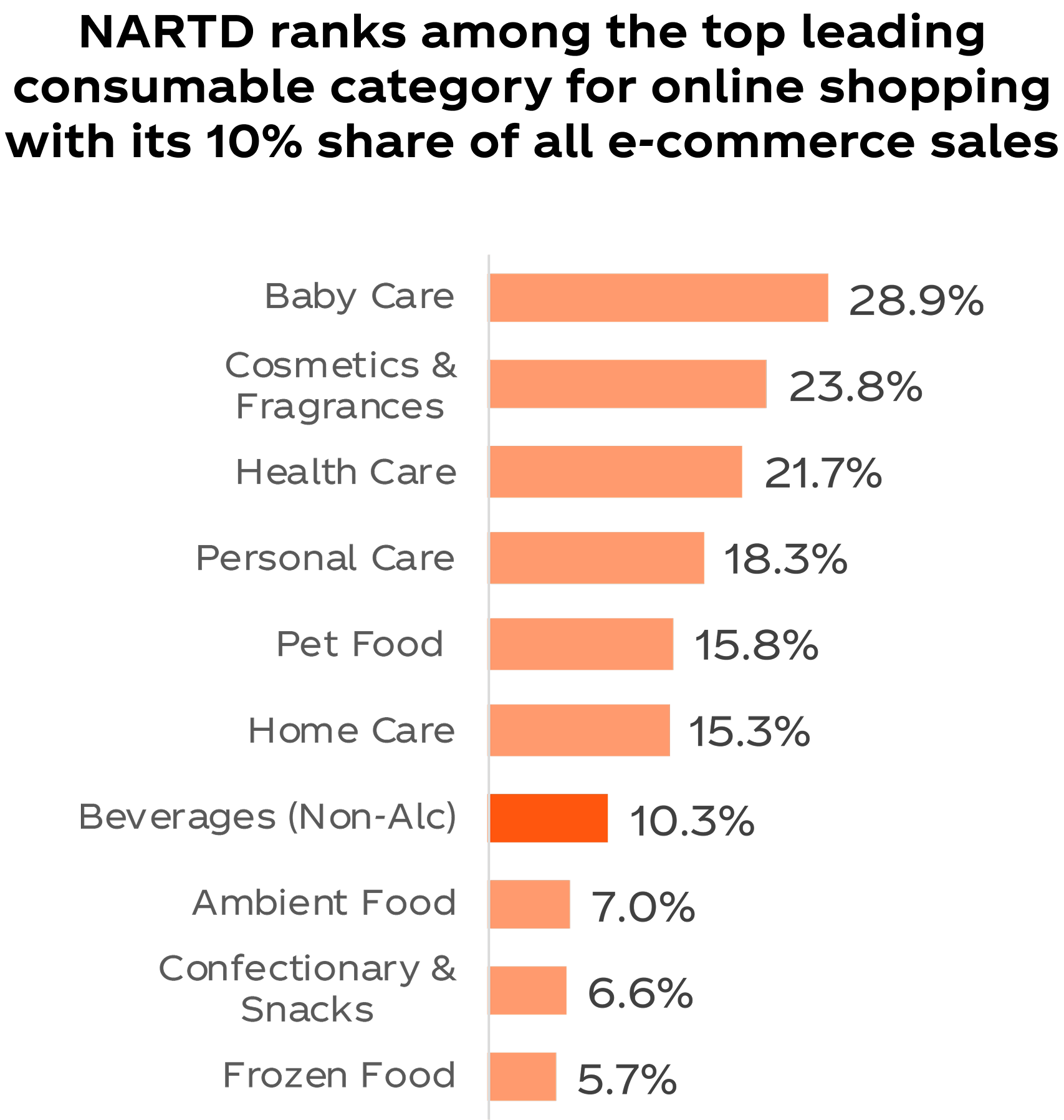

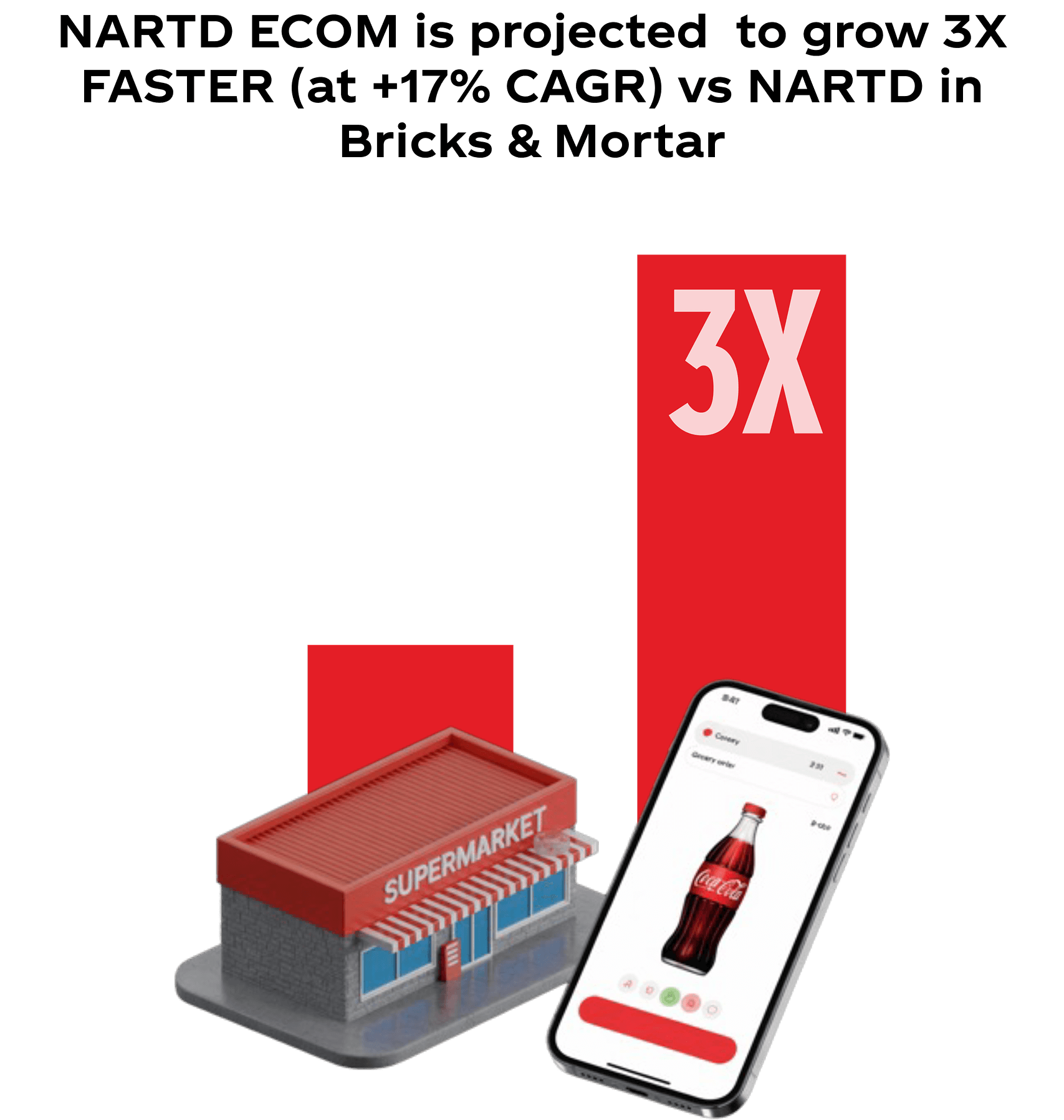

