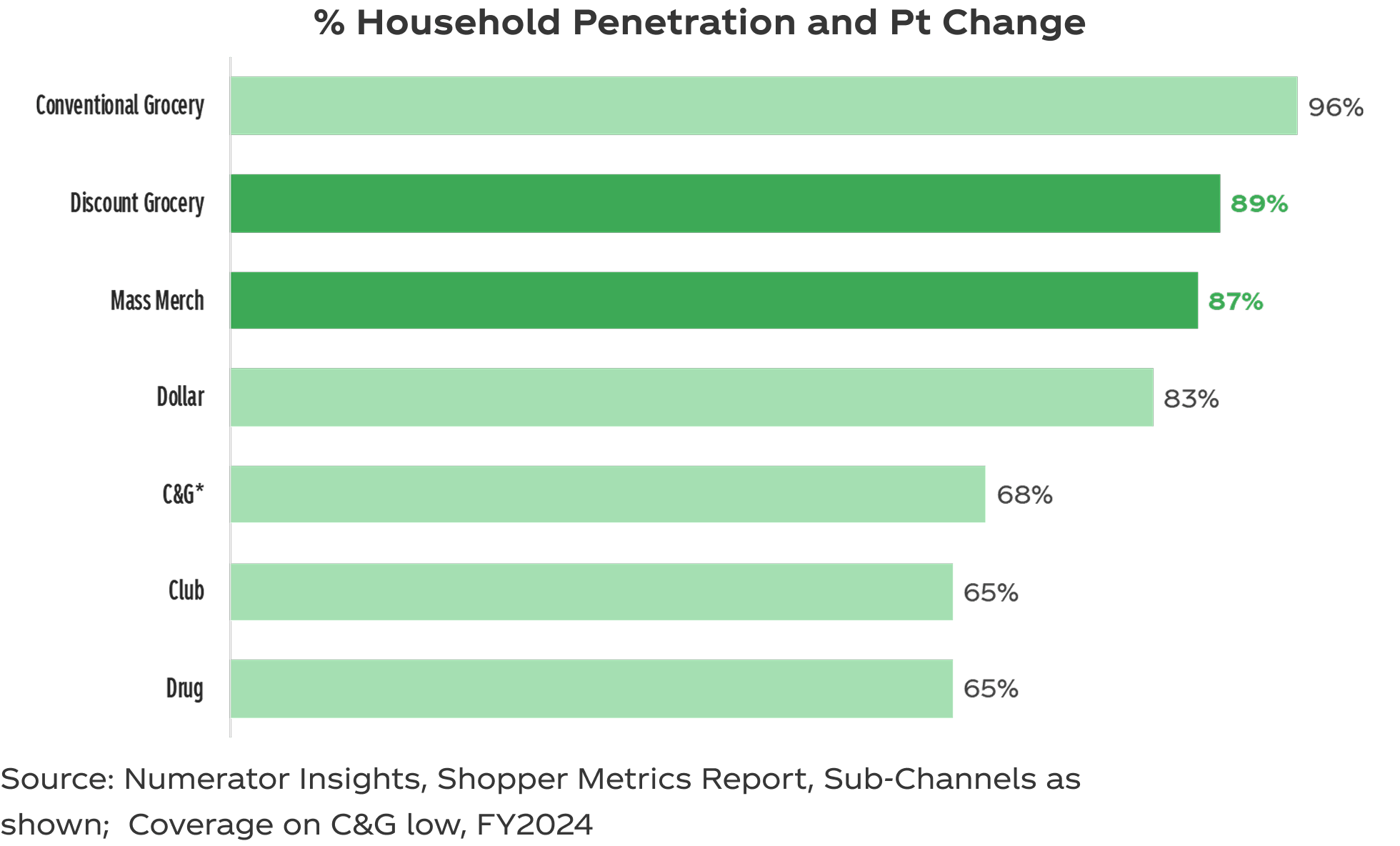

- Conventional remains critical for our growth ambition with highest HH penetration (despite shifts to value channels)

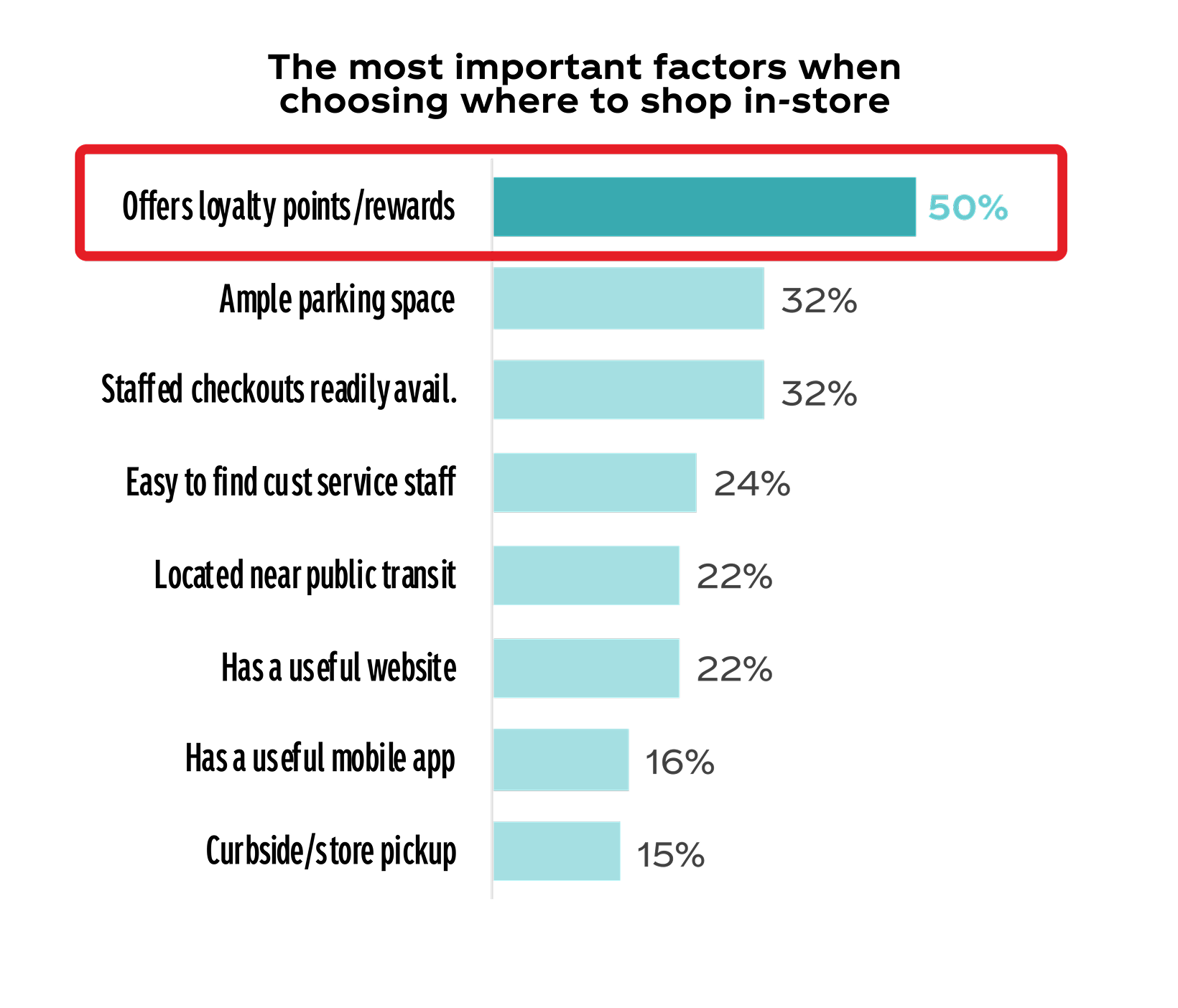

- Focus on winning with the shopper by driving recruitment, building baskets, and growing frequency

