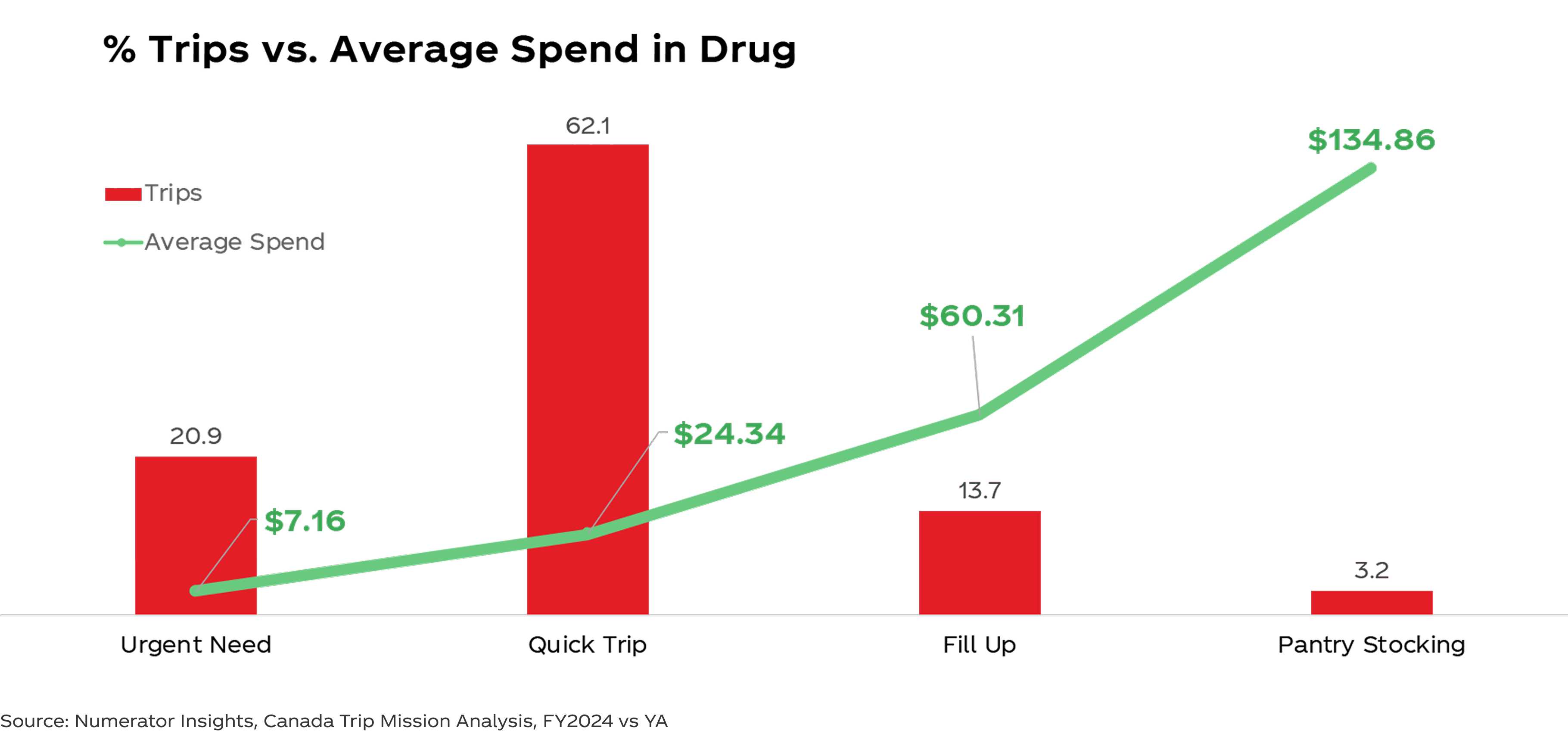

- Drive in-store trips and recruit new drinkers through promo communication and loyalty tie ups to target the the quick “in-and-out” shopper