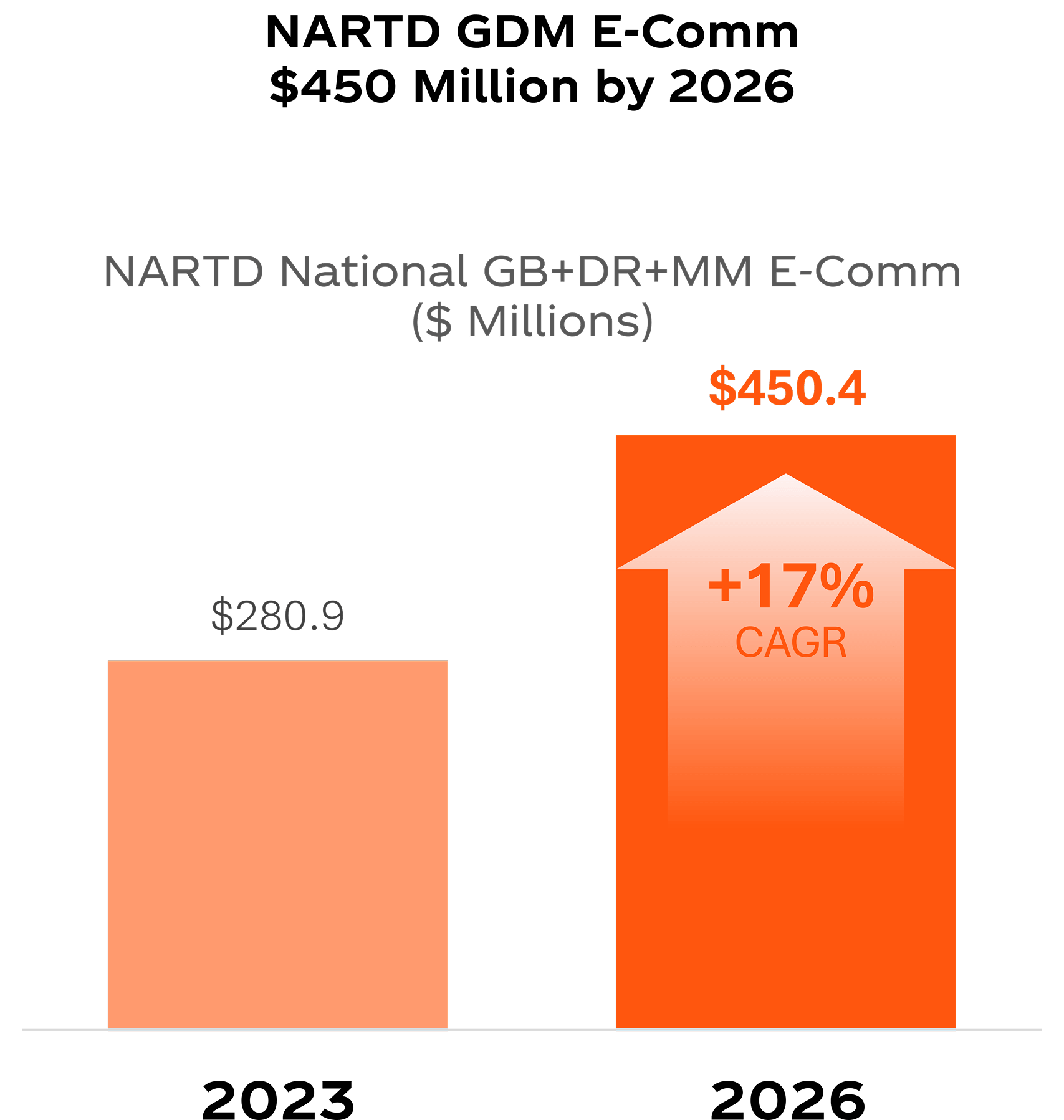

Omni Channel

Quick Tips

1. Leverage Salsify to ensure latest digital shelf content is represented on customer platforms (images, product descriptions)