Large Store Discount

Share & Traffic

Quick Tips

Source: Numerator Insights, Canada Trip Mission Analysis, FY2024 vs YA

Quick Tips

The Coca-Cola portfolio is the most complete beverage portfolio with an offering for every shopper occasion and need

Source: Nielsen Tracked Sales, NAT Conventional GDM, L52 wks P/E May 2025

Quick Tips

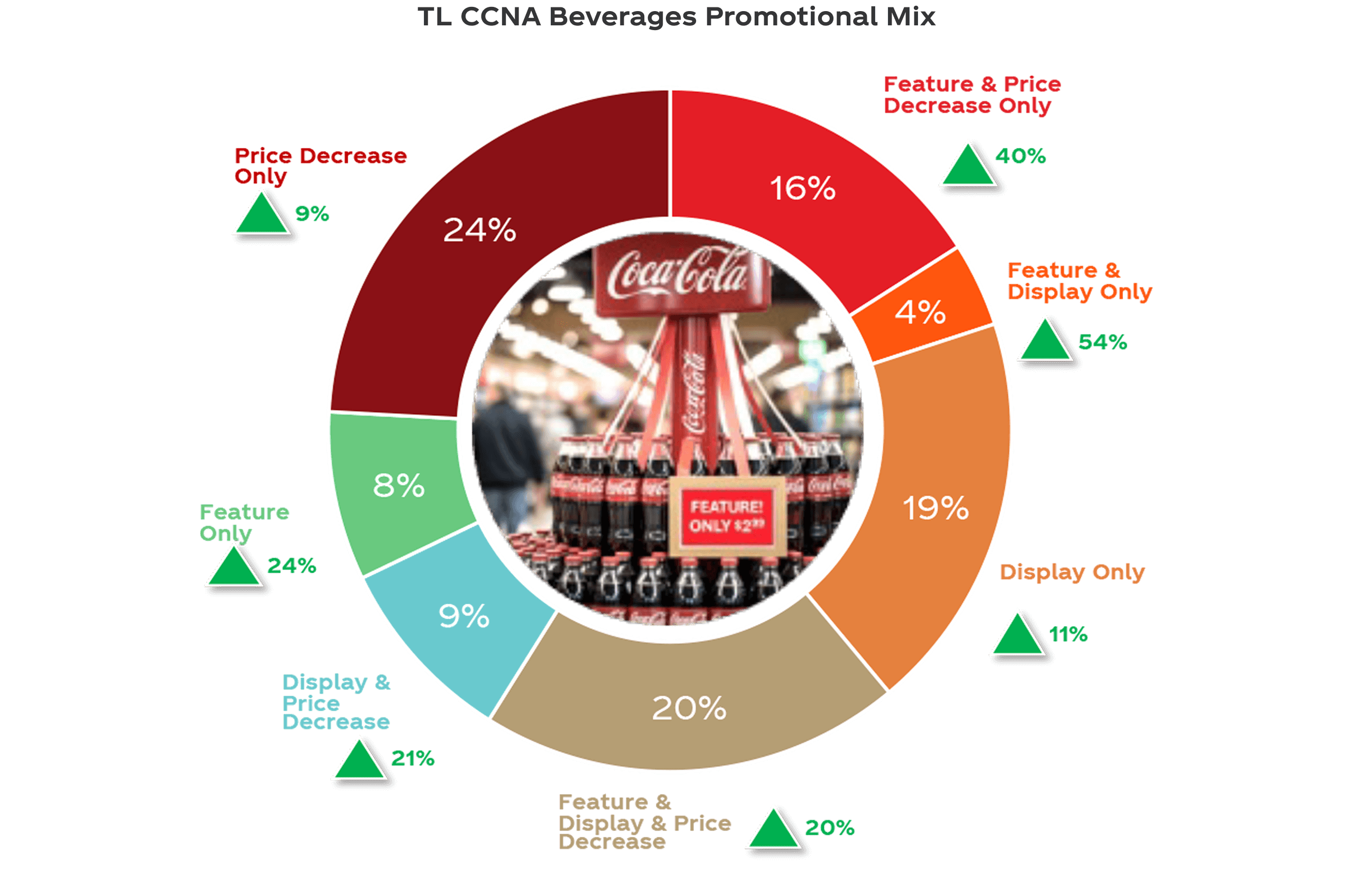

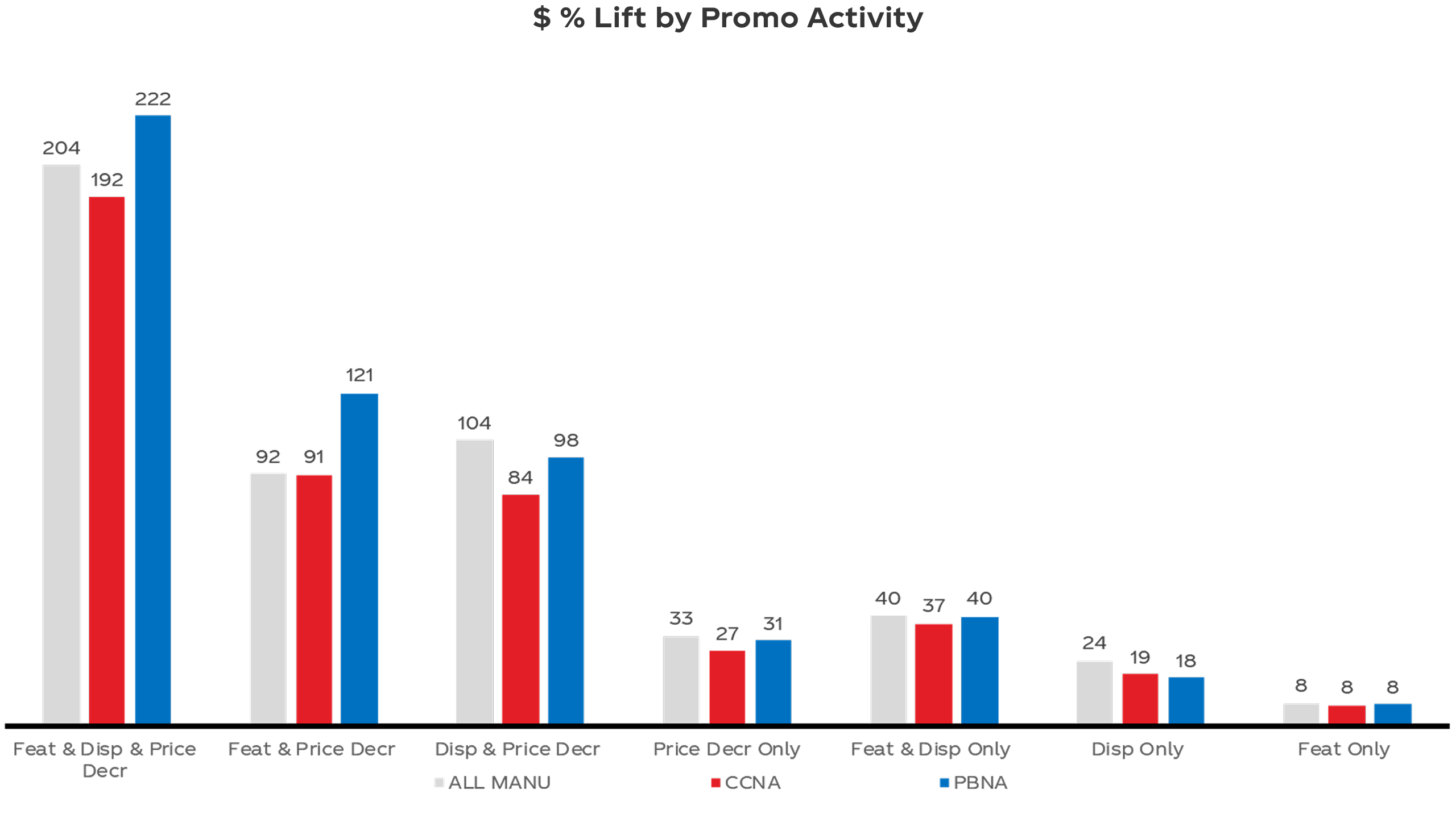

- Display represents 45% of the TL CCNA Beverage Promotional Mix (in $)

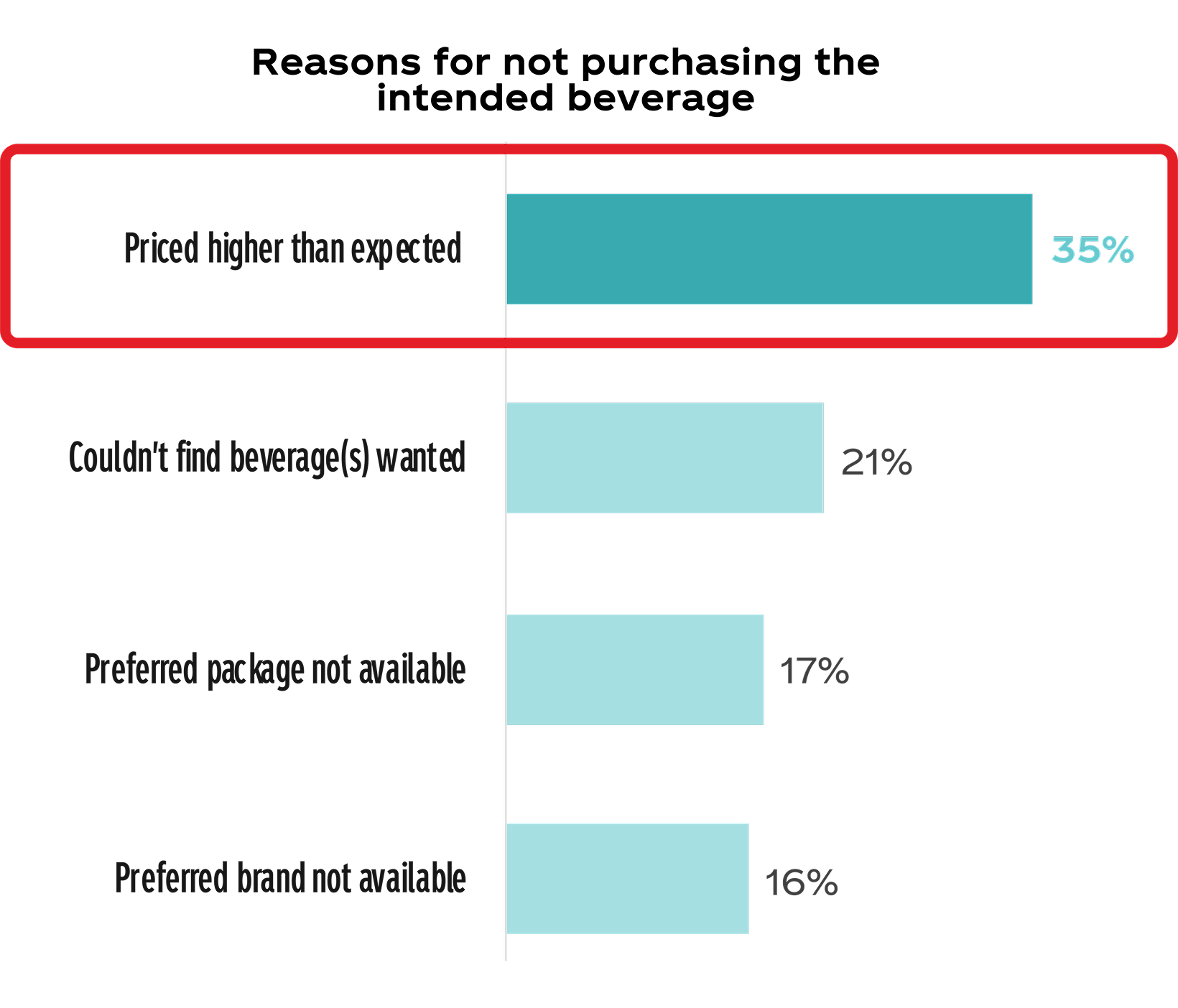

- Convert shopper from consideration to trial with the most impactful promotional mix through Feature, Display & TPR