Drug Store

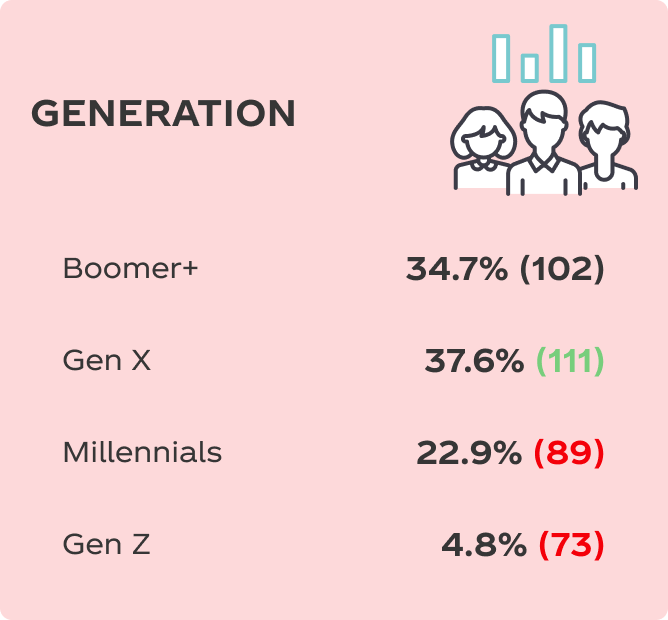

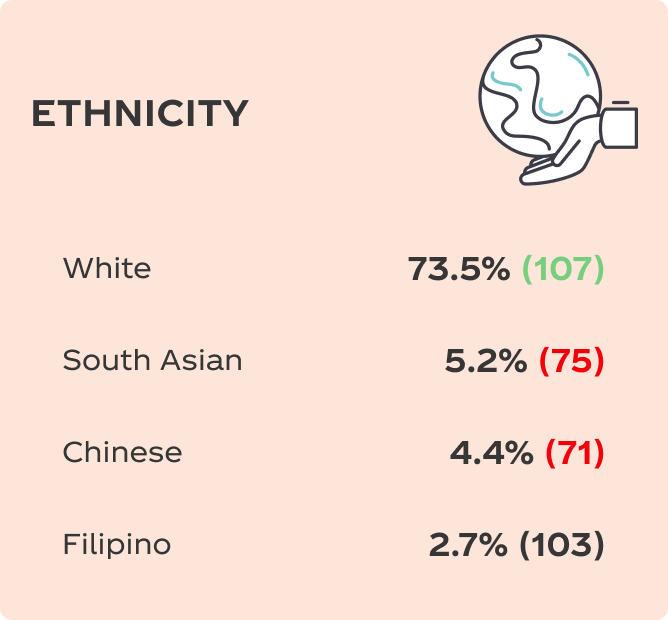

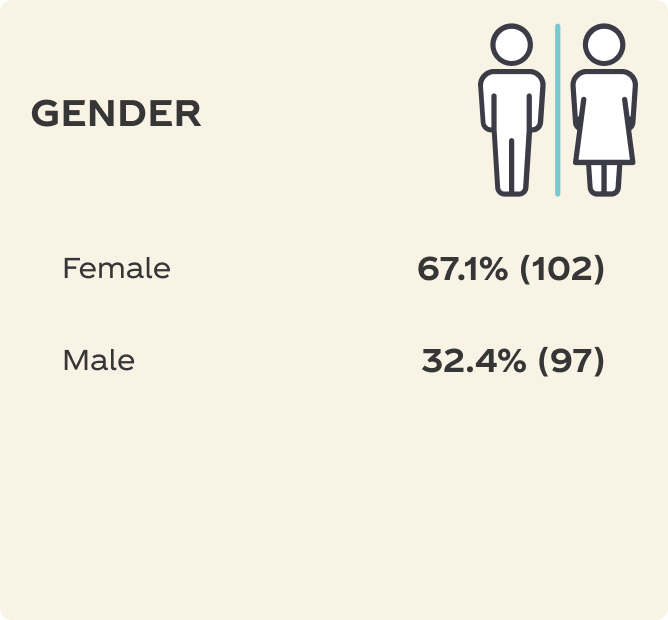

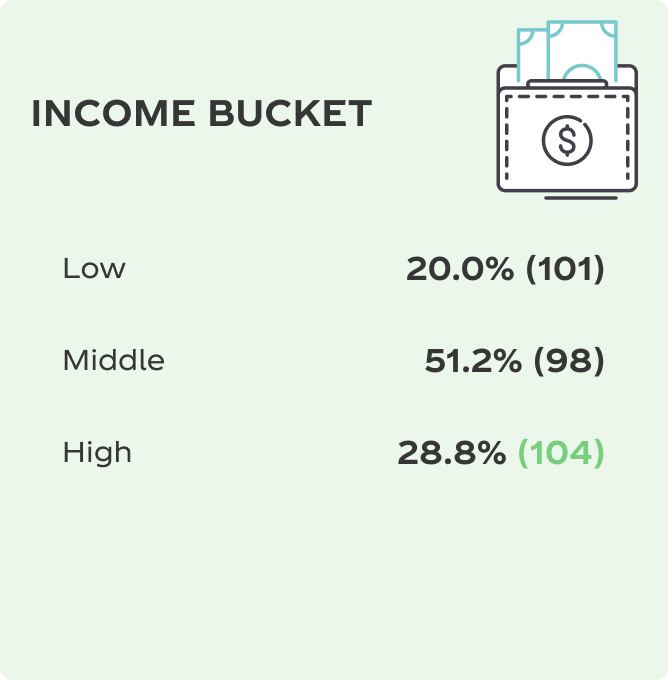

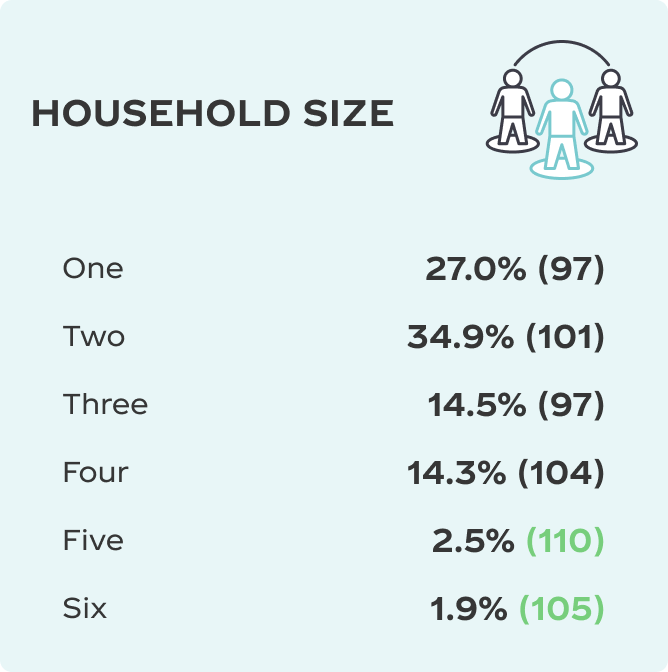

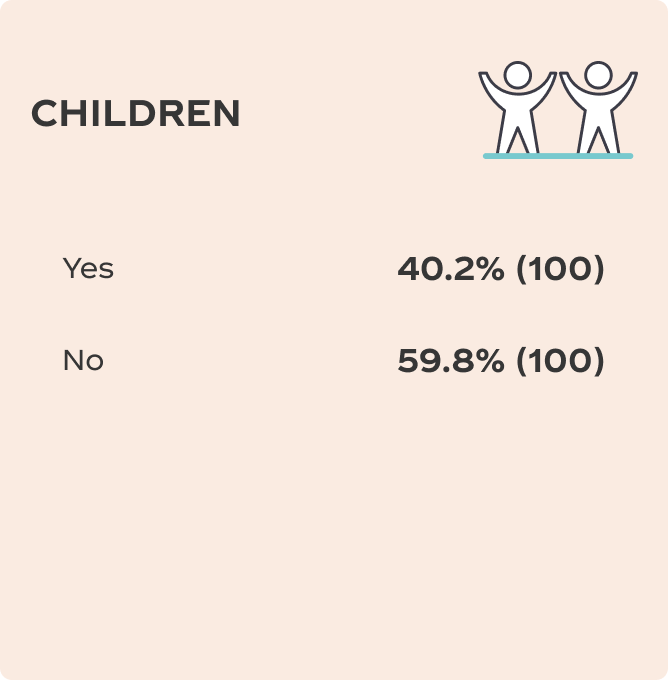

Shopper Profile

Retail Environment

Pharmacy‑led retailers combining health, beauty, personal care, and convenience grocery selections; often strong in loyalty programs.

Shopper Motivations

Mission‑based trips for prescriptions, health & beauty needs, and some grocery fill‑in; seeking trusted service and convenience, sometimes willing to pay a premium.

Key Customers

Boomer and Gen X Females

Psychographics & Behaviors

Key Metrics

Quick trips make up the largest share of visits—so ease and convenience are key.

Quick Tips

Convert Quick Trip shoppers with ambient display touchpoints along Lobby, HMR, end-caps, and check-out coolers

Drive basket incidence with pantry stocking & fill up trips through high-impactful lobby displays, in-aisle beverage executions and perimeter pallet executions