2. Capitalize on GOAT marketing programs on digital platforms to interrupt the digital path to purchase

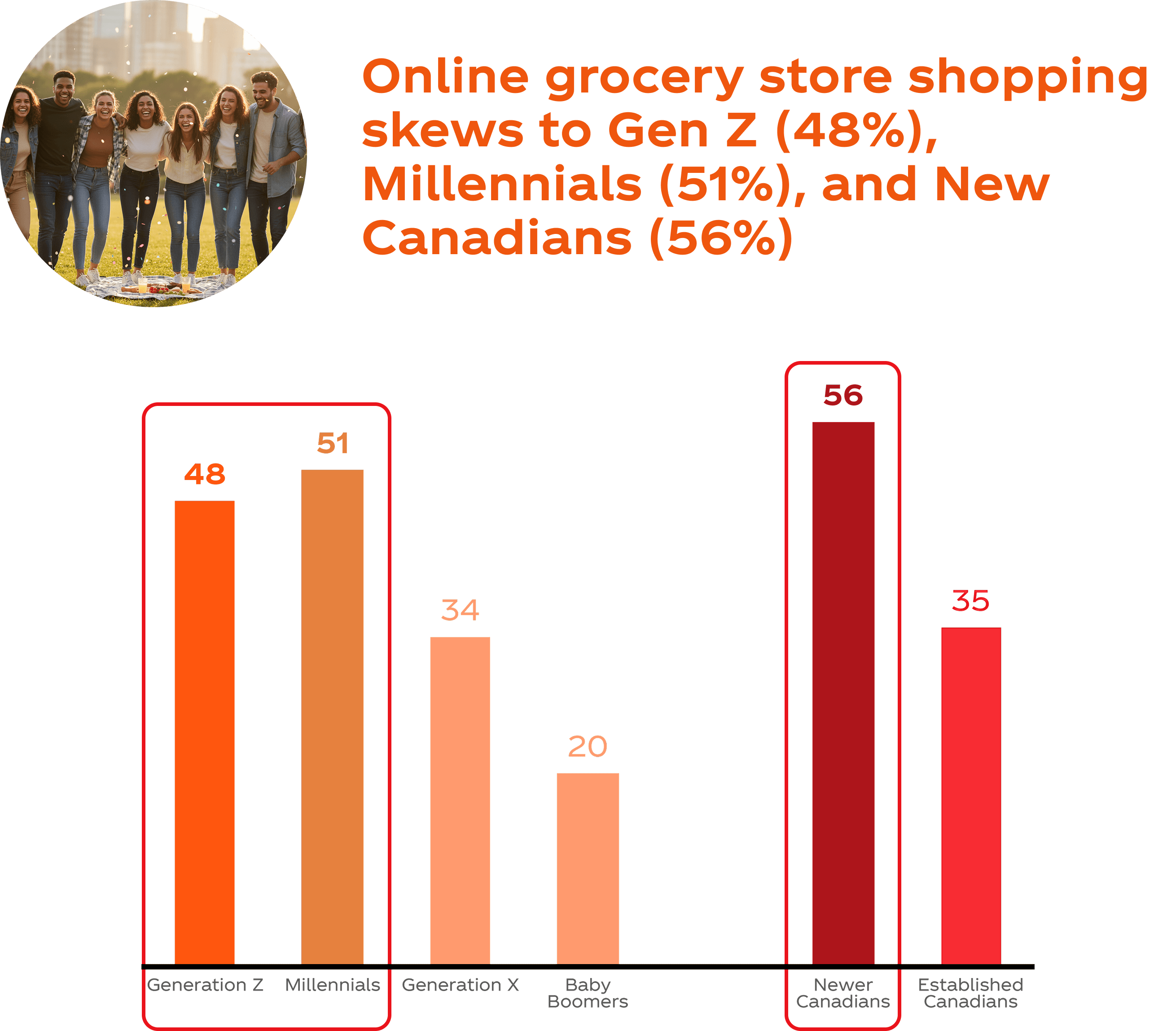

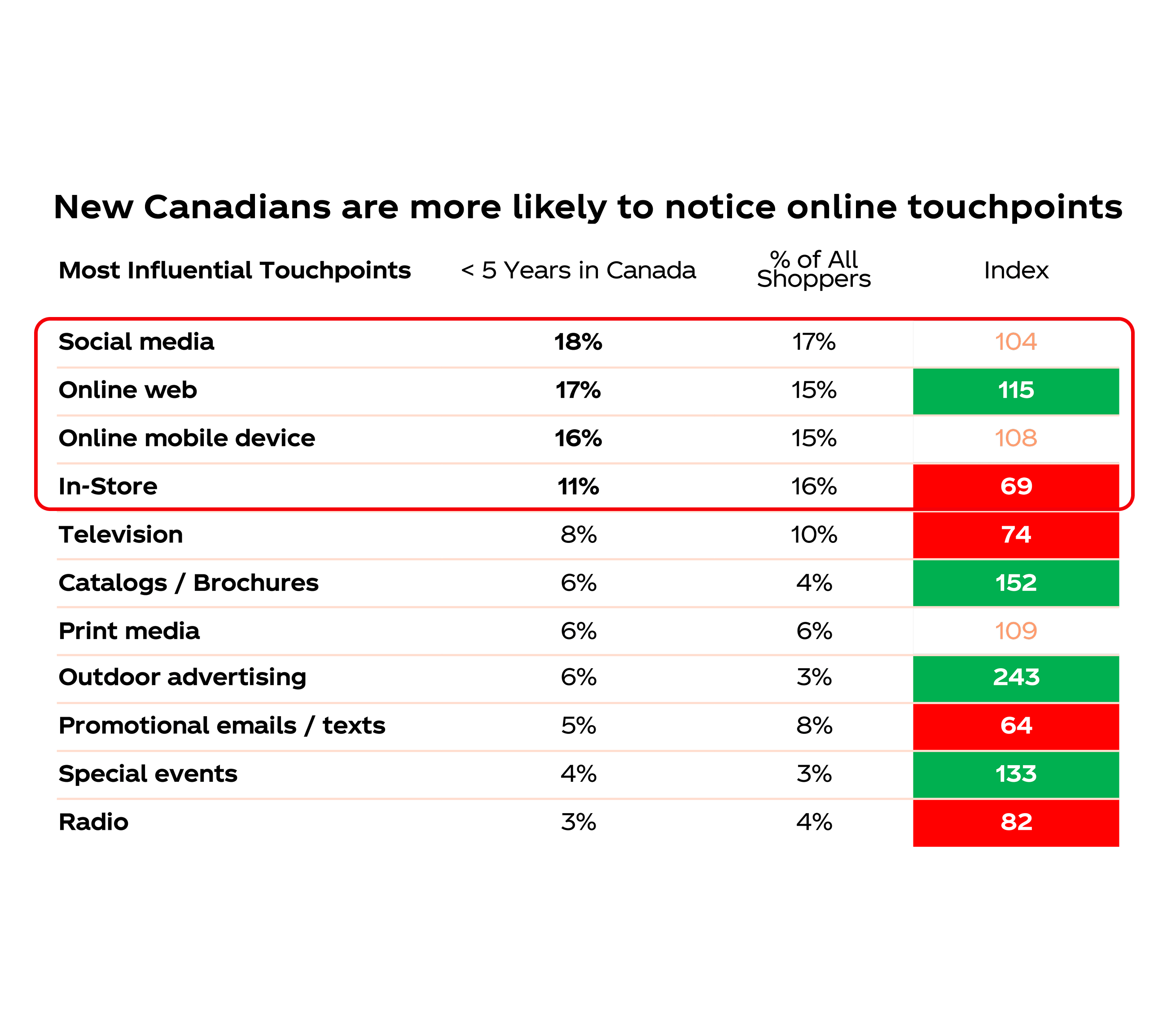

Quick Tips

1. Meet shoppers along their omni-channel path where they are connecting with our brands

2. Execute digital programs to effectively reach omni-channel shoppers especially New Canadians, Gen Z and Millennials

Summary Checklist

Traffic shifts towards the Dollar channel is lucrative to drive volumes. More Canadians going to Dollar seeking affordable options.