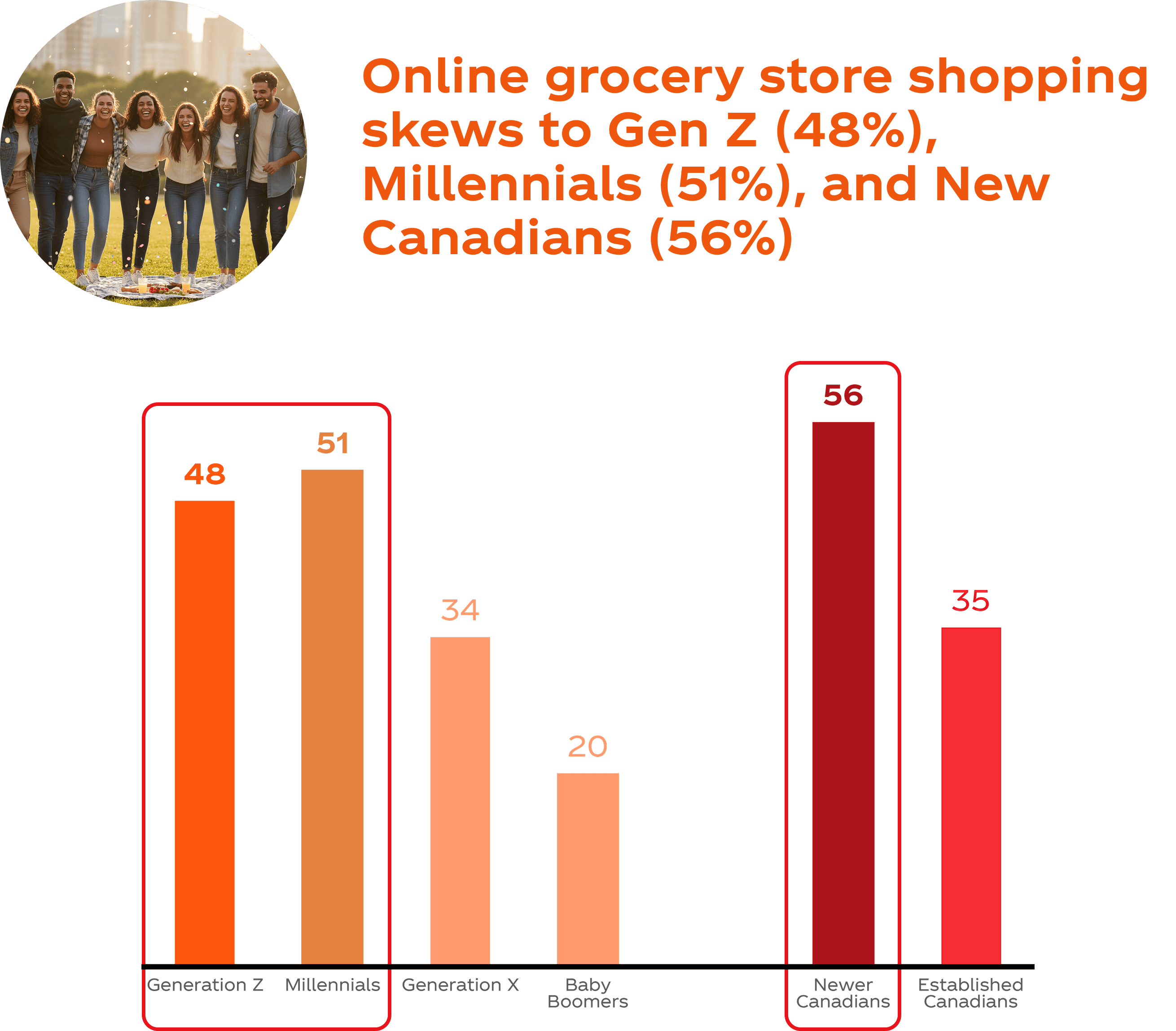

Consumer/Shoppers

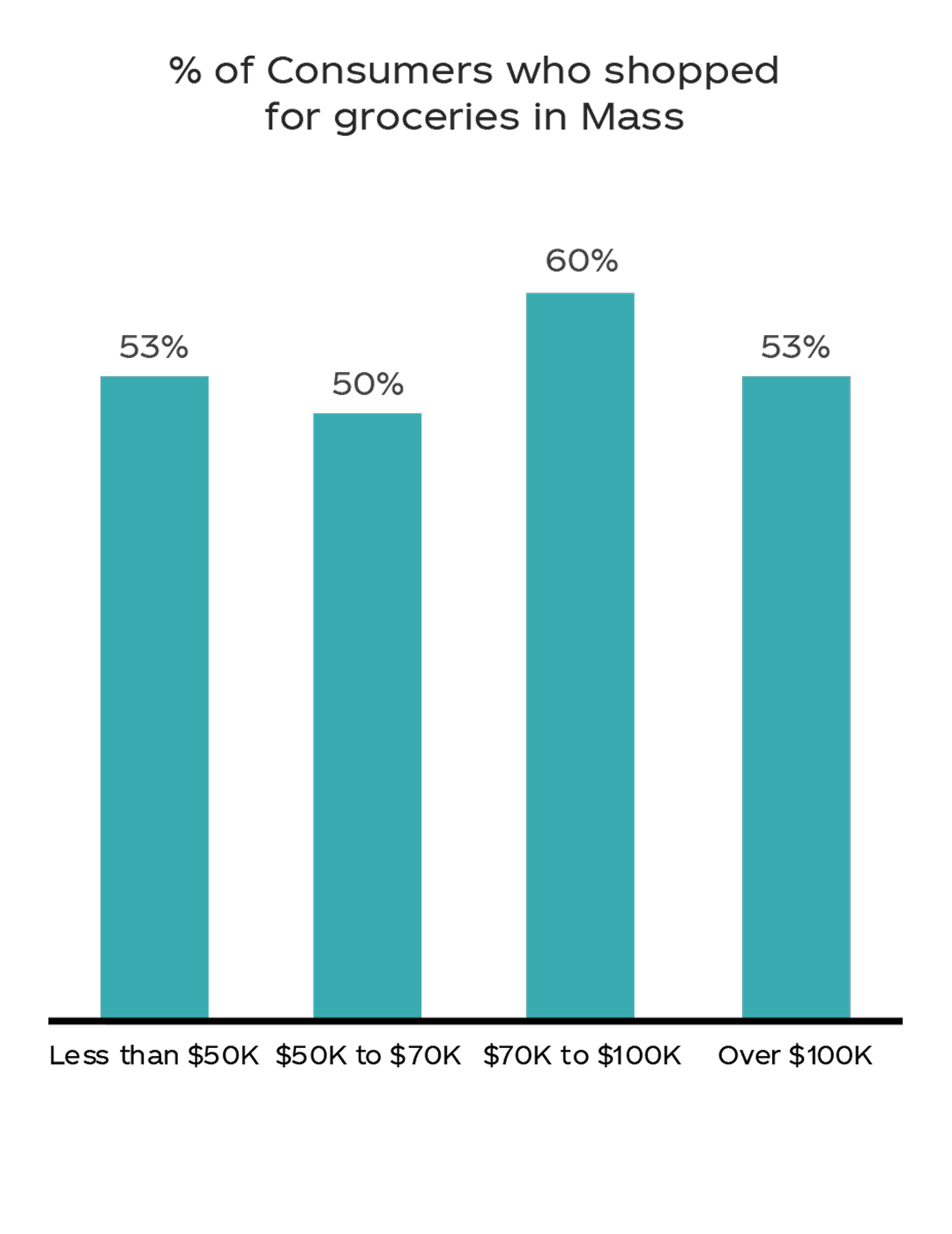

Mass Merchandisers have steady appeal across all income levels

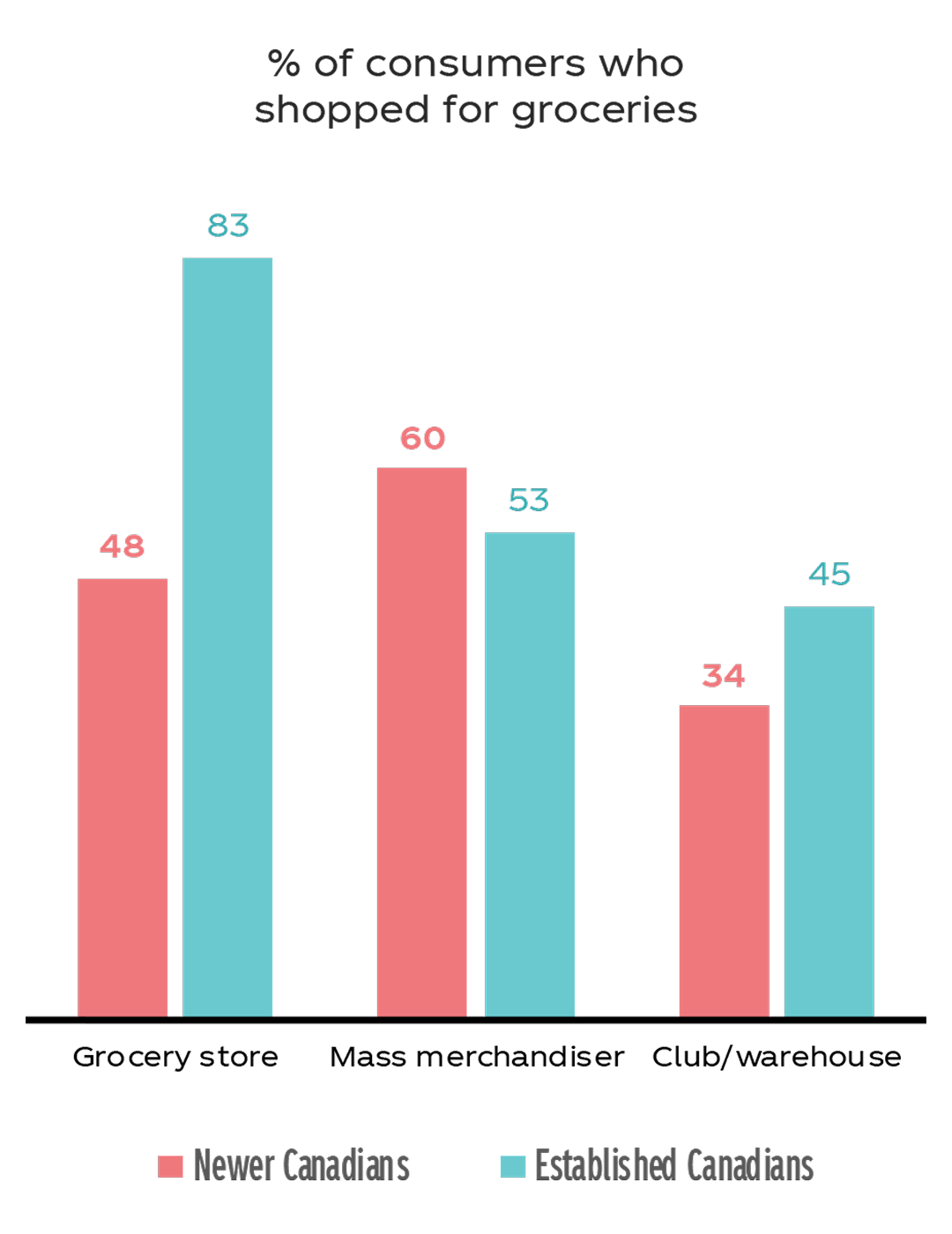

Newer Canadians are more likely to shop at discount channels