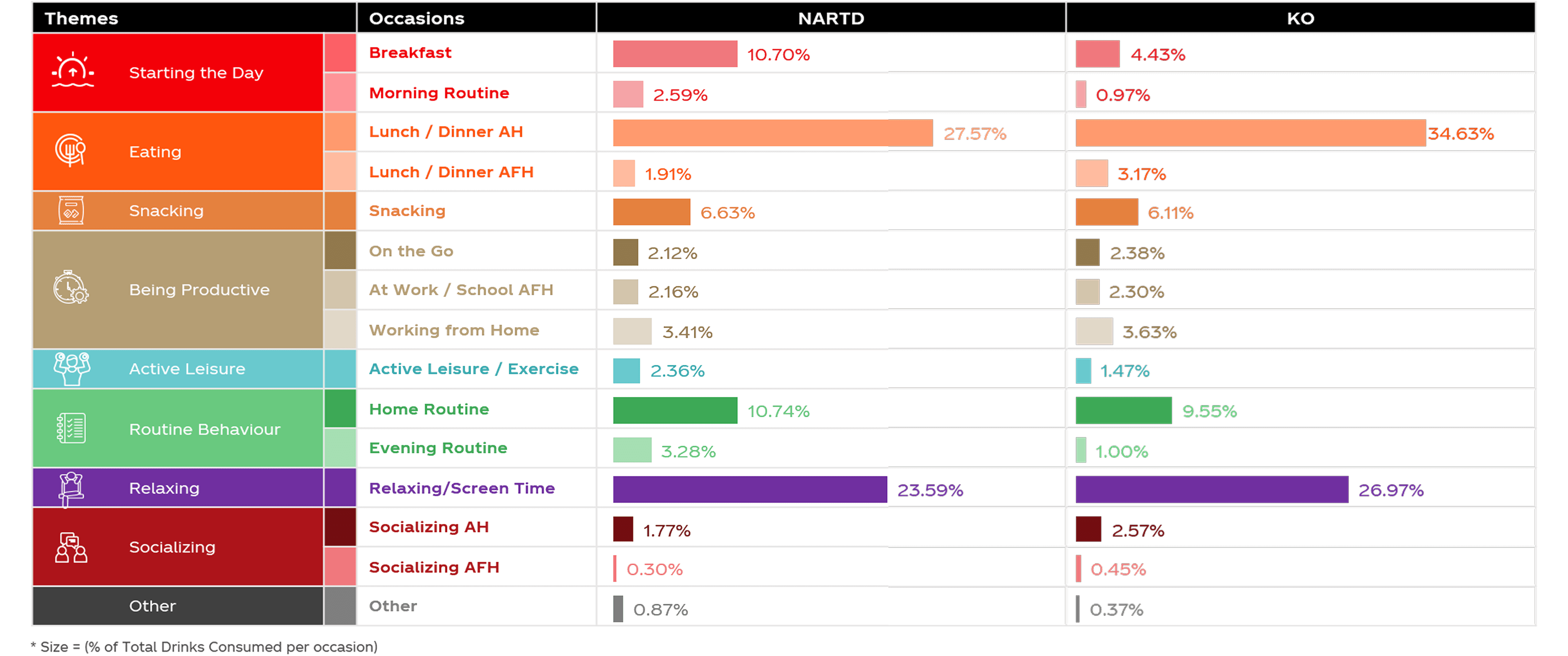

Large Store: Beverage Occasions in NARTD and KO

Quick Tips

Leverage Occasion insights to make informed decisions. For example, use Eating / Snacking occasion data for designing Open Air cooler POGs.

Connecting with the Shopper

1. AVAILABILITY

2. ACTIVATION & POI

- Create multiple touch points in-store to convert from consideration to trial and target the Impulse Buyer (ambient and Cold)

- Scale up execution of products and offerings to attract the male, multi-cultural shopper

- Leverage Marketing Communication that resonates with passion points – such as live sports and outdoor activities

3. SNACKING

- Create and communicate relevant snack bundles or meal occasions that resonate with the convenience seeker who prefers quick & easy food and beverage solutions