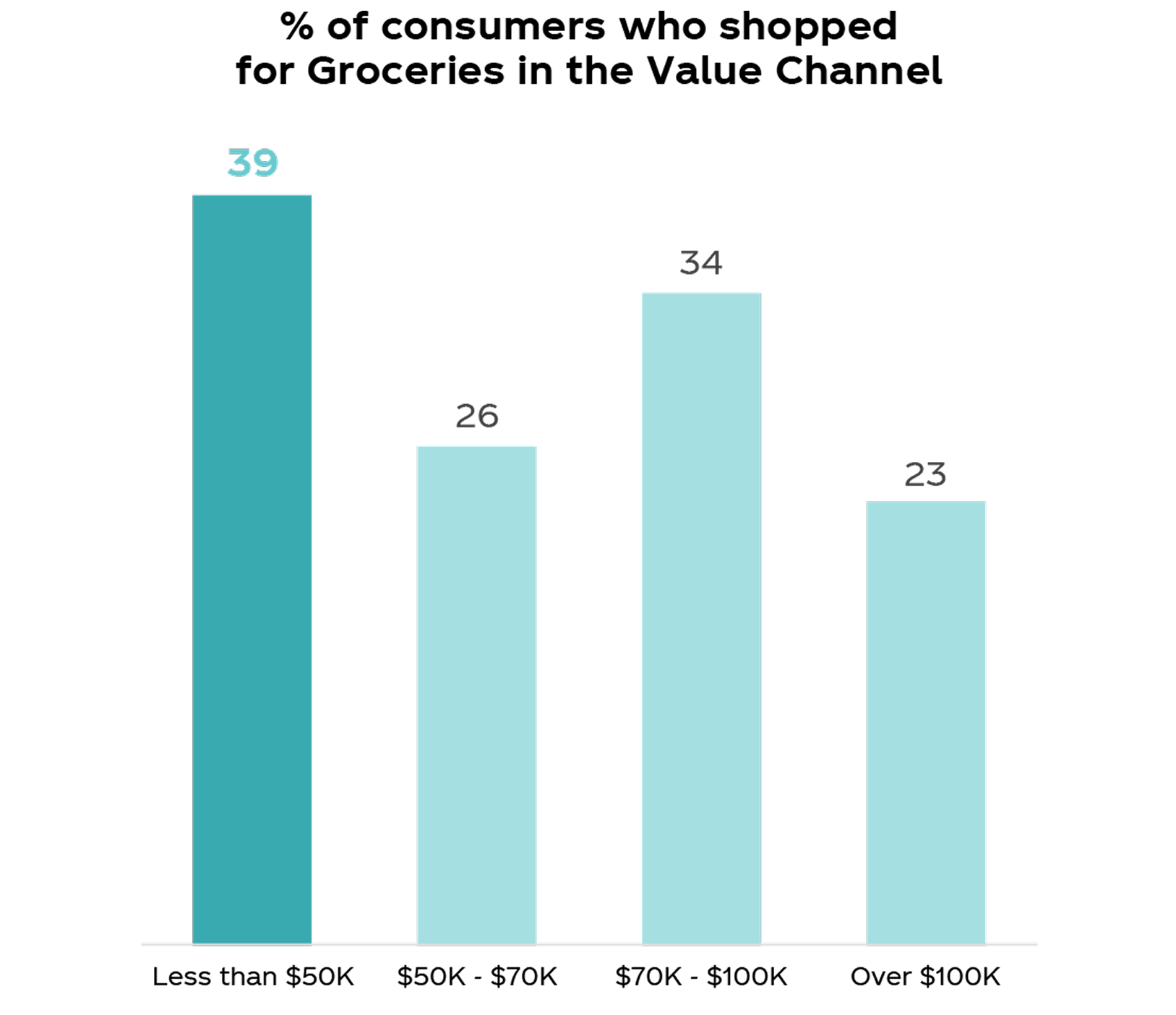

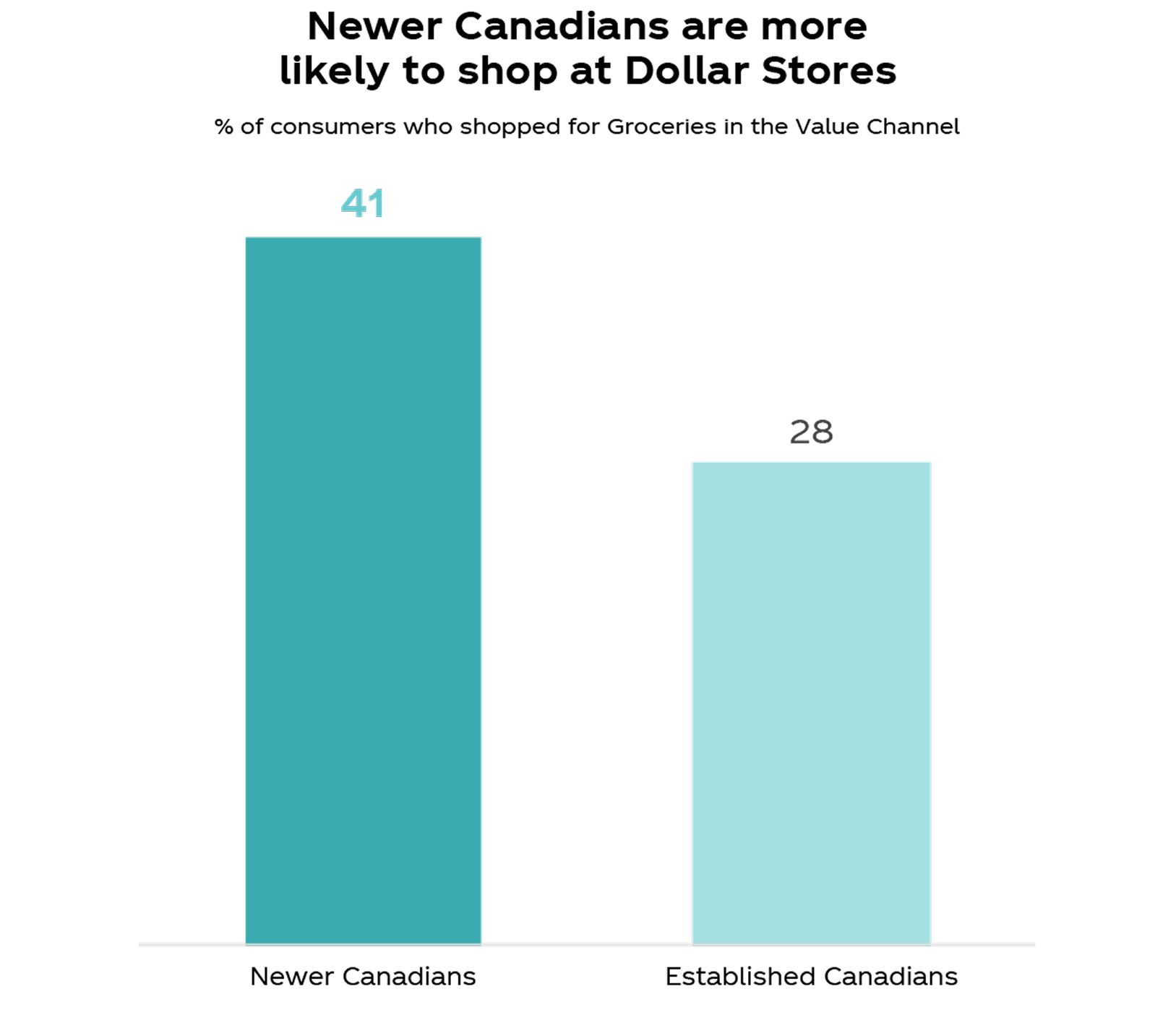

Low income, larger family size households and New Canadians over-index

- Low Income over-index of 118 at the Dollar Store, predominantly larger Household size (5+ HHLD index of 113, 6+ HHLD index of 116)

- 41% of New Canadians shop for Groceries at the Dollar Store, vs. 28% of Established Canadians

Macro factors driving affordability concerns with shoppers across board

- Consumer budgets remain tight, they are scrutinizing expenditures.

- Rising prices, threat of tariffs, and inflation remain a significant concern.

Basket size & trip frequency is growing for beverages

Shoppers are predominantly going to Dollar for quick trips comprising over half of the trips to channel (52%)

- Total Basket incidence for KO products is low at 6%

- Opportunity across all shopping missions.

The channel lends itself to seasonal shopping needs like Back to School, Summer Grilling, Halloween

Ensure Coca-Cola is present and available among these top trafficked areas of store

Dollar shoppers seek low prices packages

- 58% of all beverage transactions are IC

- 50% of total beverage sales are Stills