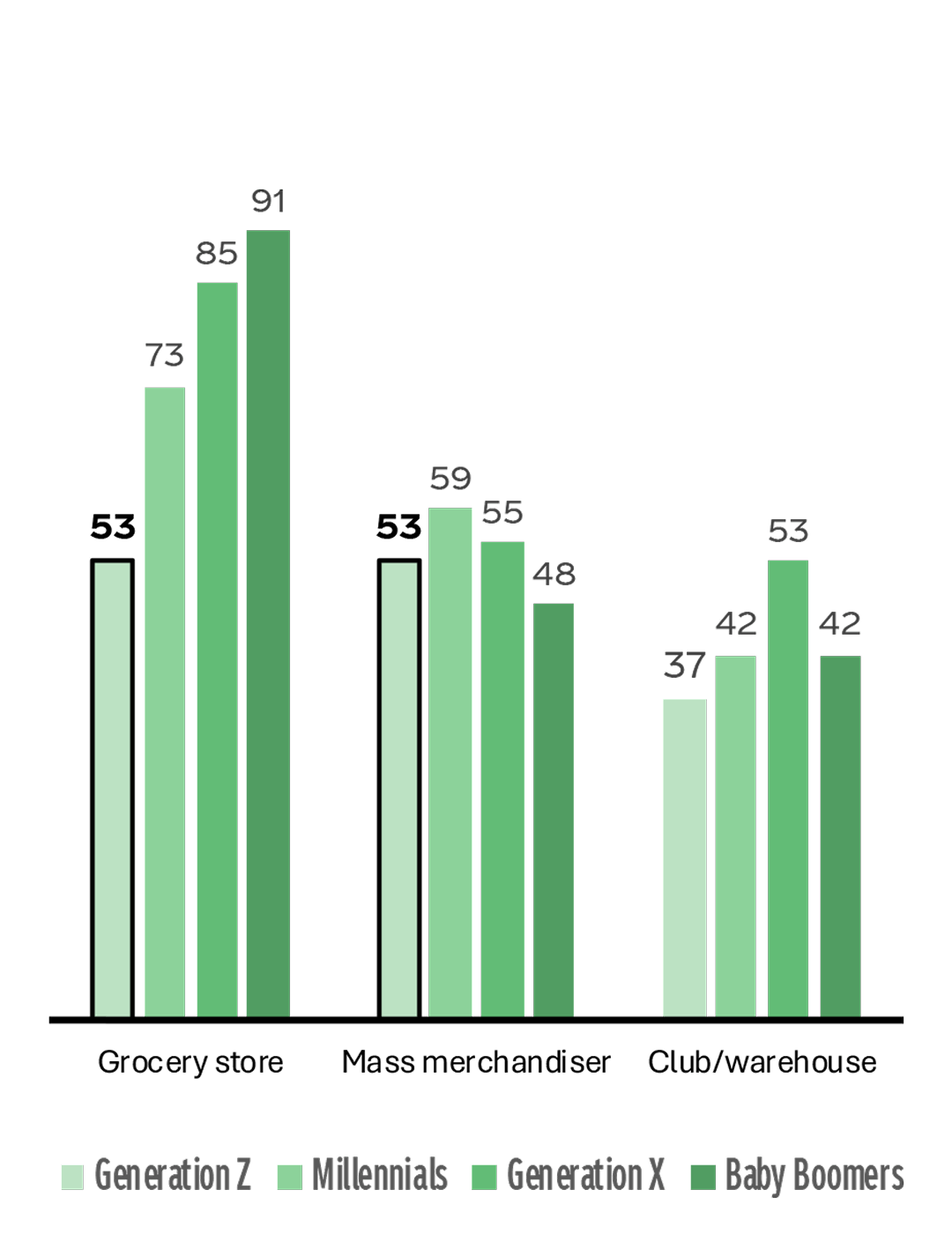

Gen Z are equally as likely to purchase groceries in Grocery or Mass

Quick Tips

- All income levels shop at Discount & Mass, yet New Canadians over index

- Implement affordability zone to target these value seeking shoppers

Quick Tips