4. DIGITAL

- Drive digital connection with food bundling and upsells to drive conversion

- Boost the digital integration into retailers’ loyalty programs and websites

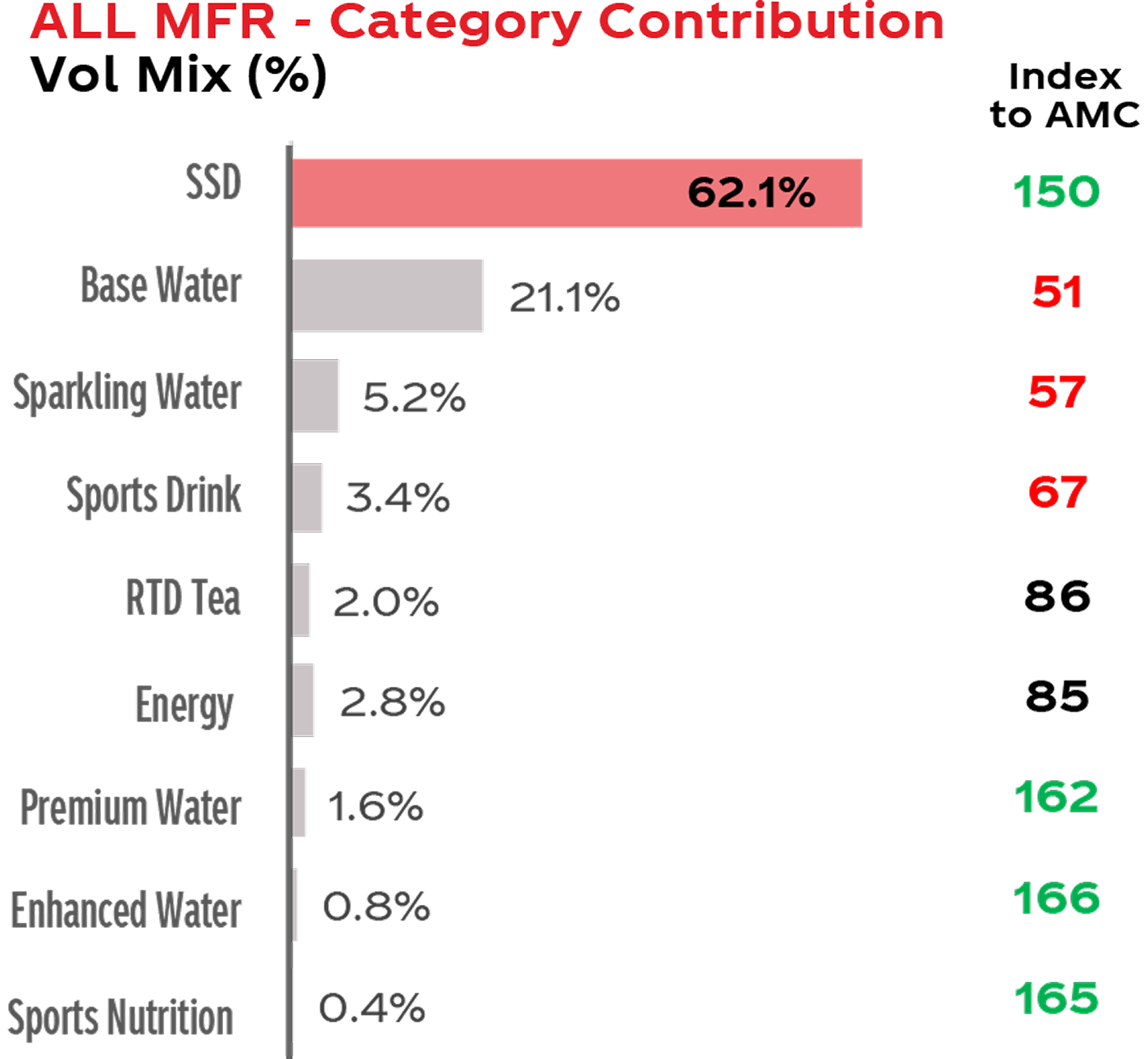

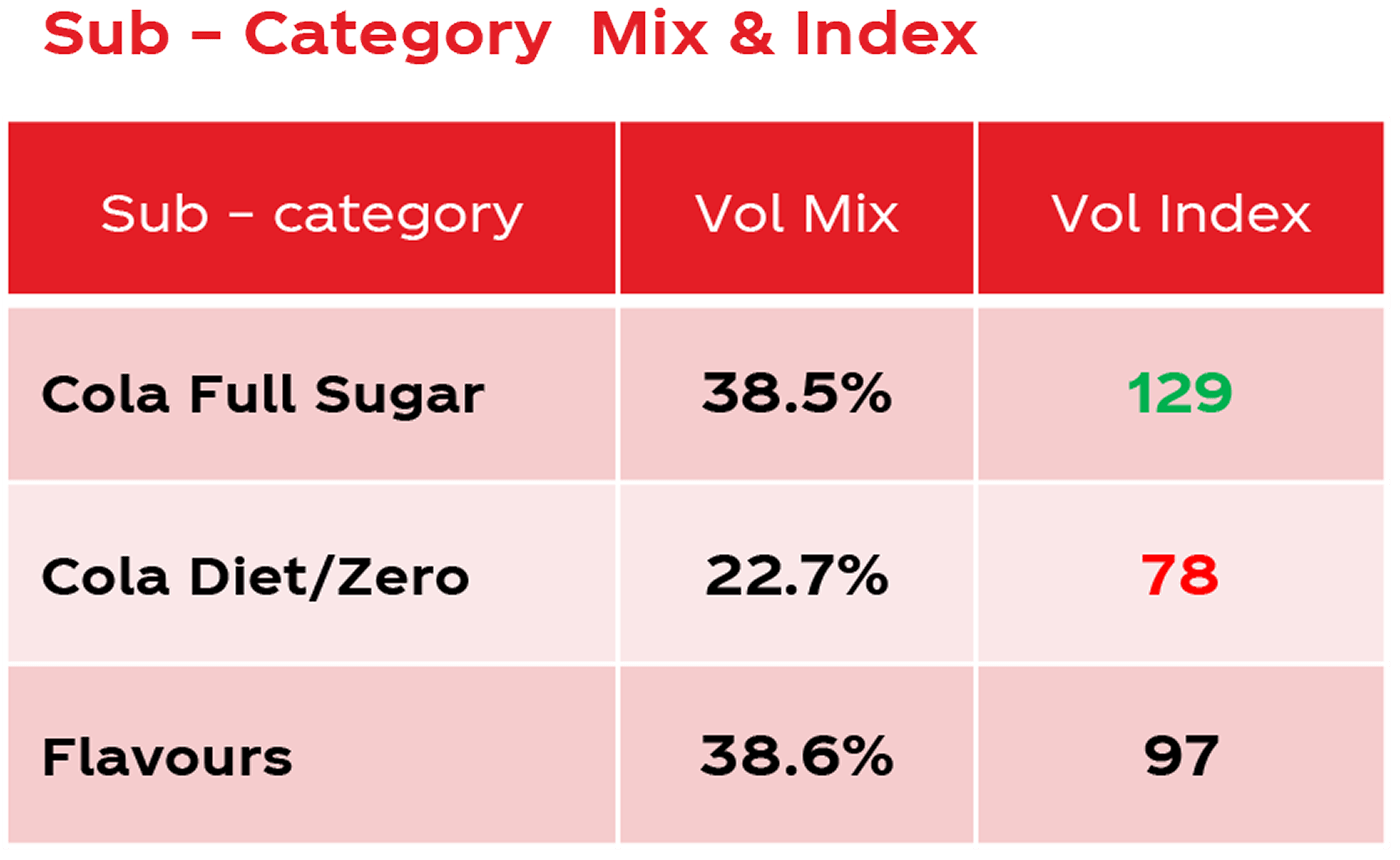

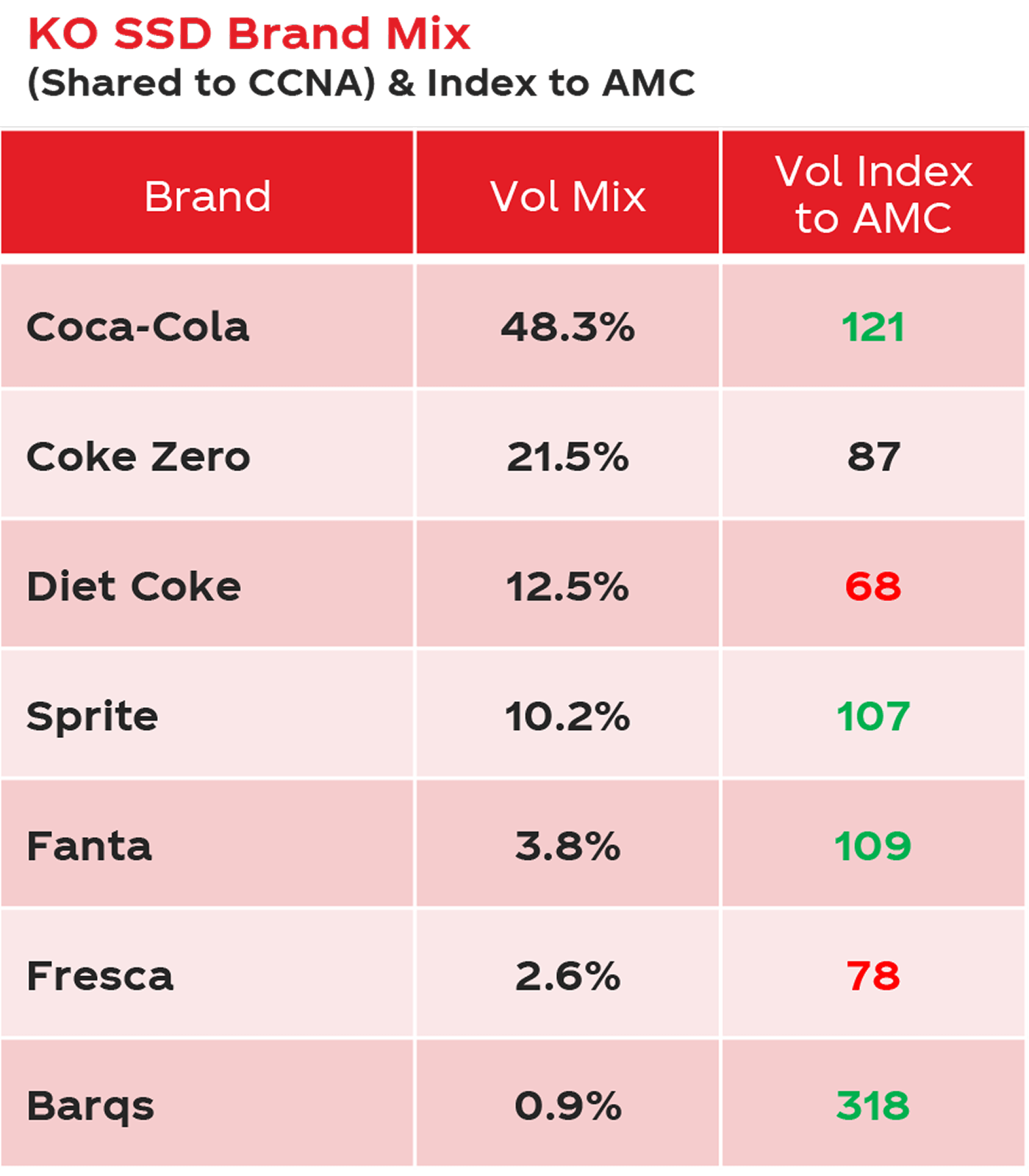

SSD C&G Category & Brand Dynamics

Index: Category Share in Channel vs Category share in AMC

Quick Tips

1. SSD is the largest NARTD category - critical to activate with multiple POIs, ambient and Cold, to win with the shopper