- All income levels shop at Discount & Mass, yet New Canadians over index

- Implement affordability zone to target these value seeking shoppers

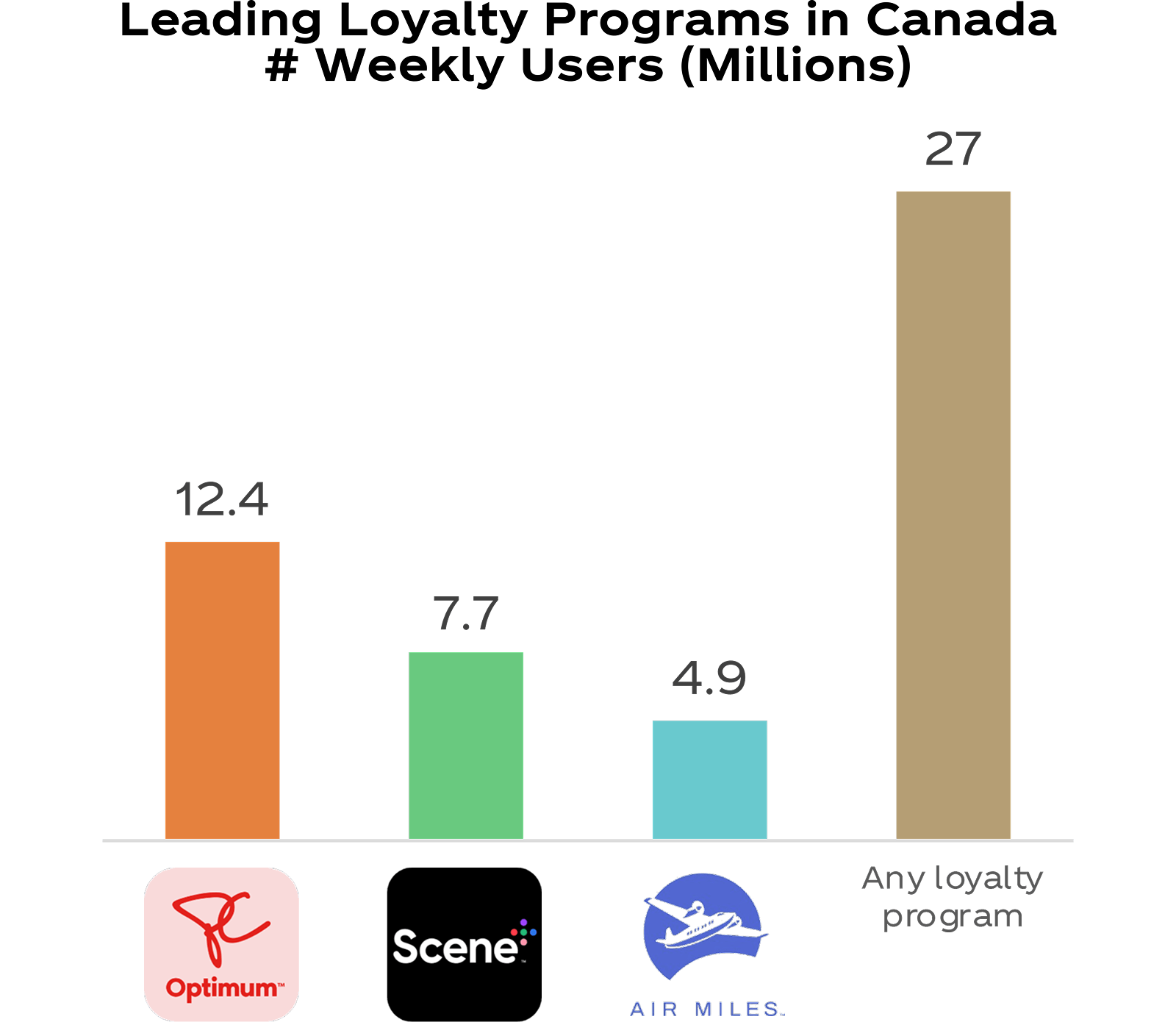

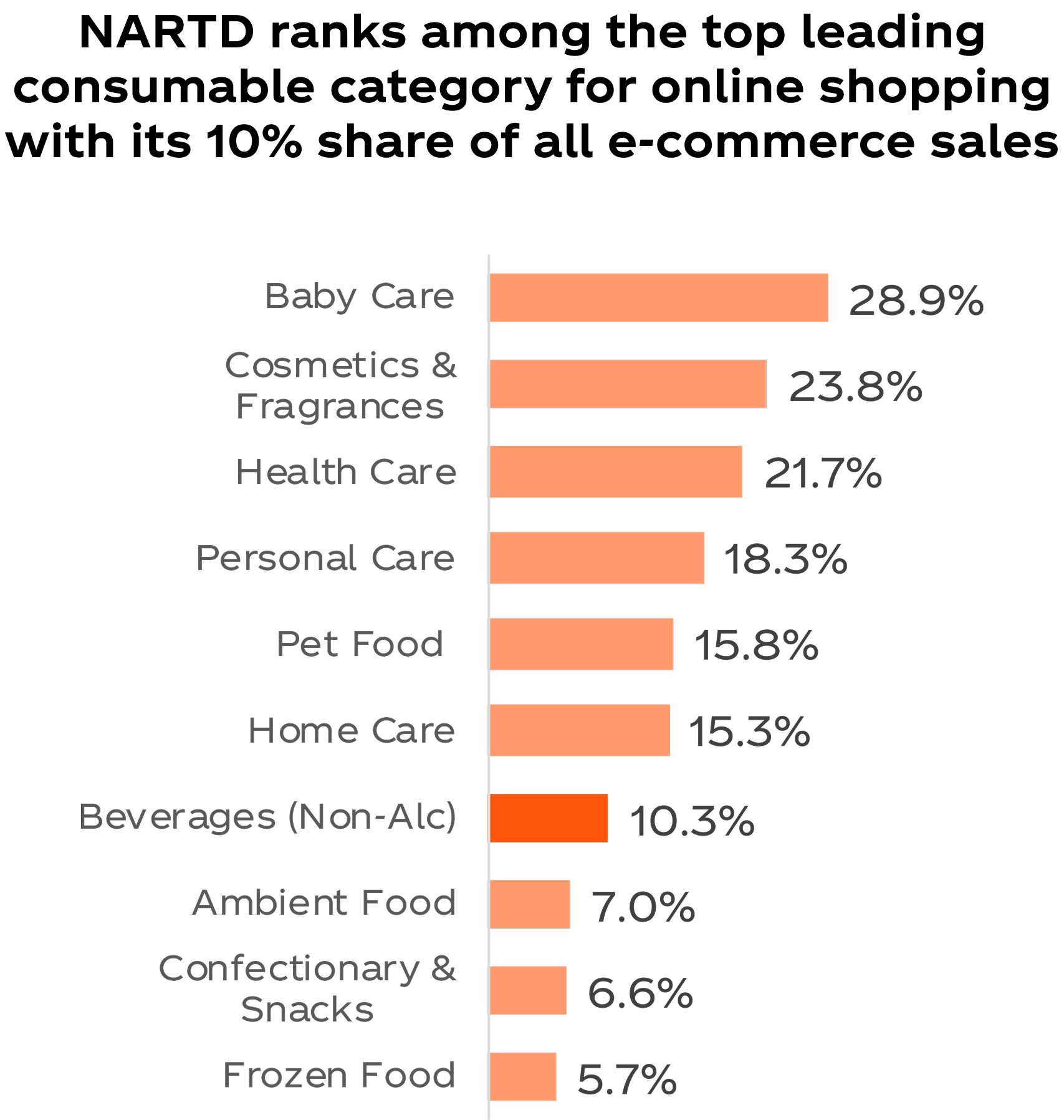

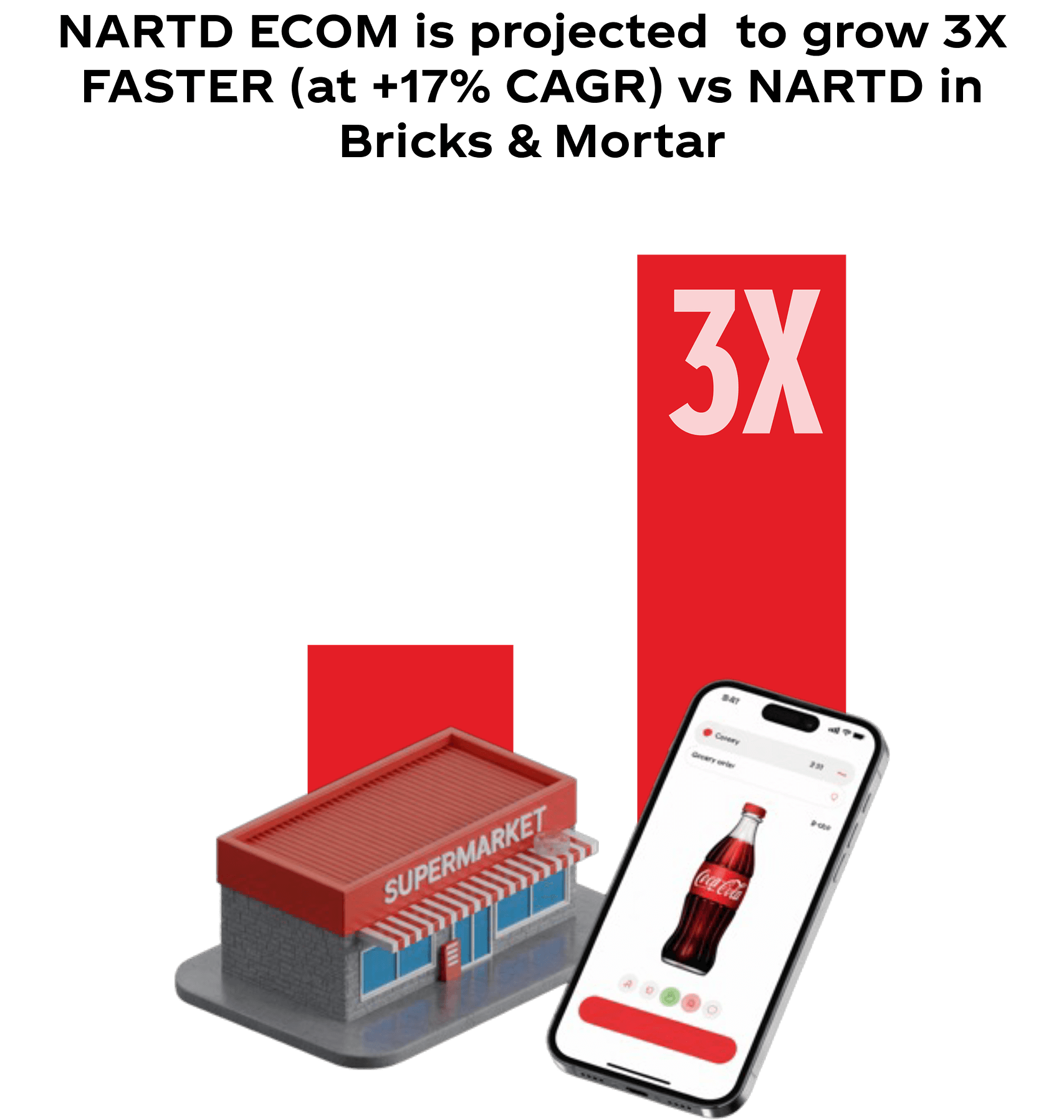