2. Zero sugar an opportunity in line with health-conscious shopper

3. Flavours remains a big opportunity at a strategic level – pulse in key activation windows

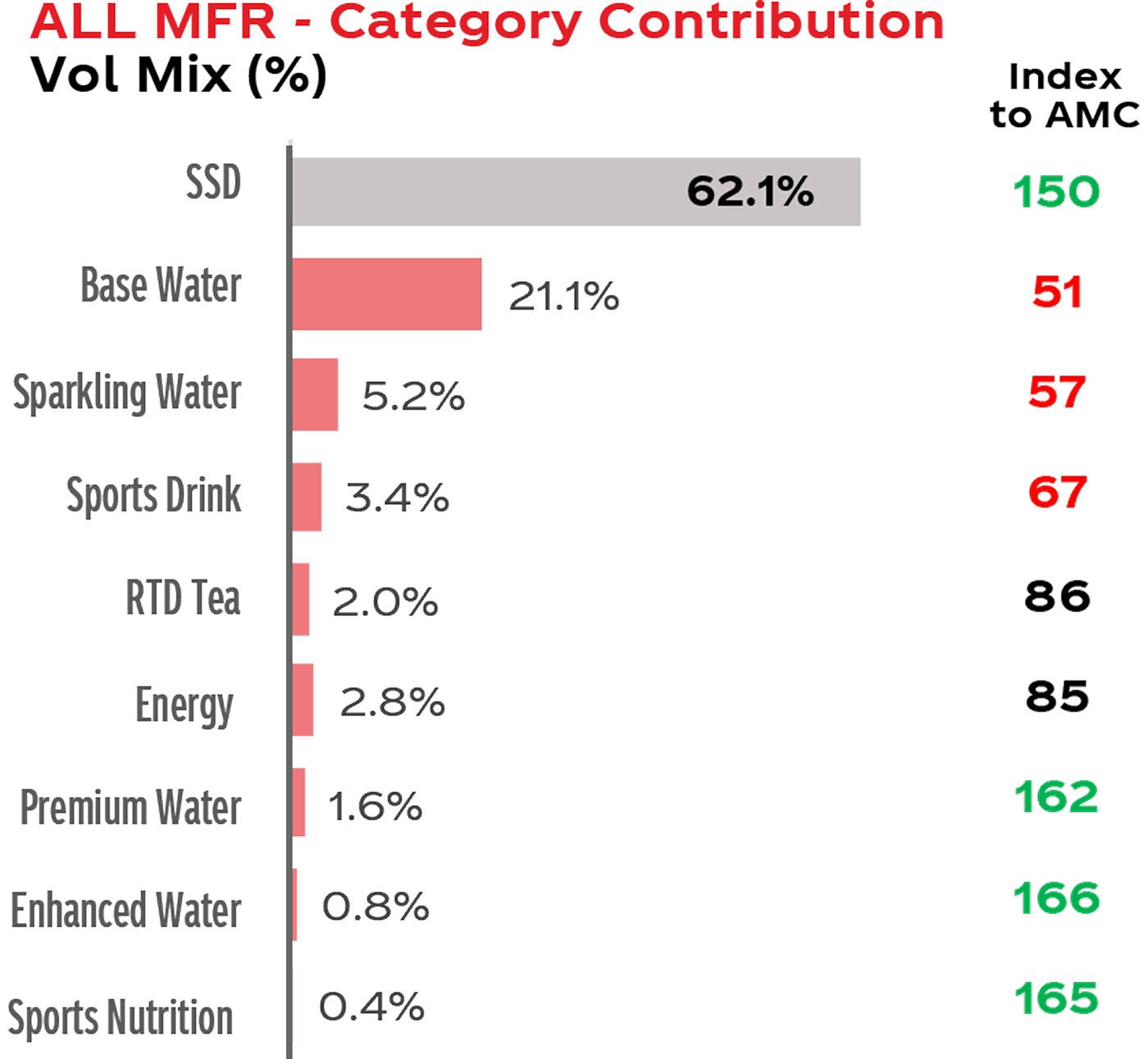

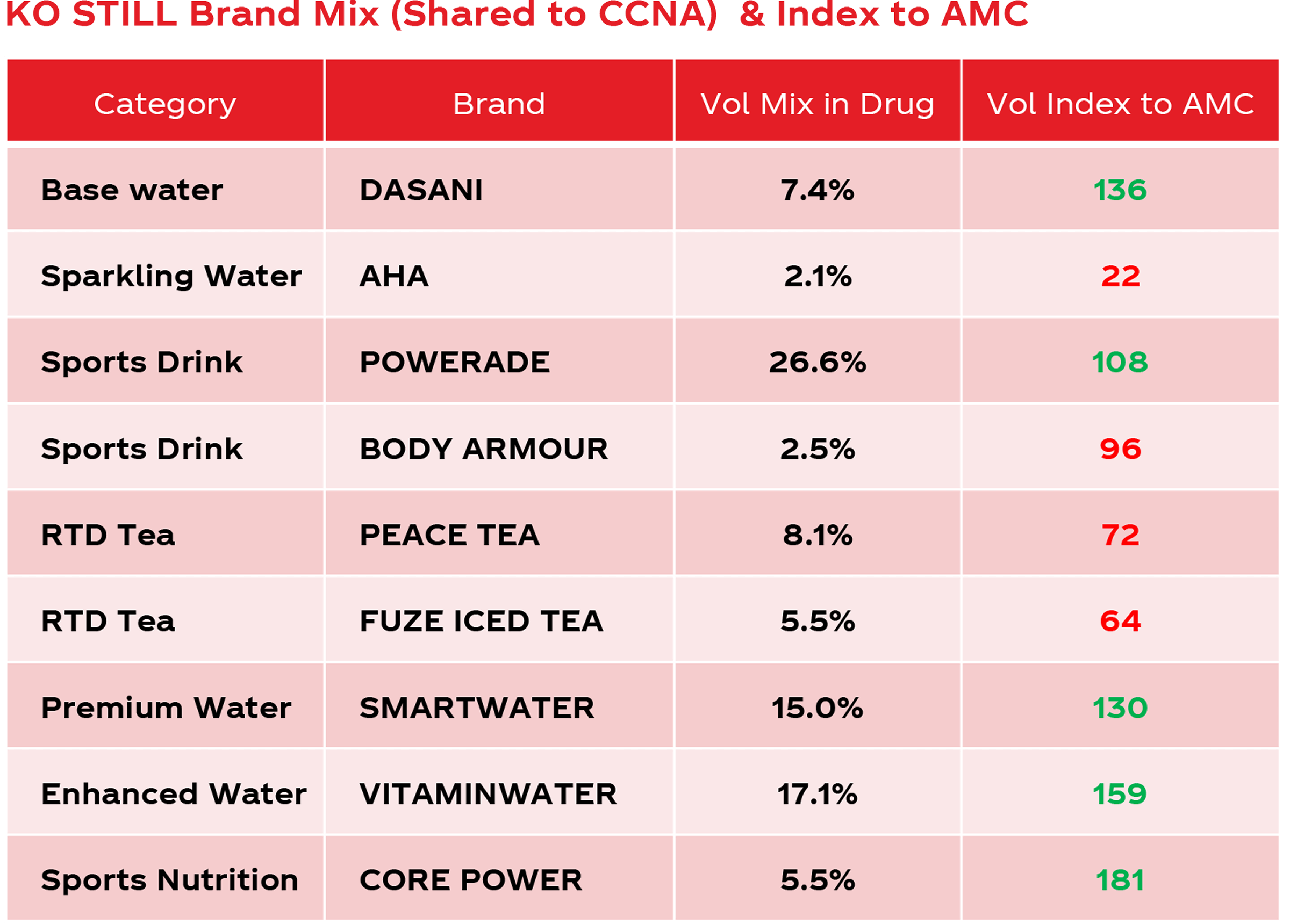

STILL C&G Category & Brand Dynamics

Index: Category in Sub Channel vs. Category in AMC

Vol Mix: Brand share of CCNA Stills in Drug, L52 Wks P/E June 07 2025 vs YA

Quick Tips

1. Ensure listings and activation of Fuze Tea, Peace Tea, Powerade, smartwater, vitaminwater, Core Power to engage with C&G shopper

2. Activate multiple touch points with Stills portfolio such as end caps, ambient display, check outs