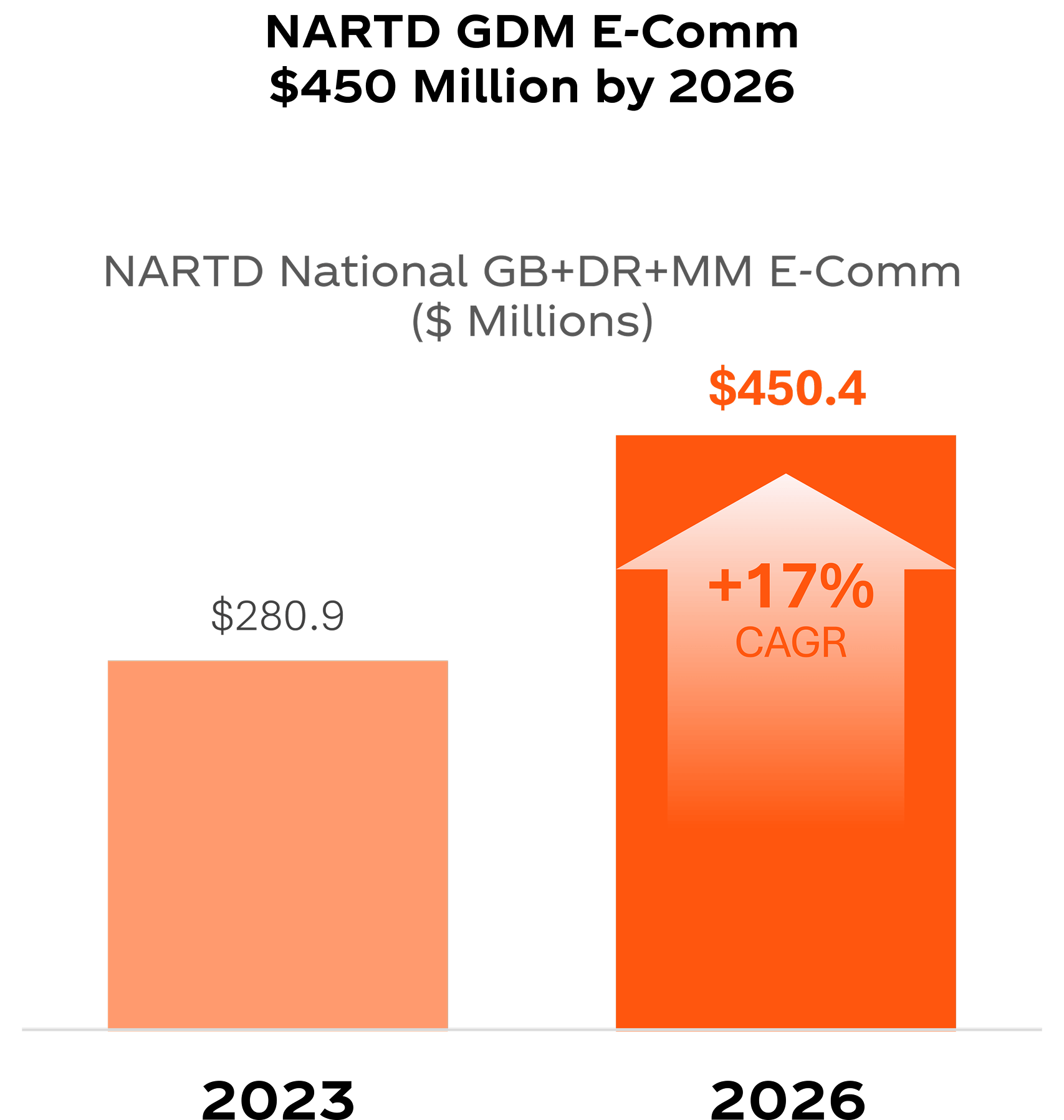

Omni Channel

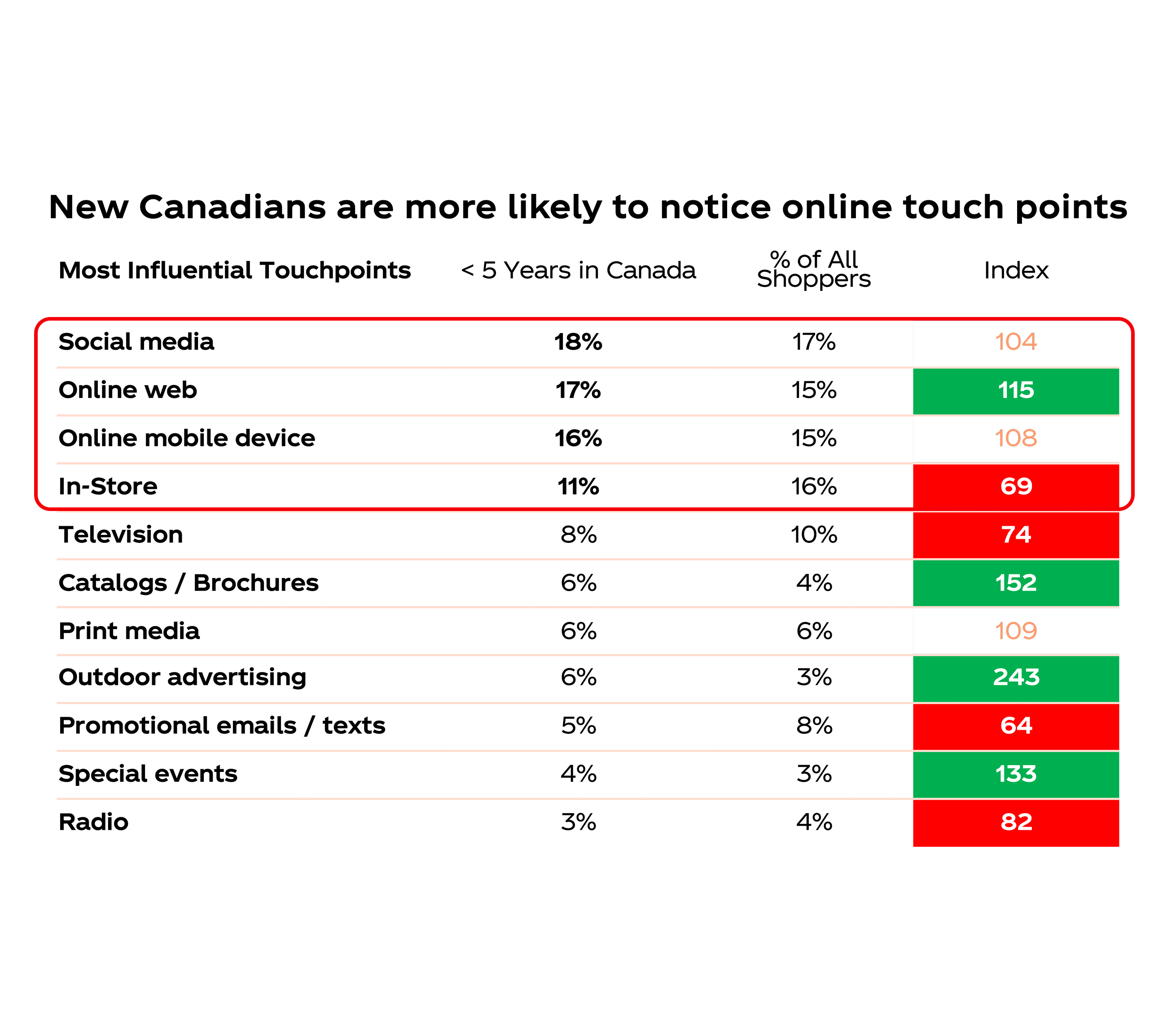

Quick Tips

- Leverage Salsify to ensure latest digital shelf content is represented on customer platforms (images, product descriptions)

- Capitalize on GOAT marketing programs on digital platforms to interrupt the digital path to purchase

Quick Tips

- Meet shoppers along their omni-channel path where they are connecting with our brands

- Execute digital programs to effectively reach omni-channel shoppers especially New Canadians, Gen Z and Millennials

Summary Checklist